-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

burrocrat's Account Talk

- Thread starter burrocrat

- Start date

burrocrat

TSP Talk Royalty

- Reaction score

- 162

no, no, no. i'm not buying, i can't afford the upkeep and maintenance, just looking for a rental or short-term lease.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

hey, no fair! you're a lot closer to those arab princesses, i bet you could save a ton of money on shipping and handling.

Closer to both, but that wasn't my point... shipping yes, handling would be VERY expensive...

jpcavin

TSP Legend

- Reaction score

- 97

Perhaps a hand-me-down would be more within your budget. :laugh:no, no, no. i'm not buying, i can't afford the upkeep and maintenance, just looking for a rental or short-term lease.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

Perhaps a hand-me-down would be more within your budget. :laugh:

nothing wrong with handmedowns, i just outgrew the last one is all.

PessOptimist

Market Veteran

- Reaction score

- 67

Handmedown=used. I'll skip to the punch line/standard answer. It ain't bad after you get past the used part.:worried:

Happy Halloween.

PO

Happy Halloween.

PO

burrocrat

TSP Talk Royalty

- Reaction score

- 162

ark update: well, the action this week rewarded those with the balls to sink in their claws and hang on for the ride. those folks healed up quite nicely to the tune of ~+3%. that ticks me off. those who threw up their paws and took an out did not fare as well.

arkers vs. indices:

>g: 46%

>f: 39%

>c: 8%

>s: 39%

>i: 92%

alevin/mouse, 5, 0.78%, g, paws.

amoeba/hare, 5, 0.69%, g, paws (nice number).

birchtree/elephant, 5, 1.23%, m, claws.

bmnevue/penguin, 10, 12.26%, m, claws.

boghie/lion, 5, 5.94%, m, claws.

burrocrat/donkey, 2, 6.17%, g, paws.

fwm/racoon, 1, (11.89%), g, paws.

jonfresno/kangarooo, 10, 1.85, s, claws.

jpcavin/cougar, 5, 6.44%, m, claws.

jth/wolf, 3, 1.24%, f, paws.

mrbowl/owl, 2, 3.61%, g, paws.

pessoptimist/squirrel, 5, 7.14%, m, claws.

whipsaw/hawk, 2, 0.63%, g, paws.

el vira = 60-65 = -5/65 = -8%. despite the gains, sentiment rolled over, time to bail.

bonus analysis:

* ark average ytd gains = 2.78%, only beating i and g funds.

* elephant, lion, cougar, and squirrel are the only true buy-and-holders = 5.19%, but losing to f and c funds.

* burro is winning both ark avg and ark bnh and losing only to c fund, but that is mostly due to luck and it requires a lot of risk and work.

* squirrel, cougar, and almost lion are winning burro by doing nothing. that ticks me off.

* penguin sucks.

* an aggresive bnh mix of 75c/25f would be killing most performances while minimizing risk. that also ticks me off.

on a personal note: burro got in too soon and didn't stay in long enough else i would be a hero. oh well, you do what you do and you pay for your sins, no sense worrying 'bout what might've been.

arkers vs. indices:

>g: 46%

>f: 39%

>c: 8%

>s: 39%

>i: 92%

alevin/mouse, 5, 0.78%, g, paws.

amoeba/hare, 5, 0.69%, g, paws (nice number).

birchtree/elephant, 5, 1.23%, m, claws.

bmnevue/penguin, 10, 12.26%, m, claws.

boghie/lion, 5, 5.94%, m, claws.

burrocrat/donkey, 2, 6.17%, g, paws.

fwm/racoon, 1, (11.89%), g, paws.

jonfresno/kangarooo, 10, 1.85, s, claws.

jpcavin/cougar, 5, 6.44%, m, claws.

jth/wolf, 3, 1.24%, f, paws.

mrbowl/owl, 2, 3.61%, g, paws.

pessoptimist/squirrel, 5, 7.14%, m, claws.

whipsaw/hawk, 2, 0.63%, g, paws.

el vira = 60-65 = -5/65 = -8%. despite the gains, sentiment rolled over, time to bail.

bonus analysis:

* ark average ytd gains = 2.78%, only beating i and g funds.

* elephant, lion, cougar, and squirrel are the only true buy-and-holders = 5.19%, but losing to f and c funds.

* burro is winning both ark avg and ark bnh and losing only to c fund, but that is mostly due to luck and it requires a lot of risk and work.

* squirrel, cougar, and almost lion are winning burro by doing nothing. that ticks me off.

* penguin sucks.

* an aggresive bnh mix of 75c/25f would be killing most performances while minimizing risk. that also ticks me off.

on a personal note: burro got in too soon and didn't stay in long enough else i would be a hero. oh well, you do what you do and you pay for your sins, no sense worrying 'bout what might've been.

Boghie

Market Veteran

- Reaction score

- 363

The denizens have started to make money. Yup, as Burro says, the C and S funds are beating the pants off most of us - but how many of us want to swing like that. I kinda like to make smooth moves based on longer trends. We mixies are like that. Anyway, here go the stats I haven't figured out how to understand.

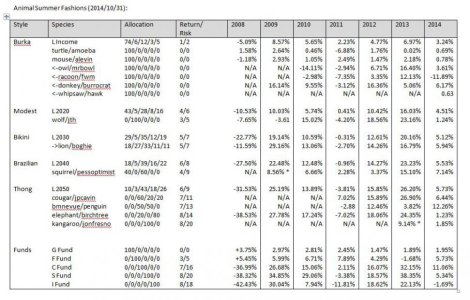

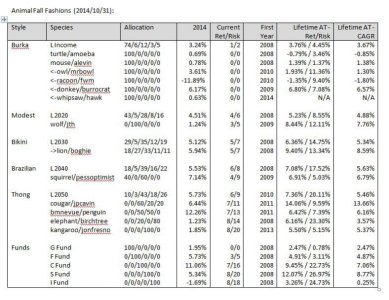

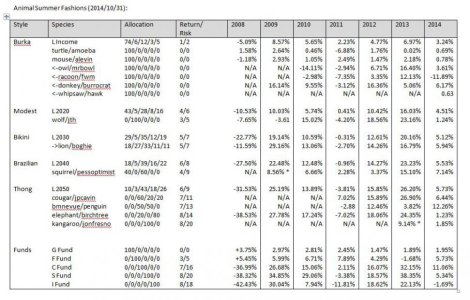

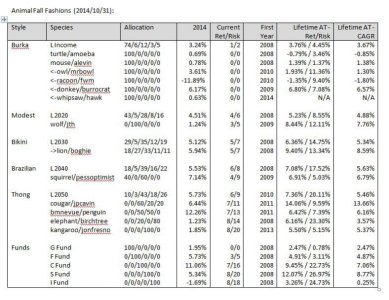

Here are the annual returns to date of the animals aboard the ark:

And here is the Compound Annual Growth Rate of the denizens:

Now, Burro, I kinda did make a move so I looked at the site KonaKathy recommended. My move requires a change of swimwear. Got into the bikini column. I normally like a modest look, but a week of working out and a little time on the beach has worked wonders. It sure is hot around here - got some sweat on the brow.

I hate to tell the rest of you chickens this, but I will probably be heading into the Brazilian cut soon. I wonder how that will change Tom's ads in TSPTalk:embarrest:.

Here are the annual returns to date of the animals aboard the ark:

And here is the Compound Annual Growth Rate of the denizens:

Now, Burro, I kinda did make a move so I looked at the site KonaKathy recommended. My move requires a change of swimwear. Got into the bikini column. I normally like a modest look, but a week of working out and a little time on the beach has worked wonders. It sure is hot around here - got some sweat on the brow.

I hate to tell the rest of you chickens this, but I will probably be heading into the Brazilian cut soon. I wonder how that will change Tom's ads in TSPTalk:embarrest:.

konakathy

Market Veteran

- Reaction score

- 41

Now, Burro, I kinda did make a move so I looked at the site KonaKathy recommended. My move requires a change of swimwear. Got into the bikini column. I normally like a modest look, but a week of working out and a little time on the beach has worked wonders. It sure is hot around here - got some sweat on the brow.

View attachment 30899

I hate to tell the rest of you chickens this, but I will probably be heading into the Brazilian cut soon. I wonder how that will change Tom's ads in TSPTalk:embarrest:.

Boghie, Boghie, Boghie....you sure look maaaavelous darlin' in that swimwear. The workouts and sunbathing have done wonders. Glad I could help you out with the site....now come on over here and let me help you wipe that sweat off your brow.

And yeah, yeah, yeah, your ark update analysis is good too.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

hey bogs, thanks for stopping by, i love your spreadsheets.

did you make a move deeper into equities and i missed it? i can spot the move from say 100g to 75c 25s, but the smooth transitions from 16 12 34 27 19 to 12 9 38 41 21 are lost on me (numbers are for illustrative purposes only). i am more of a bet or fold type person. looking sharp there cuz.

i am starting to understand the expected risk/returm compared to actual performance thing. let me see if i got this straight: if r/r is 5/10 and a person is getting 9 that is good performing at high end and making better decisions than the market? if r/r is 5/10 and a person is getting 2 then that is bad decision making? am i close?

the cagr concept still eludes me even though you have explained it multiple times. but i think it has to do with disregarding contributions and other anomalies and just looking at raw horsepower?

i wish i knew how ark recommendations/trades were performing if one followed them. my returns are sort of a proxy except i don't always follow them or do what's good for me. plus i have a mean contrarian streak.

looking sharp in those new duds bro, keep up the good work.

did you make a move deeper into equities and i missed it? i can spot the move from say 100g to 75c 25s, but the smooth transitions from 16 12 34 27 19 to 12 9 38 41 21 are lost on me (numbers are for illustrative purposes only). i am more of a bet or fold type person. looking sharp there cuz.

i am starting to understand the expected risk/returm compared to actual performance thing. let me see if i got this straight: if r/r is 5/10 and a person is getting 9 that is good performing at high end and making better decisions than the market? if r/r is 5/10 and a person is getting 2 then that is bad decision making? am i close?

the cagr concept still eludes me even though you have explained it multiple times. but i think it has to do with disregarding contributions and other anomalies and just looking at raw horsepower?

i wish i knew how ark recommendations/trades were performing if one followed them. my returns are sort of a proxy except i don't always follow them or do what's good for me. plus i have a mean contrarian streak.

looking sharp in those new duds bro, keep up the good work.

Boghie

Market Veteran

- Reaction score

- 363

hey bogs, thanks for stopping by, i love your spreadsheets.

did you make a move deeper into equities and i missed it? i can spot the move from say 100g to 75c 25s, but the smooth transitions from 16 12 34 27 19 to 12 9 38 41 21 are lost on me (numbers are for illustrative purposes only). i am more of a bet or fold type person. looking sharp there cuz.

i am starting to understand the expected risk/returm compared to actual performance thing. let me see if i got this straight: if r/r is 5/10 and a person is getting 9 that is good performing at high end and making better decisions than the market? if r/r is 5/10 and a person is getting 2 then that is bad decision making? am i close?

the cagr concept still eludes me even though you have explained it multiple times. but i think it has to do with disregarding contributions and other anomalies and just looking at raw horsepower?

i wish i knew how ark recommendations/trades were performing if one followed them. my returns are sort of a proxy except i don't always follow them or do what's good for me. plus i have a mean contrarian streak.

looking sharp in those new duds bro, keep up the good work.

Burro,

I moved from

- 22% G

- 32% F

- 26% C

- 10% S

- 10% I

- Return 4% / Risk 5%

to:

- 18% G

- 27% F

- 33% C

- 11% S

- 11% I

- Return 5% / Risk 7%

It was a small and frightened move to risk and reward. My comment when I made the IFT was: 'Initial Investment into the Falling Knife. Will initiate a bail at the -10% to -12% Mark'. I was concerned about failure, but the equity funds seemed ripe for a rebound and my 7% 'crash' point occurred. I had to get in, but I did not jump in with both feet. Should have placed another 4% in the S, but oh well. I will gain more than I lost in the transaction

Now, to the Return and Risk numbers... Regretfully, my super secret tool (Quicken and some websites) use annual calendar year numbers and do not factor in seasonality so there is a bit of SWAG when making moves during the year. However, basically 'Risk' is really variation around a center point. It is a slightly modified single standard deviation from the center line. The center line (where most of the annual returns are) is the Return percentage. Then, you add/subtract the 'Risk' from the Return + Inflation to get your normal return occurring 67% of the time. Add/Subtract 'Risk' again and you will hit somewhere in there 95% of the time.

So, to use your example, is someones Return/Risk is 5%/10% than 67% of the time that allocation will land between -5% and +10%. Inflation adjusted 3% the numbers end up being -2% through +13%. My current Return/Risk allocation inflation adjusted returns +1% through +14%. My allocation returns the same center point and has less variance (risk). Me like mine.

Now, because I am terribly long winded, the CAGR attempts to factor in the effect of even contributions on the return. Basically, each share you purchase over the year gains or loses some part of the ratio of the assets you held at the end of the prior year. That is one reason why Buy and Holders generally win in the end if they have a non-gambling allocation. They just benefit from the CAGR. That is why I play edges rather than bet big. I have bet big, but I have to feel comfortable to do so. I have bailed out, but I have to see a falling knife that is escalating. In the middle I will sit in one of three allocations with some adjustment based on market conditions.

By the way, I missed this one to some extent. I should have over-weighted the 'S' and maybe even the 'I', but that is hindsight and I made good money

Finally, there is something I cannot pin on your analysis. I think it is something that allows me to make the edge changes. Did the ark folk run - and are those the normal runners? Did the folk start sunning themselves on the deck with little more than floss - are those the normal beauties that run around with floss. Looking at the denizens and a few others helps me lean my allocation one way or the other. See how scientific that is:embarrest:.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

Finally, there is something I cannot pin on your analysis. I think it is something that allows me to make the edge changes. Did the ark folk run - and are those the normal runners? Did the folk start sunning themselves on the deck with little more than floss - are those the normal beauties that run around with floss. Looking at the denizens and a few others helps me lean my allocation one way or the other. See how scientific that is:embarrest:.

clever syntax. i think you are on to how it works, or at least how it is supposed to operate, whether it works or not is another story. the ark system basically tracks a mix of sentiment and historical performance. a denizen's ytd return and current allocation are facts, because facts are good for science. a denizen's score (1-10) and associated comment are feel, because feel is good for art (this is the part you can't pin on my analysis because it is totally subjective and situationally variable).

the score is relative to each arker. 5 for one is not the same as 5 for another. alevin is almost always in g, that is normal for her = 5. birchtree is always all in equities, that is normal for him = 5. their needles rarely move, and when they do it carries more significance then when the gunslingers move their chips. 1 is negative sentiment relative to 5/nuetral, and 10 is positive outlook.

why 13 arkers? lots of reasons:

a) mutiny, in any communal system it is good to have a quorum where a tie vote is impossible, it saves the captian from an unwelcome swim and provides the opportunity to experience galley boy duties as opposed to walking the plank being the only option.

b) indicator species, you can't go around measuring every gnat's ass, but you can pick a representative distribution of gnats whose asses you watch. if one falls, it is likely all of similar philosophy also fell.

c) diversity, with 13 options to score and 13 options to comment, you can make el vira say anything you want. and you almost never get a chance in life to make a woman say what you want to hear, make no mistake, the market is a harsh mistress. this is where the art part comes in. want to get out? adjust turtle, racoon, and kangaroo down. want to get in? adjust penguin, mrbowl, and penquin up. easy peasy.

d) village, it does take a village, it's just that sometimes i wish i was living in a different one. we are all in the same boat. if i want to sell a security i need someone around who wants to buy it. pretty simple concept there, we are all the same just different shades of grey.

e) awww, who am i kidding? i was lucky to come up with 4 reasons, there is no e).

also, it helps if the commentary is somewhat sexual in nature. because nature, and people, seem to enjoy things of a sexual nature, it keeps them engaged, and we can all understand that at some level.

as to why specifically the ark went negative and generated a sell signal? that's complicated and where the contrarian part comes in. some folks shed rainment looking for more fun in the sun, some covered up because things are starting to burn, but overall there is a feeling of optomism and clear sailing. so i prepare for a wreck.

mainly though, the ark went negative because i have a bad feeling about this and found reasons to confirm it. the key to being less subjective is to first recognize you are subjective. humans are not objective beings, we all process everything through our own unique filters. which is what i think my mom meant when she used to say 'that's ok honey, i love you, don't forget you are special'.

what a crock. i am out because of the midterm elections. big things are afoot, balances of power may significantly shift, yet this is the quietest news cycle around an election i have ever heard. something bad is going to happen i think. either way a lot of folks will he unhappy. when the forest goes quiet just get down, lay low. now that is good advice.

that is the analysis you are trying to pin on me. that is how the ark works, at least for today.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

i came across one of the most touching stories of human struggle and honesty that i can remember and thought i'd share. it's like a public service announcement except i'm not sure the public will understand, let alone consider it a service.

it seems the world is quickly moving on from tales of political defeat as the media shifts it focus to the evil rich banskter 1%. make no mistake, there is plenty of evil in the world, but just like opportunity, it is where you find it.

this lady says something very profound at the end of the interview, something rarely heard. of course it is easy to judge and read between the lines, but there was plenty of 'sex drugs and rock n roll' present in both their lives prior to 1989 when they met. it is a sad love story actually, not a tale about decadance and defeat.

No Regrets for Kissel 11 Years After Banker-Husband Death - Bloomberg

brutal self-honesty and acceptance. not many can look at the wreckage and walk forward with their chin up like that. she must be one hot tiger to catch by the tail. it makes me want to be an evil rich banker. and to research conjugal visits in hong kong prison policies. everyone could benefit from a little more lovin'.

ps. this is why i rarely do public service announcements.

it seems the world is quickly moving on from tales of political defeat as the media shifts it focus to the evil rich banskter 1%. make no mistake, there is plenty of evil in the world, but just like opportunity, it is where you find it.

this lady says something very profound at the end of the interview, something rarely heard. of course it is easy to judge and read between the lines, but there was plenty of 'sex drugs and rock n roll' present in both their lives prior to 1989 when they met. it is a sad love story actually, not a tale about decadance and defeat.

No Regrets for Kissel 11 Years After Banker-Husband Death - Bloomberg

Kissel said she asks for forgiveness and repents in her search for peace. “That’s very different from regret.”

brutal self-honesty and acceptance. not many can look at the wreckage and walk forward with their chin up like that. she must be one hot tiger to catch by the tail. it makes me want to be an evil rich banker. and to research conjugal visits in hong kong prison policies. everyone could benefit from a little more lovin'.

ps. this is why i rarely do public service announcements.

jpcavin

TSP Legend

- Reaction score

- 97

Underwear Sales Increase, Suggesting A Rebounding Economy

Based on the above article, it would appear that Donkey's recent purchases is an indicator of a growing economy. Looks like Trigger is off to the races. :toung::laugh:

Based on the above article, it would appear that Donkey's recent purchases is an indicator of a growing economy. Looks like Trigger is off to the races. :toung::laugh:

burrocrat

TSP Talk Royalty

- Reaction score

- 162

Underwear Sales Increase, Suggesting A Rebounding Economy

Based on the above article, it would appear that Donkey's recent purchases is an indicator of a growing economy. Looks like Trigger is off to the races. :toung::laugh:

i can attest to the truthfulness of the underwear indicator. not only that, but things have improved so much that i can afford to go out once in a while and have started entertaining again. if you like, you could come over for dinner next weekend.

http://www.tsptalk.com/mb/lounge/21307-screwy-news-4.html#post477238

jpcavin

TSP Legend

- Reaction score

- 97

i can attest to the truthfulness of the underwear indicator. not only that, but things have improved so much that i can afford to go out once in a while and have started entertaining again. if you like, you could come over for dinner next weekend.

http://www.tsptalk.com/mb/lounge/21307-screwy-news-4.html#post477238

I appreciate the kind gesture but I'll have to decline your offer, I'm a vegetarian.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

I appreciate the kind gesture but I'll have to decline your offer, I'm a vegetarian.

i kinda expected you to decline, but i figured it was because your cat doesn't like my dog.

Similar threads

- Replies

- 3

- Views

- 478

- Replies

- 9

- Views

- 475