happy labor day everyone. i got to thinking about labor, of all things, and what causes it. now i've only seen labor once, and it didn't look all that easy, but i'm a dad so you love 'em no matter what. then i got to thinking about this market that just won't go down, it keeps bouncing back, like rubber. which, coincidentally, got me thinking about, well condoms, i'm sure there's a connection in there somewhere. did you know they have all kinds of reviews and charts and techniques for figuring out which one to choose? but no matter how you do it, it all comes down to just 3 choices: snugger, standard, or magnum. now i never thought about it before, but maybe improper fit is what causes labor? it's odd how life comes and goes in circles.

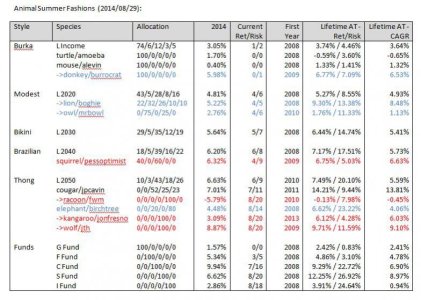

alevin/mouse, 5, 0.40%, g, snugger.

amoeba/hare, 5, 1.70%, g, snugger.

birchtree/elephant, 5, 4.48%, mix, magnum.

bmnevue/penguin, 3, 10.26%, g, snugger.

boghie/lion, 3, 5.22%, mix, standard.

burrocrat/donkey, 1, 5.98%, g, snugger.

fwm/racoon, 10, (-5.79%), s, magnum.

jonfresno/kangarooo, 10, 3.09%, s, magnum.

jpcavin/cougar, 5, 7.01%, mix, standard.

jth/wolf, 10, 8.87%, s, magnum.

mrbowl/owl, 7, 2.76% mix, magnum.

pessoptimist/squirrel, 5, 6.32%, mix, standard.

whipsaw/hawk, 1, 2.74%, g, snugger.

el vira = 70-65 = 5/65 = 8%.

so lots of folks went from 'who, l'il ole me?' to 'balls out'. that should be a positive signal right? slow down, not so fast, there is a contrarion play here. this market just keeps bouncing back, but be careful out there kids, sometimes rubber break.