burrocrat

TSP Talk Royalty

- Reaction score

- 162

weekend update:

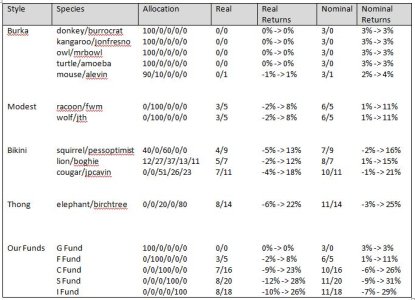

turtle/amoeba: 3, 2.88%, nice roll, seven, front line winner, seven.

mouse/alevin: 3, 0.77%, that little bit in F is paying off, slow and steady.

elephant/birchtree: 3, 4.26%, eff'n goofy. normal rules of reality bend for this guy. see disney joke. eff'n goofy.

lion/boghie: 4, 3.09%, right bettor.

donkey/burrocrat: 1, 2.14%, still boring, nothing to see here folks, except for a big chicken.

racoon/fwm: 1, (5.31%), still all out.

jonfresno/kangaroo: 3, 2.24%, staying nuetral, but looking for a spot to hop in.

cougar/jpcavin: 4, 3.48%, moving up fast, like a cheetah.

wolf/jth: 5, 9.21%, well f*ck me again! he's like charlie sheen, except for jth is right all the time. ya big jerk.

owl/mrbowl: 5, 1.02%, fortune favors the bold.

squirrel/pessoptimist: 4, 3.14%, again, way to tough it out, it's paying off.

el vira: 36. let's see, 55 max - 33 nuetral = 22 point spread. 36 - 33 = 3. 3/22 = 14%. getting bearish.

that little run on equities is still profitable for some. but the herd is nervous and ready to bolt south at the drop of a hat.

birchtree is eff'n goofy, a total balls out all time watch out he'll run you over and not even blink kind of resolve, don't mess with him.

i'm going to mess with him.

mickey mouse to judge: your honor i want a divorce from minnie. judge to mickey: son, i can't grant you a divorce, i find no grounds to prove she's insane. mickey to judge: you honor, i didn't mean she's crazy, i said she's eff'n goofy.

ba da dum.

turtle/amoeba: 3, 2.88%, nice roll, seven, front line winner, seven.

mouse/alevin: 3, 0.77%, that little bit in F is paying off, slow and steady.

elephant/birchtree: 3, 4.26%, eff'n goofy. normal rules of reality bend for this guy. see disney joke. eff'n goofy.

lion/boghie: 4, 3.09%, right bettor.

donkey/burrocrat: 1, 2.14%, still boring, nothing to see here folks, except for a big chicken.

racoon/fwm: 1, (5.31%), still all out.

jonfresno/kangaroo: 3, 2.24%, staying nuetral, but looking for a spot to hop in.

cougar/jpcavin: 4, 3.48%, moving up fast, like a cheetah.

wolf/jth: 5, 9.21%, well f*ck me again! he's like charlie sheen, except for jth is right all the time. ya big jerk.

owl/mrbowl: 5, 1.02%, fortune favors the bold.

squirrel/pessoptimist: 4, 3.14%, again, way to tough it out, it's paying off.

el vira: 36. let's see, 55 max - 33 nuetral = 22 point spread. 36 - 33 = 3. 3/22 = 14%. getting bearish.

that little run on equities is still profitable for some. but the herd is nervous and ready to bolt south at the drop of a hat.

birchtree is eff'n goofy, a total balls out all time watch out he'll run you over and not even blink kind of resolve, don't mess with him.

i'm going to mess with him.

mickey mouse to judge: your honor i want a divorce from minnie. judge to mickey: son, i can't grant you a divorce, i find no grounds to prove she's insane. mickey to judge: you honor, i didn't mean she's crazy, i said she's eff'n goofy.

ba da dum.