robo

TSP Legend

- Reaction score

- 471

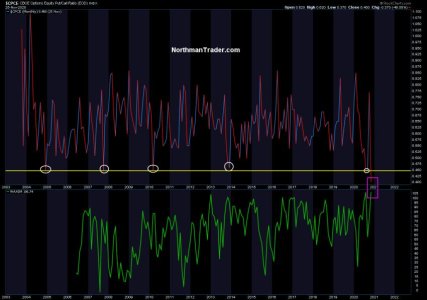

Is SILJ leading or lagging the SPX? We shall know soon....

Bottom Line: I'm flat SILJ, reduced stock positions, and hedged remaining positions with PSQ. I will be watching UUP and HYG for tells.

https://stockcharts.com/h-sc/ui?s=HYG&p=D&yr=0&mn=6&dy=0&id=p81107152681&a=836201126

Looking to buy SILJ again.... Note the ebb and flow of SILJ candlesticks and the SPX purple thick line. One is probably going to converge on the other soon.

Bottom Line: I'm flat SILJ, reduced stock positions, and hedged remaining positions with PSQ. I will be watching UUP and HYG for tells.

https://stockcharts.com/h-sc/ui?s=HYG&p=D&yr=0&mn=6&dy=0&id=p81107152681&a=836201126

Looking to buy SILJ again.... Note the ebb and flow of SILJ candlesticks and the SPX purple thick line. One is probably going to converge on the other soon.

Attachments

Last edited: