A very small excerpt from one of Steve Kaplan's updates.

Update #2146: Wednesday night, January 13, 2016: Commitments 2016-1-8; right after wrong

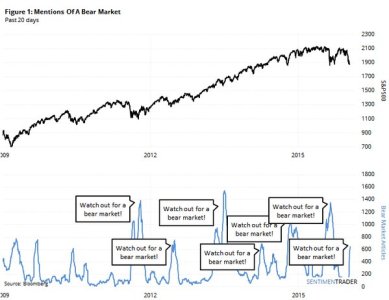

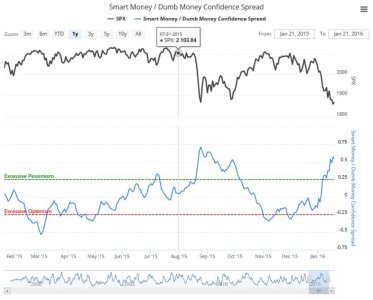

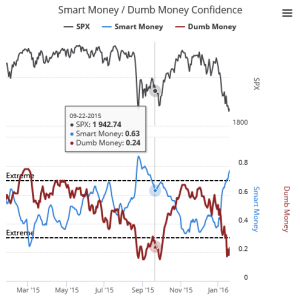

Lately there have been sudden outflows from many funds of U.S. risk assets. These outflows will tend to be sharpest near any intermediate-term bottom, while there will continue to be meaningful inflows near all rebound highs as many investors become convinced that the worst is over and that they should buy in dips because that is what they should have done and didn't do during most of the past several years. As is always the case in the early stages of any bear market, investors have learned the wrong lessons too late. Investors won't stop buying into rebounds until the stock market is truly near its ultimate bottom, when they will be terrified about buying anything because of a sequence of a dozen or so lower lows which will have been attained by then.

True Contrarian

Fair Value, Like A Reliable But Tardy Guest, Is Always Late And Always Arrives

Jan. 8, 2016 2:23 PM ET

Many investors like to repeat John Maynard Keynes' overquoted quip about how the market can remain irrational longer than you can remain solvent. There are numerous problems with this saying, especially when taken out of context, since as long as you don't use margin you should always remain solvent. Those who go overboard with investing, as with anything else in life, will sometimes be rewarded in the short run but will inevitably fail in the long run. Those who bet on extremes becoming more extreme will similarly often prosper for some unknown period of time, but will eventually lose in the end because all assets eventually revisit fair value. After doing so, whatever had been previously wildly trendy and overvalued usually ends up becoming roughly equally despised and underpriced.

Fair Value, Like A Reliable But Tardy Guest, Is Always Late And Always Arrives | Seeking Alpha