alevin

Market Veteran

- Reaction score

- 97

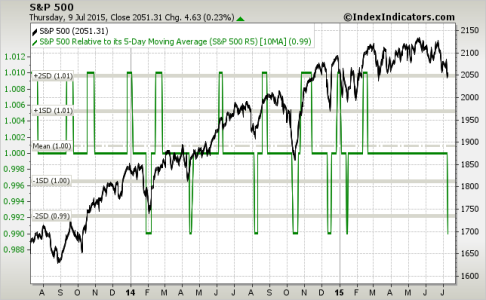

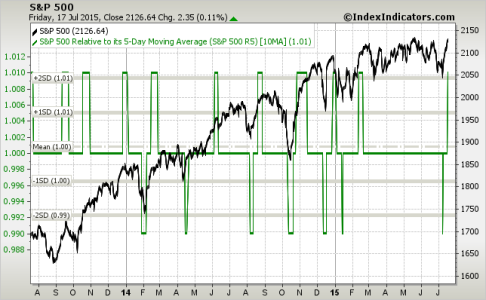

No change with the indicators I'm watching. Still. I could bail and wait for the final drop, with my horrible sense of timing, the big indicator drop would happen the day I bail. then I'd only have 1 IFT left for the month. erm. thinking I'll keep holding. for now. It might go the other way.

In the meantime, more decisions afoot. Property directly behind me has gone into foreclosure by the bank. Not on the auction block-yet. House have been substantially damaged inside, the aspiring owners that have been officially kicked out, still have belongings present outside the house, cars, lawnmower, cat, still doing things around the place including stripping any strippable outside metal for scrap-interesting situation. not sure about belongings still on the inside. there was huge amount of extended family living in the place previously, shared ownership amongst some of them. anglo, no other ethnic group. the younger parties were the ones who failed to hold up their end of the bargain with dad/grandpa. long story short, the place wraps around one back corner of my property, essentially 3 lots that were combined sometime in the past. I've longed to buy the lot directly behind me for some time, but would need to be re-divided and resurveyed before that could happen. I'm hearing secondhand that the bank had previously been urging the aspiring owners to re-divide the place into the original 3 lots. so the bank might be willing to deal on the subject.

FEMA has their house mapped as half within a required-flood insurance floodplain (mortgage implications). I know, bizarre. Same level as my house-which is outside mortgage-mandatory flood insurance zone, far from it in fact. Subtle elevational differences, floodmapping error on FEMA's part, but insurance/mortgage company don't know that. I was never required to pay flood insurance before I paid off my mortgage, and wouldn't be required now if there was still a mortgage. The other 2 lots are basically undeveloped other than power to the lot lines. The other house's sideporch off the master bedroom was added on after the 2d lot was acquired. The porch extends onto the second lot-into the "flood zone".

So, I'd feel very uncomfortable paying what the aspiring owners had for a mortgage-$180K, especially given the damage done inside the house due to having 16 people living in it for a short while-they tore out some walls to make more room inside, for one thing, so I'm told-don't know if they were support walls or not. Even given the potential to separate off the back lot that I really want, fix up the house, including new roof that's been needed awhile, and turn into a rental landlord or some darn thing, and develop my minifarm with the back lot like I've wanted to do.

They haven't put the place up on the auction block yet, but I know which bank holds the mortgage. I know one person on here got an incredibly good cash deal buying a foreclosed house from a bank. I just don't know if they'd laugh in my face if I offered $15K for that place or not. the max I'd go is $80, considering I paid 90 for my place originally and my house was in way better condition then than the other one currently is. And they are/were identical floor plans originally, built the same year. 60 years ago. and property taxes keep going up. worth it to try to become a landlord with a fixer-upper? worth it to fixer-upper, split off the back lot for me and sell the other house with those 2 lots unsplit? many questions running through my mind. TBD (to be determined).

In the meantime, more decisions afoot. Property directly behind me has gone into foreclosure by the bank. Not on the auction block-yet. House have been substantially damaged inside, the aspiring owners that have been officially kicked out, still have belongings present outside the house, cars, lawnmower, cat, still doing things around the place including stripping any strippable outside metal for scrap-interesting situation. not sure about belongings still on the inside. there was huge amount of extended family living in the place previously, shared ownership amongst some of them. anglo, no other ethnic group. the younger parties were the ones who failed to hold up their end of the bargain with dad/grandpa. long story short, the place wraps around one back corner of my property, essentially 3 lots that were combined sometime in the past. I've longed to buy the lot directly behind me for some time, but would need to be re-divided and resurveyed before that could happen. I'm hearing secondhand that the bank had previously been urging the aspiring owners to re-divide the place into the original 3 lots. so the bank might be willing to deal on the subject.

FEMA has their house mapped as half within a required-flood insurance floodplain (mortgage implications). I know, bizarre. Same level as my house-which is outside mortgage-mandatory flood insurance zone, far from it in fact. Subtle elevational differences, floodmapping error on FEMA's part, but insurance/mortgage company don't know that. I was never required to pay flood insurance before I paid off my mortgage, and wouldn't be required now if there was still a mortgage. The other 2 lots are basically undeveloped other than power to the lot lines. The other house's sideporch off the master bedroom was added on after the 2d lot was acquired. The porch extends onto the second lot-into the "flood zone".

So, I'd feel very uncomfortable paying what the aspiring owners had for a mortgage-$180K, especially given the damage done inside the house due to having 16 people living in it for a short while-they tore out some walls to make more room inside, for one thing, so I'm told-don't know if they were support walls or not. Even given the potential to separate off the back lot that I really want, fix up the house, including new roof that's been needed awhile, and turn into a rental landlord or some darn thing, and develop my minifarm with the back lot like I've wanted to do.

They haven't put the place up on the auction block yet, but I know which bank holds the mortgage. I know one person on here got an incredibly good cash deal buying a foreclosed house from a bank. I just don't know if they'd laugh in my face if I offered $15K for that place or not. the max I'd go is $80, considering I paid 90 for my place originally and my house was in way better condition then than the other one currently is. And they are/were identical floor plans originally, built the same year. 60 years ago. and property taxes keep going up. worth it to try to become a landlord with a fixer-upper? worth it to fixer-upper, split off the back lot for me and sell the other house with those 2 lots unsplit? many questions running through my mind. TBD (to be determined).

Last edited: