alevin

Market Veteran

- Reaction score

- 97

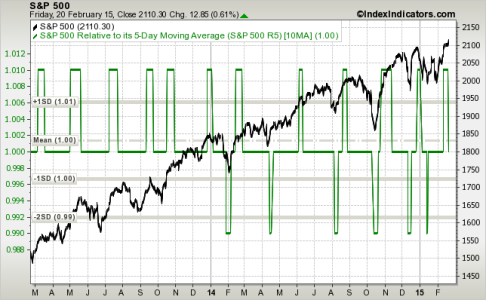

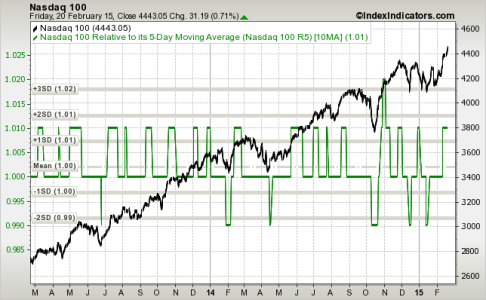

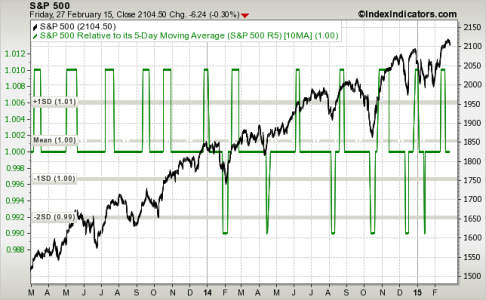

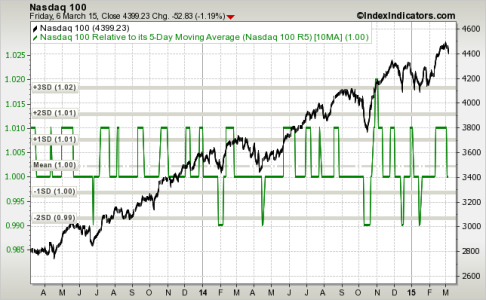

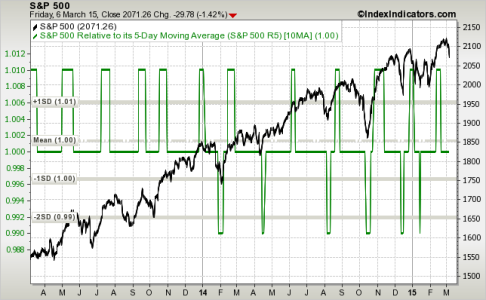

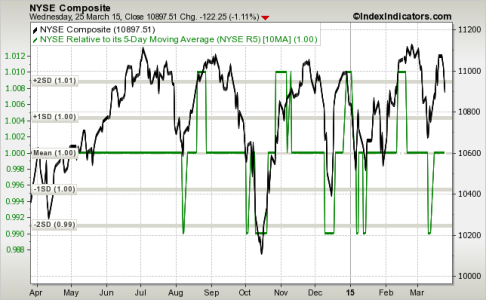

The signal has changed since the last time I posted this chart. Signal has now moved up into the normal sell signal zone up at 1 standard deviation, started last Thursday, I waited for confirmation Friday that the sell signal had started to move sideways. it did. So I thought earlier this weekend that I would move out of C fund as of COB today, but after further reviewing the normal sell signals, it seems to be typical for the signal to come and stay a little while before the market actually tops out, so I decided to stay a little longer.

I'd post a current chart, but you'll have to use your imagination with this older one. for some reason the site where I'm pulling these charts from has been down all day today. Every other site I've tried, still works so it's something with the server for the charting site. Hope the site will be back up and running tomorrow morning so I can see what the signal did today. I may or may not move in the am. It depends. There's hesitation in the chart, and it's a dangerfull market, so I may move just to go to ground and play it on the safer side. will post tomorrow if I actually decide to make a move.