-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

XL-entLady's Account Talk

- Thread starter XL-entLady

- Start date

- Status

- Not open for further replies.

XL-entLady

TSP Pro

- Reaction score

- 48

Interesting read of the morning:

NY Fed Treasury Spread Model Suggests Economic Recovery Has Started, Recession Will End This Year

By Mark Perry on June 4, 2009

"According to the New York Fed, “Research beginning in the late 1980s documents the empirical regularity that the slope of the yield curve is a reliable predictor of future real economic activity.”

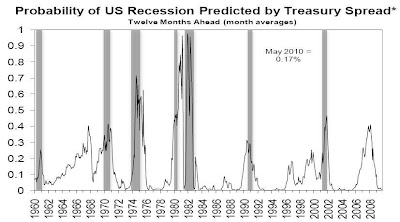

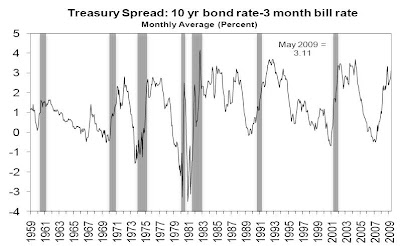

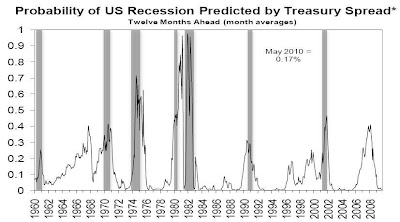

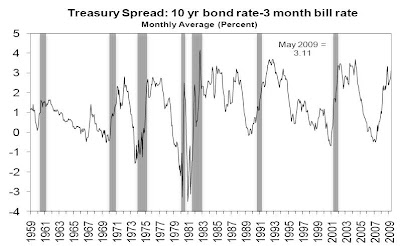

The New York Fed just released its latest “Probability of U.S. Recession Predicted by Treasury Spread,” with data through May 2009, and the Fed’s recession probability forecast through May 2010 (see chart above, click to enlarge). The NY Fed’s model uses the spread between 10-year and 3-month Treasury rates (currently at 3.11%) to calculate the probability of a recession in the United States twelve months ahead (see chart below of the Treasury spread, click to enlarge).

The Fed’s data show that the recession probability peaked during the October 2007 to April 2008 period at around 35-40%, and has been declining since then in almost every month (see top chart above). For May 2009, the recession probability is only 1.54% and by May 2010 the recession probability is only .17%, the lowest level since June 2005.

Further, the Treasury spread has been above 2% for the last 15 months, a pattern consistent with the economic recoveries following the last six recessions (see chart above). The pattern of the recession probability index so far this year (going below double-digits and declining monthly) is very similar to the pattern starting in March 2002 that signalled the end of the 2001 recession.

Bottom Line: Looking forward to next year, there is almost no chance that the recession will continue into 2010. Further, my reading of the New York Fed’s Treasury spread model suggests that an economic recovery is probably already underway, and the Fed’s model predicts the end of the recession in 2009."

http://www.dailymarkets.com/economy...ery-has-started-recession-will-end-this-year/

Lady

NY Fed Treasury Spread Model Suggests Economic Recovery Has Started, Recession Will End This Year

By Mark Perry on June 4, 2009

"According to the New York Fed, “Research beginning in the late 1980s documents the empirical regularity that the slope of the yield curve is a reliable predictor of future real economic activity.”

The New York Fed just released its latest “Probability of U.S. Recession Predicted by Treasury Spread,” with data through May 2009, and the Fed’s recession probability forecast through May 2010 (see chart above, click to enlarge). The NY Fed’s model uses the spread between 10-year and 3-month Treasury rates (currently at 3.11%) to calculate the probability of a recession in the United States twelve months ahead (see chart below of the Treasury spread, click to enlarge).

The Fed’s data show that the recession probability peaked during the October 2007 to April 2008 period at around 35-40%, and has been declining since then in almost every month (see top chart above). For May 2009, the recession probability is only 1.54% and by May 2010 the recession probability is only .17%, the lowest level since June 2005.

Further, the Treasury spread has been above 2% for the last 15 months, a pattern consistent with the economic recoveries following the last six recessions (see chart above). The pattern of the recession probability index so far this year (going below double-digits and declining monthly) is very similar to the pattern starting in March 2002 that signalled the end of the 2001 recession.

Bottom Line: Looking forward to next year, there is almost no chance that the recession will continue into 2010. Further, my reading of the New York Fed’s Treasury spread model suggests that an economic recovery is probably already underway, and the Fed’s model predicts the end of the recession in 2009."

http://www.dailymarkets.com/economy...ery-has-started-recession-will-end-this-year/

Lady

XL-entLady

TSP Pro

- Reaction score

- 48

Pardon my ignorance, Scribbler, but "QE"? "Quarter end"? Or?? Thanks in advance for the clarification!Of course, none of those prior spreads reflect a QE strategy by the Fed. So this normally market-based metric is currently giving a reading that is skewed.

Lady

XL-entLady

TSP Pro

- Reaction score

- 48

Ah, got it. Thanks for the clarification. Yes, I understand now why you're saying that model is not as indicative of recession end as the article makes it seem.Quantitative Easing. Basically, The Fed buying treasuries in order to force the treasury yield down.

So the free-market signal that this indicator has shown in the past in not being used now, since the Fed is pushing rates where it wants them to be.

Lady

XL-entLady

TSP Pro

- Reaction score

- 48

"Japan may outperform other markets over five years, Marc Faber, the investor who publishes the Gloom, Boom and Doom report, said in an interview with Bloomberg Television in Hong Kong. “Of all the regions in the world, Asia is still the most attractive by far.”

http://marcfaberblog.blogspot.com/

The quote above is from Faber's 6/5/09 post on his blog. Sounds like I Fund is going to be a good long-term bet for the next few years.

Lady

http://marcfaberblog.blogspot.com/

The quote above is from Faber's 6/5/09 post on his blog. Sounds like I Fund is going to be a good long-term bet for the next few years.

Lady

Lady,

As we have all seen, the I Fund only does well with a weak dollar regardless of how the underlying countries are doing thanks to "fair-valuing". I have read others say it is Asia without Japan who will do well and of course since our I fund is mostly Japan and Great Britain, it won't help us a whole lot.

C

As we have all seen, the I Fund only does well with a weak dollar regardless of how the underlying countries are doing thanks to "fair-valuing". I have read others say it is Asia without Japan who will do well and of course since our I fund is mostly Japan and Great Britain, it won't help us a whole lot.

C

XL-entLady

TSP Pro

- Reaction score

- 48

I'm seeing a huge amount of bullish sentiment on the MB. From a contrarian viewpoint that could be a very bad thing. Just a thought. :worried:

Lady

Lady

JTH

TSP Legend

- Reaction score

- 1,158

I'm seeing a huge amount of bullish sentiment on the MB. From a contrarian viewpoint that could be a very bad thing. Just a thought. :worried:

Lady

That's only because I'm helping Birchtree spred the manure

XL-entLady

TSP Pro

- Reaction score

- 48

You just keep on keepin' on, you two. Manure helps things grow!That's only because I'm helping Birchtree spred the manureBut hey, I'm still telling the truth, the trend is your friend, and price pays.

Lady

coolhand

TSP Legend

- Reaction score

- 530

That's only because I'm helping Birchtree spred the manureBut hey, I'm still telling the truth, the trend is your friend, and price pays.

Ha, yeah, and we have another range-bound Friday. What's the odds we run the stops in the last 30 minutes of trading again.

XL-entLady

TSP Pro

- Reaction score

- 48

Hi, my friend, glad you stopped by! But if we run the stops in the last bit of trading for the week, that would mean that the market is ...um-m-m... rigged!Ha, yeah, and we have another range-bound Friday. What's the odds we run the stops in the last 30 minutes of trading again.

:nuts:

Lady

coolhand

TSP Legend

- Reaction score

- 530

Hi, my friend, glad you stopped by! But if we run the stops in the last bit of trading for the week, that would mean that the market is ...um-m-m... rigged!

:nuts:

Lady

You conspiracy theorist, you. :laugh:

XL-entLady

TSP Pro

- Reaction score

- 48

We have already established the fact that I am a chicklet, running back to the shelter of the G Fund garage at the first sign of thunder. Well, I'm heading back again.

After studying where the dollar is in its cycle this weekend, it appears to me that a swing low is definitely in. So the dollar will move higher for at least a few days, and if I'm right then I Fund will have rough waters. :worried:

And this next week I'm headed back up to the tall pines so I can't watch the markets every day. Which means that I think I'd better move more to safety. If I was going to be around to watch the markets I would never make this move, but I'm not. There goes an IFT...

so I can't watch the markets every day. Which means that I think I'd better move more to safety. If I was going to be around to watch the markets I would never make this move, but I'm not. There goes an IFT...

As of COB Monday, I'm moving to 85% G and 5% in each of C, S and I Funds.

Lady

After studying where the dollar is in its cycle this weekend, it appears to me that a swing low is definitely in. So the dollar will move higher for at least a few days, and if I'm right then I Fund will have rough waters. :worried:

And this next week I'm headed back up to the tall pines

As of COB Monday, I'm moving to 85% G and 5% in each of C, S and I Funds.

Lady

Last edited:

XL-entLady

TSP Pro

- Reaction score

- 48

I'm back from the tall pines but am a little under the weather. As you can see from the attached picture, the scenery was so beautiful that I wanted to see everything, and I ended up overdoing a bit.

I've been trying to catch up on the posts I missed while I was gone. Glad to see SB checking in. I know we've all been keeping him in our thoughts and prayers. I love the new "Ask James" thread; since L2R hasn't had the time to post much, James is now my "go to" person to get the correct information on a given subject.

Regarding the markets, you may recall that I moved things back to 85% G and 5% in each of C, S and I while I was away. It appears that I didn't need to run back to the G Garage while I was gone after all.

In my financial reading the last day or two, it appears that the market gurus are just as schizophrenic as ever. Half are warning that there is going to be a deep market correction any minute now, and the other half are warning that this bull market train has already left the station and if you're not on this train you're going to be under it. :cheesy:

Probably the most interesting thing I've found in my recent financial perusals is a video from Zacks entitled, "Three Strategies for Today's Market."

http://www.etvmedia.com/etv/Custom/Zacks/Zacks_hub.jsp?movieid=46415&channel=1341

I've decided I've got to make my decisions based on trends. I think I'm keeping my 15% (wish it was more - darn IFT restrictions) in the markets until the 5 day moving average crosses back below the 20 day moving average. Maybe that will keep me from being my own worst enemy in my TSP account. :nuts:

Lady

I've been trying to catch up on the posts I missed while I was gone. Glad to see SB checking in. I know we've all been keeping him in our thoughts and prayers. I love the new "Ask James" thread; since L2R hasn't had the time to post much, James is now my "go to" person to get the correct information on a given subject.

Regarding the markets, you may recall that I moved things back to 85% G and 5% in each of C, S and I while I was away. It appears that I didn't need to run back to the G Garage while I was gone after all.

In my financial reading the last day or two, it appears that the market gurus are just as schizophrenic as ever. Half are warning that there is going to be a deep market correction any minute now, and the other half are warning that this bull market train has already left the station and if you're not on this train you're going to be under it. :cheesy:

Probably the most interesting thing I've found in my recent financial perusals is a video from Zacks entitled, "Three Strategies for Today's Market."

http://www.etvmedia.com/etv/Custom/Zacks/Zacks_hub.jsp?movieid=46415&channel=1341

I've decided I've got to make my decisions based on trends. I think I'm keeping my 15% (wish it was more - darn IFT restrictions) in the markets until the 5 day moving average crosses back below the 20 day moving average. Maybe that will keep me from being my own worst enemy in my TSP account. :nuts:

Lady

XL-entLady

TSP Pro

- Reaction score

- 48

We’ve had some ruffled feathers on the MB over the last few days. And we’ve had some posters who have delighted in continually posting items that are guaranteed to tick off other members. This is my home and my rules. So allow me to babble for a while here about some things I’ve been thinking lately.

I’ve already posted one of my favorite quotes on the MB, but for the sake of continuity, here it is again:

"You've seen what goodness does. It breeds intolerance, rigidity, the belief that because I'm right those who don't believe exactly as I do are wrong and must change. We don't need good. We need balance." - Said by one of the characters in a book by L. E. Modesitt.

The reason that’s one of my favorite quotes is because I think it gets to the root of a lot of the problems I see around me. So many people, and I am including myself in that number, think there is “my opinion and the wrong one.” And then people think that if they only shout loud enough and long enough it will convert everyone else over to the right opinion. Or people think that if they use whatever power they possess in their power structure then they can make everyone else think their RightThink.

I realize that people are passionate about what they think is wrong in this country, or about their religion or their sexual preference or their ____ (fill in the blank). This country was founded on the idea that maybe there wasn’t ONE right idea so maybe everyone should be able to think what they wanted as long as their thinking didn’t harm anyone else.

Even before this country WAS a country, it was settled partly by people searching for a place where they could get away from the GroupThink. Some of my family came here in 1620 for that very reason and I listen to big family speeches about it each Thanksgiving. And yet I also listen to my family (whom I love dearly, don’t get me wrong) become incensed at people who won’t think just exactly like they do about subjects of religion and politics. And I think maybe they’ve forgotten why that ship landed at Plymouth Harbor.

I love the fact that Utah allowed women the right to vote so early in our country’s history, but am frustrated that my voting as a blue dog Democrat in this state makes me a flaming Liberal here.

I’m getting ready for a big family reunion that will take place over the July 4th holiday. My family will gather and they will consist of Scandinavians and Germans and Navajos and blacks and Latinos, and Catholics and Mormons and Buddhists and pagans and atheists, and members of Southern Utah Wilderness Alliance and members of Southern Utah Land Users, and Republicans and at least one Democrat. And at some point in the reunion, one of those differences is going to result in a flaming “knock down drag out” fight. I wish I could figure out how to help achieve less right and more balance.

I wish I had some brilliant piece of rhetoric to close this with before I climb down off my soapbox but I don’t. I just hope I’ve made some sense.

Any suggestions?

[FONT="]Lady[/FONT]

I’ve already posted one of my favorite quotes on the MB, but for the sake of continuity, here it is again:

"You've seen what goodness does. It breeds intolerance, rigidity, the belief that because I'm right those who don't believe exactly as I do are wrong and must change. We don't need good. We need balance." - Said by one of the characters in a book by L. E. Modesitt.

The reason that’s one of my favorite quotes is because I think it gets to the root of a lot of the problems I see around me. So many people, and I am including myself in that number, think there is “my opinion and the wrong one.” And then people think that if they only shout loud enough and long enough it will convert everyone else over to the right opinion. Or people think that if they use whatever power they possess in their power structure then they can make everyone else think their RightThink.

I realize that people are passionate about what they think is wrong in this country, or about their religion or their sexual preference or their ____ (fill in the blank). This country was founded on the idea that maybe there wasn’t ONE right idea so maybe everyone should be able to think what they wanted as long as their thinking didn’t harm anyone else.

Even before this country WAS a country, it was settled partly by people searching for a place where they could get away from the GroupThink. Some of my family came here in 1620 for that very reason and I listen to big family speeches about it each Thanksgiving. And yet I also listen to my family (whom I love dearly, don’t get me wrong) become incensed at people who won’t think just exactly like they do about subjects of religion and politics. And I think maybe they’ve forgotten why that ship landed at Plymouth Harbor.

I love the fact that Utah allowed women the right to vote so early in our country’s history, but am frustrated that my voting as a blue dog Democrat in this state makes me a flaming Liberal here.

I’m getting ready for a big family reunion that will take place over the July 4th holiday. My family will gather and they will consist of Scandinavians and Germans and Navajos and blacks and Latinos, and Catholics and Mormons and Buddhists and pagans and atheists, and members of Southern Utah Wilderness Alliance and members of Southern Utah Land Users, and Republicans and at least one Democrat. And at some point in the reunion, one of those differences is going to result in a flaming “knock down drag out” fight. I wish I could figure out how to help achieve less right and more balance.

I wish I had some brilliant piece of rhetoric to close this with before I climb down off my soapbox but I don’t. I just hope I’ve made some sense.

Any suggestions?

[FONT="]Lady[/FONT]

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 90

- Replies

- 0

- Views

- 83