You had to know something was up when we have a market crash on Thursday due to EU debt contagion and two trading days later we get the biggest rally in a year.

Leaders of the European Union (EU) and International Monetary Fund (IMF) pledged their financial support to eurozone countries. The European Central Bank also announced that it will make eurozone bond purchases via the secondary market, while the U.S. Federal Reserve reopened swap lines with foreign institutions.

But not all losses have been retraced, and suspicion abounds about Thursday's crash, followed by a rare weekend EU deal and then followed up by another big white Monday candle. Nuff said.

Nuff said.

Here's the charts:

NAMO and NYMO managed to flip to buys today, but are still in fairly negative territory.

NAHL barely flipped to a buy, while NYHL barely stayed on a sell.

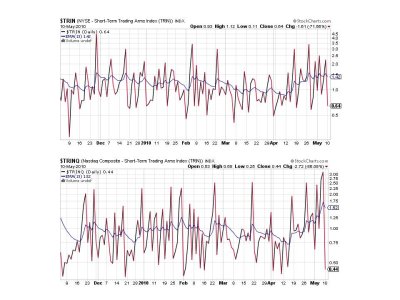

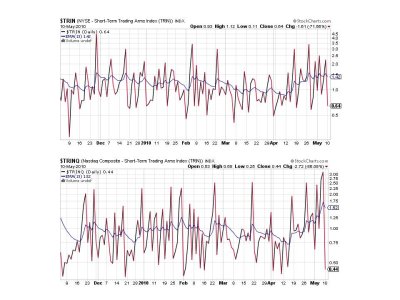

TRIN and TRINQ both dropped well within buy territory.

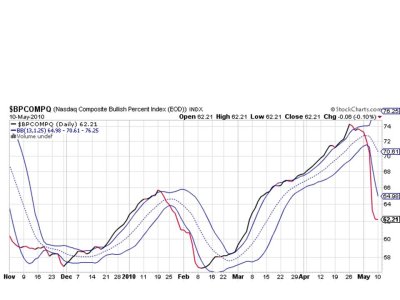

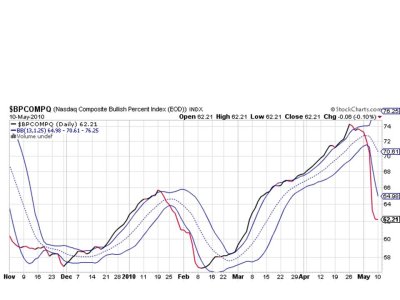

BPCOMPQ has more work to do to get back to a buy. One big rally ain't nearly enough.

So we have 5 of 7 signals on a buy, but the system remains on a sell. I am neither bullish or bearish, but I am very wary of this market. See you tomorrow.

Leaders of the European Union (EU) and International Monetary Fund (IMF) pledged their financial support to eurozone countries. The European Central Bank also announced that it will make eurozone bond purchases via the secondary market, while the U.S. Federal Reserve reopened swap lines with foreign institutions.

But not all losses have been retraced, and suspicion abounds about Thursday's crash, followed by a rare weekend EU deal and then followed up by another big white Monday candle.

Here's the charts:

NAMO and NYMO managed to flip to buys today, but are still in fairly negative territory.

NAHL barely flipped to a buy, while NYHL barely stayed on a sell.

TRIN and TRINQ both dropped well within buy territory.

BPCOMPQ has more work to do to get back to a buy. One big rally ain't nearly enough.

So we have 5 of 7 signals on a buy, but the system remains on a sell. I am neither bullish or bearish, but I am very wary of this market. See you tomorrow.