We're getting close. Very close. As expected today's strength improved the indicators within the Seven Sentinels system, but we didn't quite trigger a buy signal. However, any follow through tomorrow may push it into buy territory.

As I'd been mentioning in my blog of late, I was looking for a buy signal to get triggered as early as this week. Preferably on moderate strength to allow us TSPers time to get in front of it. But we've already seen some nice gains the first day of the week while still remaining on a sell. And they we're not "moderate" gains.

But today's strength does not necessarily mean immediate follow through, so we could see more selling before a bigger move higher (assuming we get one). Volume started out fairly brisk in the early going today, but it dropped off later in the morning and ended at the close leaving a sense that there was not much conviction on the part of buyers and/or perhaps not much conviction by sellers either.

Since I do not have a buy signal yet, I have to wait and see how tomorrows trading goes. If we have immediate and convincing follow through before our noon cut-off, I might get invested and assume a buy signal will be triggered. But any weakness will probably keep me on the sidelines. While big reversals higher the past few months have generally translated quickly into significant gains, I need to stay mindful of the fact that whipsaws may occur at an inopportune time. Past market behavior is often not indicative of future behavior even if I'm inclined to think it will be similar.

So here's where we stand:

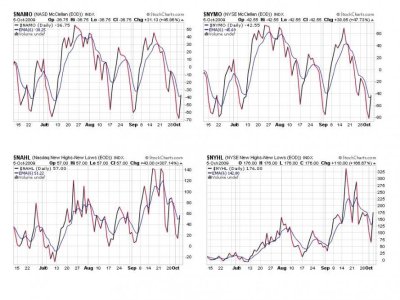

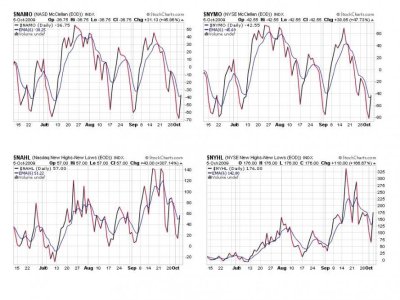

All four signals here managed to get above the 6-day EMA today, which puts them in a buy condition.

TRIN and TRINQ are below their 13-day EMA and also flashing buys. However, BPCOMPQ has not turned up high enough to give us a positive cross of the lower bollinger band, which would trigger a buy signal. So it is the only signal remaining on a sell. That may be a good thing, depending on how the next few trading days play out. So I wait at least one more day.

Our Top 25% have relatively unchanged, so I'll wait to post those charts tomorrow.

As I'd been mentioning in my blog of late, I was looking for a buy signal to get triggered as early as this week. Preferably on moderate strength to allow us TSPers time to get in front of it. But we've already seen some nice gains the first day of the week while still remaining on a sell. And they we're not "moderate" gains.

But today's strength does not necessarily mean immediate follow through, so we could see more selling before a bigger move higher (assuming we get one). Volume started out fairly brisk in the early going today, but it dropped off later in the morning and ended at the close leaving a sense that there was not much conviction on the part of buyers and/or perhaps not much conviction by sellers either.

Since I do not have a buy signal yet, I have to wait and see how tomorrows trading goes. If we have immediate and convincing follow through before our noon cut-off, I might get invested and assume a buy signal will be triggered. But any weakness will probably keep me on the sidelines. While big reversals higher the past few months have generally translated quickly into significant gains, I need to stay mindful of the fact that whipsaws may occur at an inopportune time. Past market behavior is often not indicative of future behavior even if I'm inclined to think it will be similar.

So here's where we stand:

All four signals here managed to get above the 6-day EMA today, which puts them in a buy condition.

TRIN and TRINQ are below their 13-day EMA and also flashing buys. However, BPCOMPQ has not turned up high enough to give us a positive cross of the lower bollinger band, which would trigger a buy signal. So it is the only signal remaining on a sell. That may be a good thing, depending on how the next few trading days play out. So I wait at least one more day.

Our Top 25% have relatively unchanged, so I'll wait to post those charts tomorrow.