It was a listless day of trading, and after yesterday's hard sell-off a bounce was probable. And we got one as the major averages managed to chop their way higher by the close of trade. But it wasn't an impressive performance by the bulls as gains were relatively modest across the board.

The latter part of April does tend to be weak after tax season expires. And I suspect there are investors and traders who may be looking to front-run the "go away in May" crowd too. Especially given QE2 will be winding down in a little more than two months. I wish I knew how that might play out, but it's unknown what the Fed's plan really is, not to mention how the market will react to whatever path they follow. Throw in the fact that this bull market is long-in-the-tooth and I can see investors beginning to ratchet down market exposure to fit individual risk profiles.

Among the latest round of earnings results, Goldman Sachs and U.S. Bancorp both exceeded earnings expectations, but their stocks were hit with selling pressure anyway. Texas Instruments had an earnings miss and met the same fate, although its losses were modest. Steel Dynamics had better-than-expected earnings and its stock was rewarded with a gain on the day's trading. Johnson & Johnson was up as well on better-than-expected results as well as giving an improved outlook.

On the domestic data front, monthly housing starts for March improved to an annualized rate of 549,000, which was more than expected, while building permits improved to an annualized rate of 594,000, which was also better than expected.

Here's the charts:

NAMO remains on a sell, while NYMO managed to flip back to a buy. Both are under pressure and do not look bullish at the moment.

NAHL flipped back to a buy, while NYHL remained on a sell.

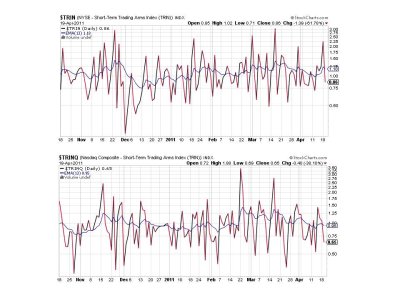

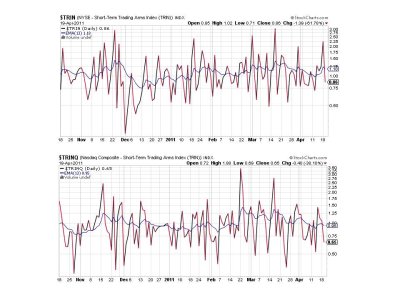

Both TRIN and TRINQ are now flashing buy signals.

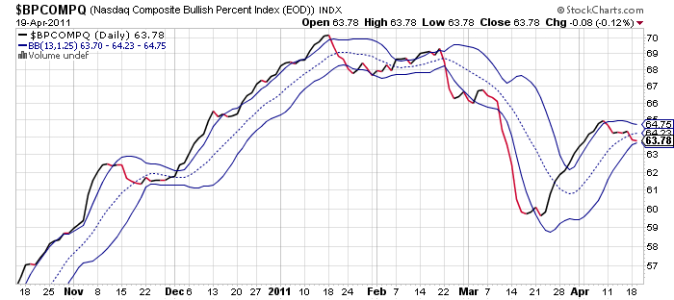

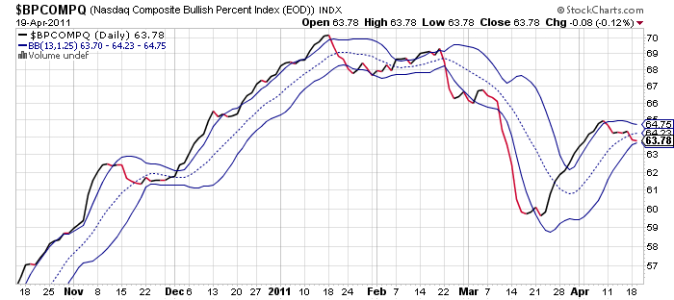

BPCOMPQ tracked just a tad lower and remains on a sell. It's very close to that lower bollinger band and if it drops below that in a meaningful way I'll be more inclined to think we're in for lower prices for at least the short term.

But for now the system technically remains in a buy condition although it has issued two unconfirmed sell signals in the past week. The caution flag is now flying.

The latter part of April does tend to be weak after tax season expires. And I suspect there are investors and traders who may be looking to front-run the "go away in May" crowd too. Especially given QE2 will be winding down in a little more than two months. I wish I knew how that might play out, but it's unknown what the Fed's plan really is, not to mention how the market will react to whatever path they follow. Throw in the fact that this bull market is long-in-the-tooth and I can see investors beginning to ratchet down market exposure to fit individual risk profiles.

Among the latest round of earnings results, Goldman Sachs and U.S. Bancorp both exceeded earnings expectations, but their stocks were hit with selling pressure anyway. Texas Instruments had an earnings miss and met the same fate, although its losses were modest. Steel Dynamics had better-than-expected earnings and its stock was rewarded with a gain on the day's trading. Johnson & Johnson was up as well on better-than-expected results as well as giving an improved outlook.

On the domestic data front, monthly housing starts for March improved to an annualized rate of 549,000, which was more than expected, while building permits improved to an annualized rate of 594,000, which was also better than expected.

Here's the charts:

NAMO remains on a sell, while NYMO managed to flip back to a buy. Both are under pressure and do not look bullish at the moment.

NAHL flipped back to a buy, while NYHL remained on a sell.

Both TRIN and TRINQ are now flashing buy signals.

BPCOMPQ tracked just a tad lower and remains on a sell. It's very close to that lower bollinger band and if it drops below that in a meaningful way I'll be more inclined to think we're in for lower prices for at least the short term.

But for now the system technically remains in a buy condition although it has issued two unconfirmed sell signals in the past week. The caution flag is now flying.