Yesterday I said that the Seven Sentinels were suggesting yet another bounce after Monday's sell-off and low and behold we got a bit of a rally. Of course it was an intra-day rally, but it was a rally none-the-less.

So is that it? Probably not. I suspect another pop higher is still in the cards, but the unemployment report is looming later this week, so it's a difficult call to predict what may happen.

Here's today's charts:

We're sitting just above the 6 day EMA on both signals here and they are technically on buys. But they don't look particularly bullish.

NAHL and NYHL both fell back below their 6 day EMAs are now flashing sells.

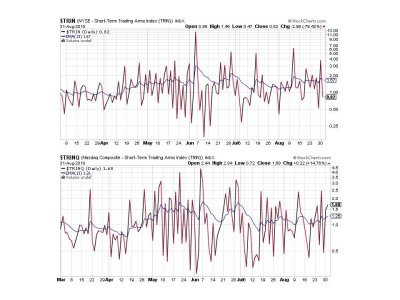

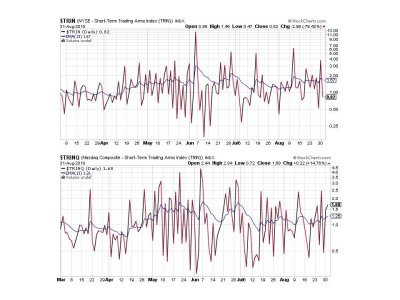

Mixed bag with TRIN and TRINQ. One buy and one sell.

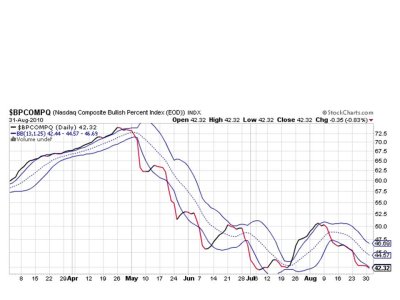

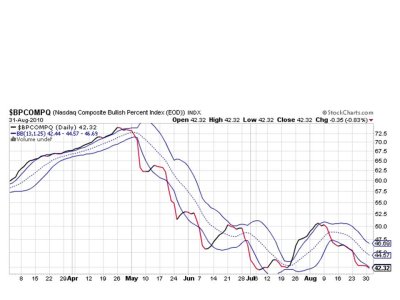

BPCOMPQ continues to drop lower. This particular signals continues to point lower and remains a bearish sign.

So we have 4 of 7 signals flashing sells, which keeps the system on a sell. Although I am expecting another run higher this week, it may not last the day, or we may not get much of a move higher at all with those unemployment numbers looming. We are also moving towards a long weekend, which may spook buyers more than they already are. The Sentinels look neutral overall, but that's only for the very short term. Longer term we are still pointed down.

Things could get very interesting by the end of the week.

So is that it? Probably not. I suspect another pop higher is still in the cards, but the unemployment report is looming later this week, so it's a difficult call to predict what may happen.

Here's today's charts:

We're sitting just above the 6 day EMA on both signals here and they are technically on buys. But they don't look particularly bullish.

NAHL and NYHL both fell back below their 6 day EMAs are now flashing sells.

Mixed bag with TRIN and TRINQ. One buy and one sell.

BPCOMPQ continues to drop lower. This particular signals continues to point lower and remains a bearish sign.

So we have 4 of 7 signals flashing sells, which keeps the system on a sell. Although I am expecting another run higher this week, it may not last the day, or we may not get much of a move higher at all with those unemployment numbers looming. We are also moving towards a long weekend, which may spook buyers more than they already are. The Sentinels look neutral overall, but that's only for the very short term. Longer term we are still pointed down.

Things could get very interesting by the end of the week.