Another sideways day, another averted Seven Sentinels Sell Signal.

This market is really being coy right now. Negative divergences continue to develop, but every time the market gets some pressure, the dip buyers step in. At least I think it's dip buyers, but whatever the case the market continues to keep everyone guessing. I'm not totally surprised as I've been saying we could chop around for a bit until some of the major news issues hanging over the market are resolved and that's exactly what we are doing.

Tuesday is election day followed by the FOMC announcement and QE2. That's a lot of potential market moving issues mixed in with the usual data items and earnings so that could be the reason for the very tight trading range.

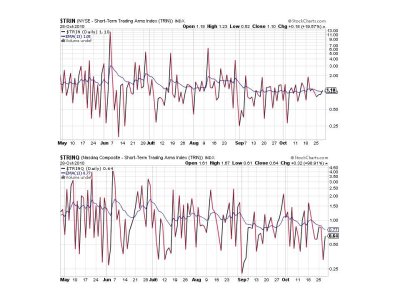

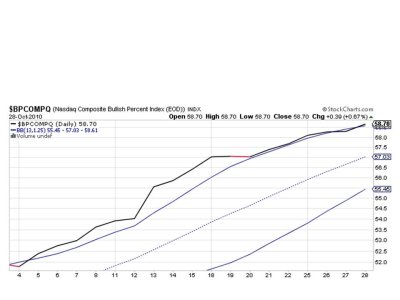

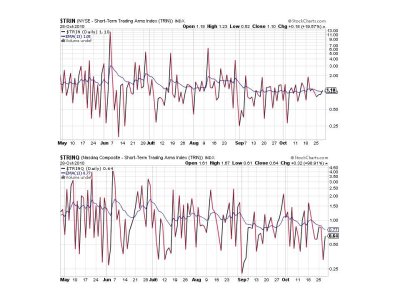

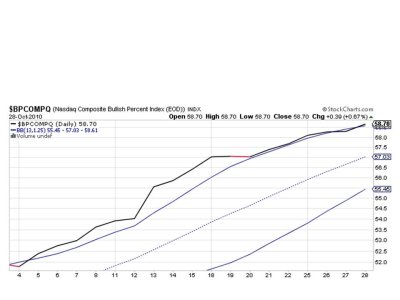

Here's today's charts:

Both signals continue to deteriorate here and remain on sells.

Market internals did manage to improve today with NAHL flipping back to a buy, but NYHL, while showing positive action today, remained on a sell.

TRIN flipped to a sell, while TRINQ remained on a buy.

BPCOMPQ managed to cross back up through that upper bollinger band today and returned to a buy status.

So we have 3 of 7 signals flashing buys, which keeps the system on a buy.

Maybe the weakness is just too obvious. Everyone knows this rally is getting long in the tooth, but sentiment doesn't seem to suggest the contrarian play is long. It's still not over-the-top bullish, but it darn sure isn't where it was 2 months ago. Our own sentiment survey, while not complete for next week yet, is a bit more bullish now than this week was. That's a pattern that's been playing out for several weeks. It seems more and more market participants are becoming bullish and that may be enough to trigger a correction.

I cannot take either side with conviction right now, so I remain neutral. I did however, raise more cash today. I kept a token stock and bond exposure in play for next week, but I wanted a significant amount of cash available in case the Sentinels finally do issue a sell signal. I suspect when this market does finally break out of its current range, it won't be subtle, so if it's to the downside I am well positioned. If we break higher I have something in play there too. And since it's the beginning of the month Monday I'll have two new IFTs to play with. I'm ready for anything, but I sure hope I don't have to watch the paint dry for much longer.

This market is really being coy right now. Negative divergences continue to develop, but every time the market gets some pressure, the dip buyers step in. At least I think it's dip buyers, but whatever the case the market continues to keep everyone guessing. I'm not totally surprised as I've been saying we could chop around for a bit until some of the major news issues hanging over the market are resolved and that's exactly what we are doing.

Tuesday is election day followed by the FOMC announcement and QE2. That's a lot of potential market moving issues mixed in with the usual data items and earnings so that could be the reason for the very tight trading range.

Here's today's charts:

Both signals continue to deteriorate here and remain on sells.

Market internals did manage to improve today with NAHL flipping back to a buy, but NYHL, while showing positive action today, remained on a sell.

TRIN flipped to a sell, while TRINQ remained on a buy.

BPCOMPQ managed to cross back up through that upper bollinger band today and returned to a buy status.

So we have 3 of 7 signals flashing buys, which keeps the system on a buy.

Maybe the weakness is just too obvious. Everyone knows this rally is getting long in the tooth, but sentiment doesn't seem to suggest the contrarian play is long. It's still not over-the-top bullish, but it darn sure isn't where it was 2 months ago. Our own sentiment survey, while not complete for next week yet, is a bit more bullish now than this week was. That's a pattern that's been playing out for several weeks. It seems more and more market participants are becoming bullish and that may be enough to trigger a correction.

I cannot take either side with conviction right now, so I remain neutral. I did however, raise more cash today. I kept a token stock and bond exposure in play for next week, but I wanted a significant amount of cash available in case the Sentinels finally do issue a sell signal. I suspect when this market does finally break out of its current range, it won't be subtle, so if it's to the downside I am well positioned. If we break higher I have something in play there too. And since it's the beginning of the month Monday I'll have two new IFTs to play with. I'm ready for anything, but I sure hope I don't have to watch the paint dry for much longer.