Uptrend

TSP Pro

- Reaction score

- 74

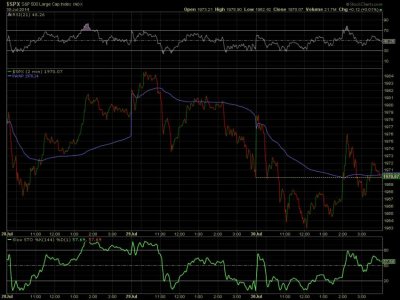

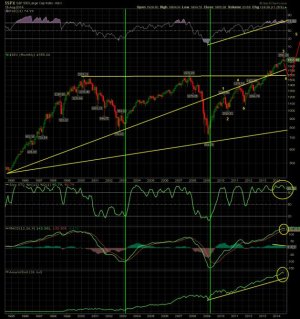

Not much is happening. Market action is somewhat typical for OX week. Based on my models it still paints TSP C and S funds as projecting down. The I fund still shows sideways action with a down bias (EFA chart). I am expecting the downtrend to resume in earnest, as soon as the week is over or even by sometime tomorrow or Friday. Watch carefully if SPX 1956 acts as support or is taken out. If it fails, as I expect it will, the market could fall as far as 1897. The upcoming EW should be a three, which is normally the steepest and longest down wave of a series. Gold is floundering around $1300 or slightly below and points down to the $1240-1280 area. Sticking to my G/F plan for now (G 60%, F40%). The reason I didn't go 100% F from C/S when I made a change a few days ago is because a combo tends to do better when the market is going sideways and I knew OX week could do just that. Sentiment is neutral (my methodology), but still with a bullish tendency (bearish for stocks).