Khotso

Market Veteran

- Reaction score

- 27

I know I have taken a big break from TSP, but was remodeling my home, and something had to go. Have been following the market though and making some Stock trades. Just sold AUY (for now) and bought EBAY this AM (It is way oversold). The charts tell me that EBAY is a screaming buy. Zach's rating is a 3 (hold). It has come down more than 20% off its highs this spring.

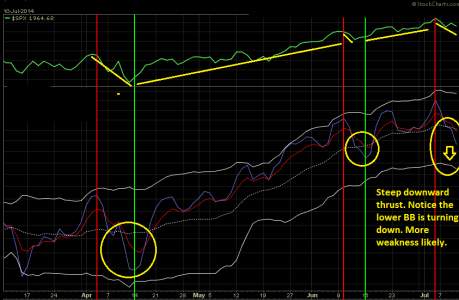

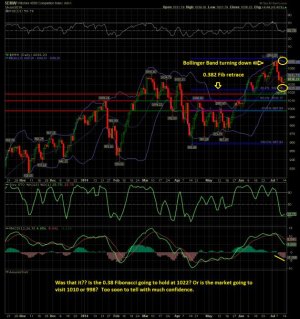

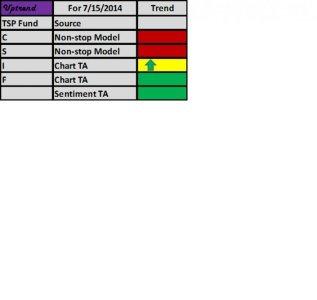

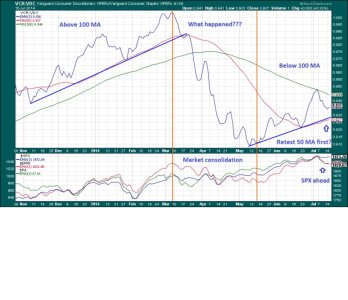

On the TSP front, institutions have laid down big money on the buy side this AM, so I went back in from the sidelines (60% S and 40% C). My two non-stop models (NYSE and NASDAQ) are somewhat in disagreement: NYSE model on a sell, but improving and NASDAQ on a buy. These models have been highly reliable; especially when combined with money-flow. Sentiment is quite bullish now, so we shall see if that kills any further gains. Gold should pull back a little here, unless the Irag or Ukraine situations worsen and safe haven buying resumes. I also think the recent inflation perking up may be influencing the gold buying.

In short the market has mixed signals, so some caution is probably warranted. However, I am going with the big boys money-flow and my trend models.

Hey, good to see you back posting. Home remodel eh? Me too! Looks like I'll be plugging away at finishing family room, roof, and replacing siding after tear off for new picture windows this summer. Hope I can get it all done! But, hey, that's why I retired right?