Uptrend

TSP Pro

- Reaction score

- 74

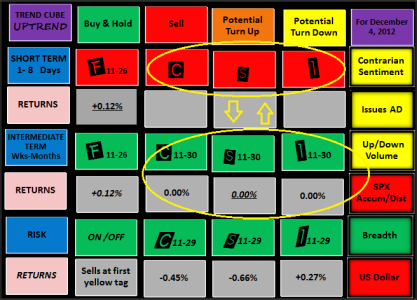

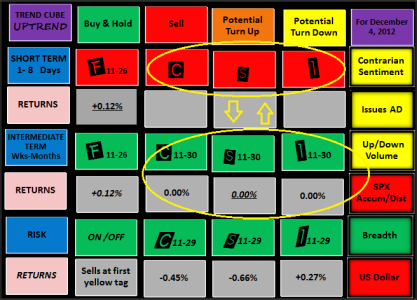

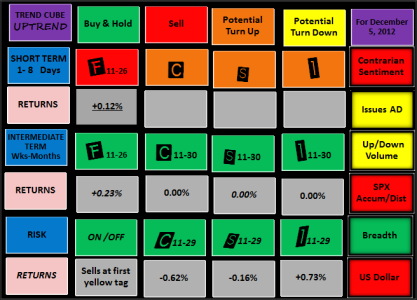

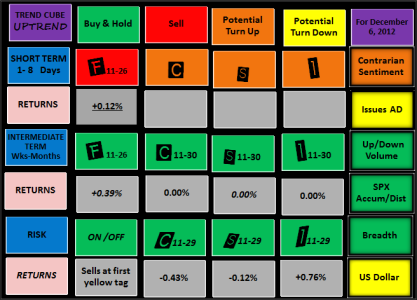

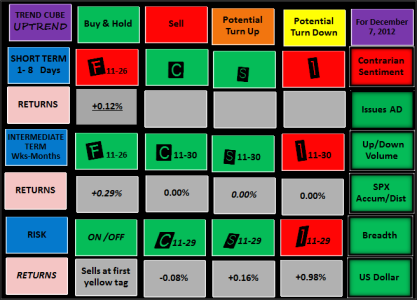

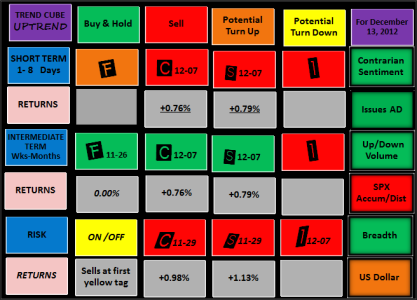

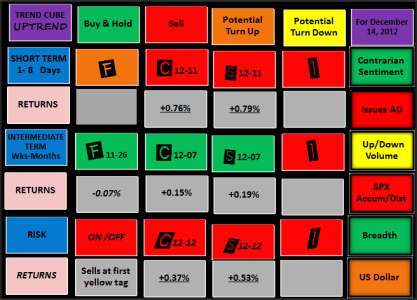

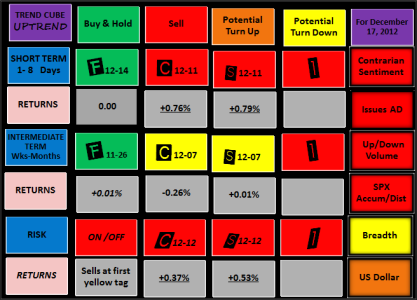

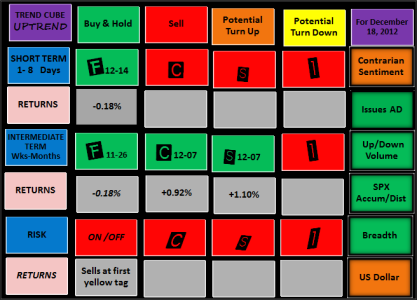

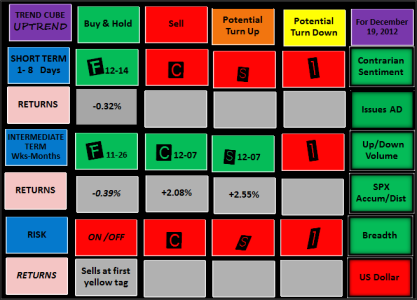

Cube for December 4. Note that the intermediate term trade is green, but will delay starting, until the short term trade turns from red to green. Once the intermediate term trade is underway, the short term can flip back and forth while the intermediate term trade continues. The current difference in cycles should get in synch within a few days. The 60 minute charts are down around nuetral. Whether that's it or a little more remains to bew seen. Even though there has been net distribution on SPX the last 2 days, the institutions have been buying. Also, there is a disparity in strength between the NY and Nasdaq stock exchanges, with the NY being much stronger. The Nasdaq needs to pick up to spark a rally.