Uptrend

TSP Pro

- Reaction score

- 74

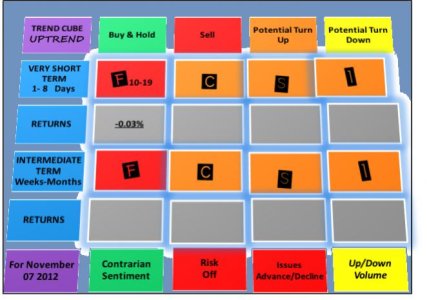

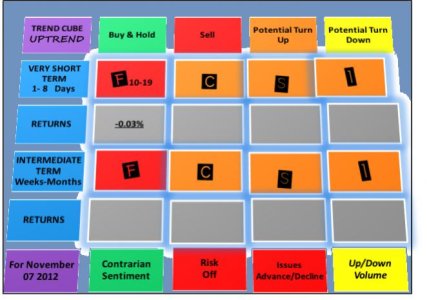

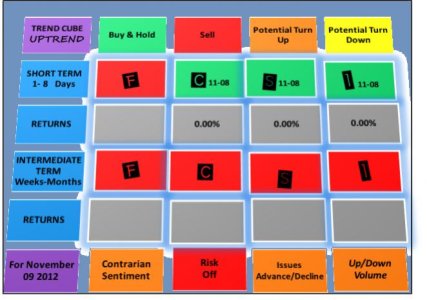

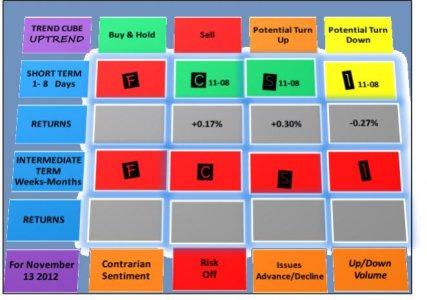

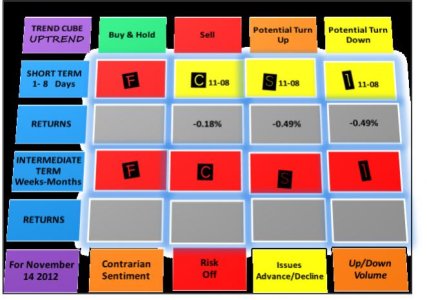

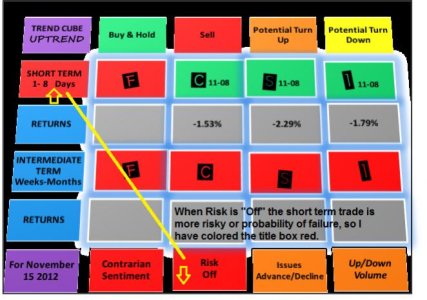

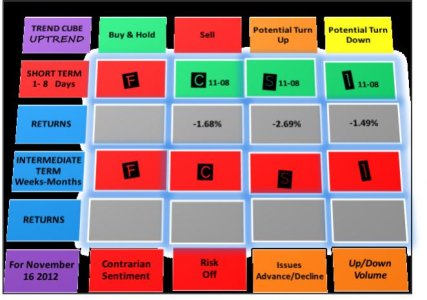

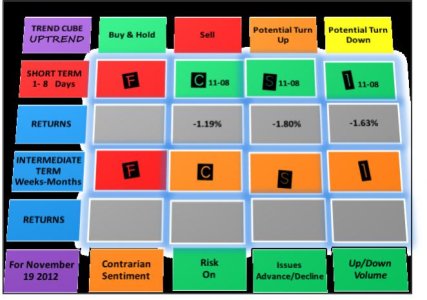

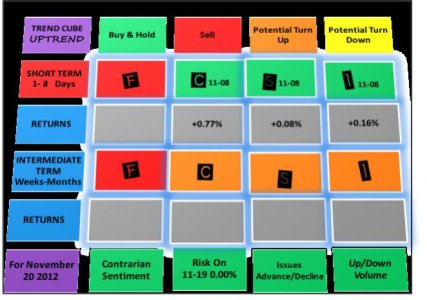

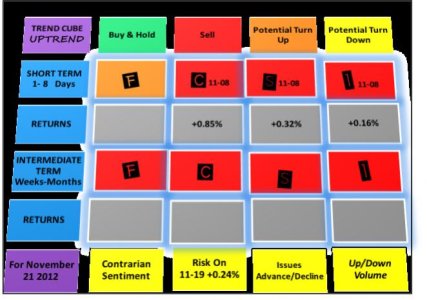

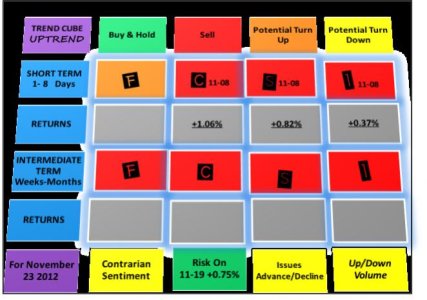

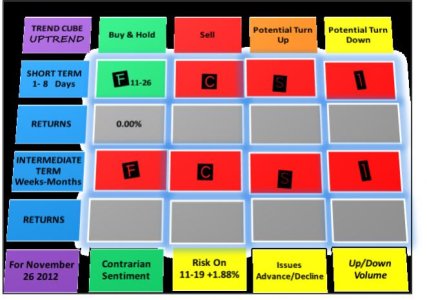

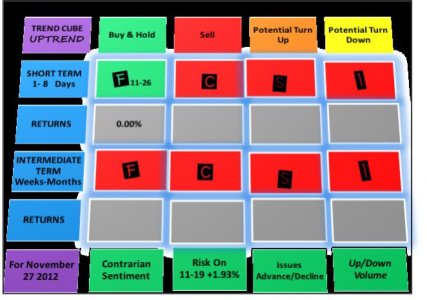

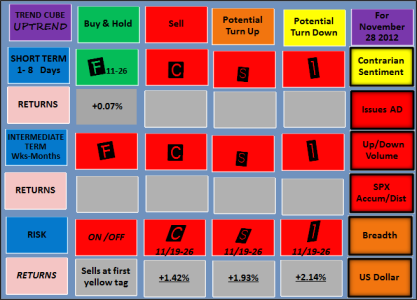

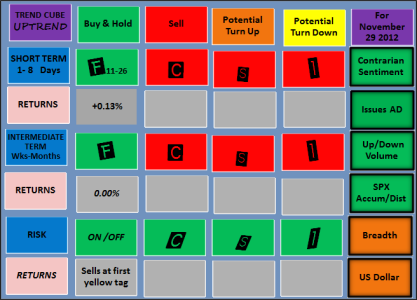

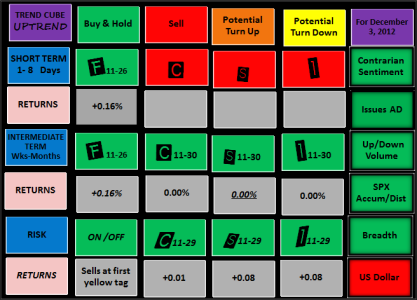

Now that the election is over, the market is lining up for a buy. Big jump on bonds this AM, but no volume. For equities, up/down volume is up and in the buy zone, despite this flush-out. A short term and intermediate term buy are shaping up, as soon as "Risk On" cooperates. This time short term and intermediate term buys may trigger almost together, and this may happen as soon as tomorrow or in the next few sessions. There is good support at SPX 1389-1398, which in my view needs to be tested. The US dollar is getting toppy short term.