jkenjohnson

Market Veteran

- Reaction score

- 24

I also sold C and S on Thursday! I think that was the first right thing I have done this year!! :nuts:

Thanks!

Good moves

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

I also sold C and S on Thursday! I think that was the first right thing I have done this year!! :nuts:

Thanks!

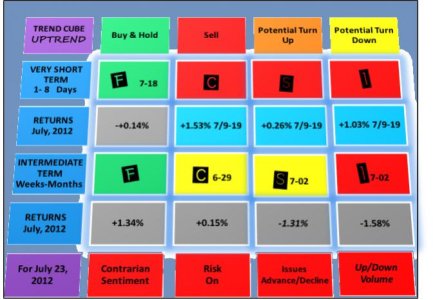

SPX 1340 support area is being tested today. If this fails, then 1313 should be next, but I am not real sure it will happen. I notice the institutions have been accumulating a lot of Apple the last few days. And several charts of mine, in addition to what was shared in my recent blog, suggest a big rally around the corner. Bonds are topping and the cube very short term trade went to sell. However, they should take off again if the SPX 1340 area is breached below 1334. Breadth indicators are negative, but are setting up for a breadth thrust; at least the formation is there and this is bullish.

View attachment 19690

Re: Uptrend's Account Talk

Originally Posted by Uptrend

SPX 1340 support area is being tested today. If this fails, then 1313 should be next, but I am not real sure it will happen. I notice the institutions have been accumulating a lot of Apple the last few days. And several charts of mine, in addition to what was shared in my recent blog, suggest a big rally around the corner. Bonds are topping and the cube very short term trade went to sell. However, they should take off again if the SPX 1340 area is breached below 1334. Breadth indicators are negative, but are setting up for a breadth thrust; at least the formation is there and this is bullish."

Betting on APPL, a lot of people would consider a safe bet given its track record. Given this last 3-day triple digit slide though, if they don't meet expectations in today's report, the selloff could be massive.

I went all in on today's weakness...also betting on AAPL! :nuts:

What I am wondering, UPTREND, is why you moved to G. Your own charts seem to indicate a rebound now that S&P is under 1340. Are you still holding out for a lower low???

I went all in on today's weakness...also betting on AAPL! :nuts:

What I am wondering, UPTREND, is why you moved to G. Your own charts seem to indicate a rebound now that S&P is under 1340. Are you still holding out for a lower low???

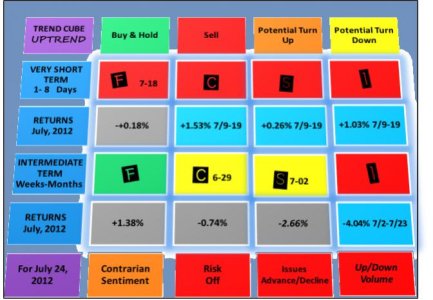

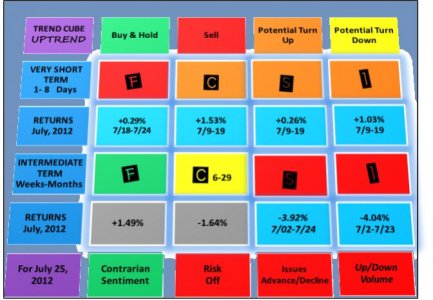

Uptrend are you around? I'm missing the daily cube :worried:

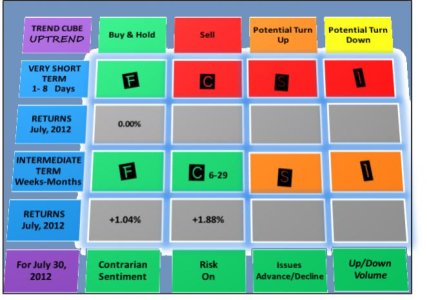

My cube intermediate trend C fund sells and goes to G today. Internals under the market are poor. I will be back later in the week.