Appatite

Market Tracker

- Reaction score

- 3

A buy signal is given for the F fund today.

Doesn't that equate to a sell signal for the S and I funds?

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

A buy signal is given for the F fund today.

Birchtree:343601 said:Gee, I've never owned the F fund - what have I been missing.

A 7.89% gain last year in your TSP account.

Better than a sharp stick in the eye....I would've taken it.

The only thing that is a little concerning is that the dumb money is outspending the smart money.

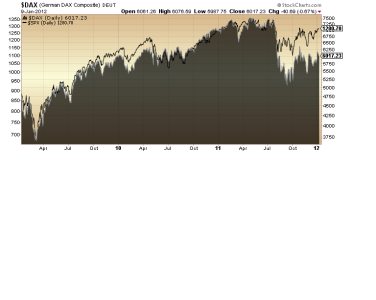

Thank you for your analysis Uptrend! I am a little surprised that you expect 6-7 more days to the low. I would think that 2-3 days is all that will be needed to get to 1258. Especially with the Europeans left on the own on Monday? Also the week after next being options expiration week...doesn't that week trend to be positive? Thanks again.

Currently up 0.92% in the F Fund since 12/21/11.

Thank you for your analysis Uptrend! I am a little surprised that you expect 6-7 more days to the low. I would think that 2-3 days is all that will be needed to get to 1258. Especially with the Europeans left on the own on Monday? Also the week after next being options expiration week...doesn't that week trend to be positive? Thanks again.

Currently up 0.92% in the F Fund since 12/21/11.

Ok, the low may come by January 18 (and that is one of my turn dates), although sometimes the market is shifted by several sessions.

You would think the trend would be positive during options X; however the odds are against it when the SPX hits a multimonth high like it did this week. Under this set of circumstances, according to Frank Hogelucht research shows: "The S&P 500 closed at a lower level (compared to the previous week's close) two and three days into option expiration week on 3 out of every 4 (to be exact: on 31 out of 40) occurrences, and closed out option expiration week with a loss on 29 out of 40 occurrences (or almost 75% of the time)". Thease are odds I am not playing, and in fact I like the odds in reverse.

http://www.safehaven.com/article/23973/spx-at-multi-month-high-before-opex

I can hardly contain myself thinking about the down move coming.

Sarcasm is not your strong suit...

I think he is actually excited. Every down move is an opportunity to buy!