-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Uptrend's Account Talk

- Thread starter Uptrend

- Start date

KevinD

Market Veteran

- Reaction score

- 41

To clarify:

Day trade Buy and sell the same day. Don't hold overnight.

Swing trade Hold overnight and for a few days to a few weeks. Exit the trade when the trend breaks. Don't hold in a contra trend.

Position trade Hold overnight for several weeks to months. Hold through a contra trend.

Since I was expecting an ABC (A and C are up waves and B is a contra trend downwave) uptrend for primary wave II, once primary wave I (12345) down is completed, I was saying to consider holding trhough the B wave. The length of time for this ABC to develop should be 4-6 weeks.

However I am not real sure if wave 4 of primary wave I has completed or if we are in it now. I had previously thought wave 4 had ended, but based on the price action in the latest runup, I am not sure. Either wave 4 (if it is wave 4) turns over fairly soon, or we previously completed wave 4 and had a truncated wave 5. In that case we are already in the ABC relief rally. This rally when it begins, or if it has already began, should last 4-6 weeks and retrace about half of the drop or a little more. Anywhere between SPX 1260 and 1315 on the upside is fair game.

We need to find out what the jobs numbers in the ADP report tomorrow and the employment report on Friday do, if anything. The breakout of the bullish falling wedge I talked about in previous posts could be backtested anywhere between SPX 1080-1060. If tis test results in as higher low, we have a screamin buy and Mr. market should be in the ABC rally. This would be the last change to get on board. My original turn dates were September 2, 6 or 7. Under this scenario, wave 5 of primary wave I down would have ended abruptly.

My uptrend system is not calling a tradable buy yet, due to market internal weakness. That may change very soon.

Bear Case Low and declining volume for this mini-rally. Financials (XLF) failed to make new highs. Volatility (VIX) still above 30. Sentiment starting to turn bullish. Bond prices moving up. Gold moving up. Somewhat overbought. Still a chance for a fall to SPX 1090 -1110 to complete wave 5 of primary wave I.

Bull Case Support at SPX 1187 and now 1208. Breakout of bullish falling wedge. Gap and go on 5 minute charts. Bullish allignment of moving averages firming up on the charts. Island bullish reversal pattern on some charts (can see on EFA (for I fund) or COMPQ for example. Still a chance for a backtest and a higher low, and then off to the races. Or no backtest at all and just keep going up. In summary, IMO, need more volume to confirm the move. A lower high might do the trick.

Last one. Lunch time is over.:cheesy:

Uptrend

TSP Pro

- Reaction score

- 74

If the breakout today on SPX holds, Mr market is off to test the previous highs or come within 1%. Little resistance now until the 1290 area. There is a chance this trend might be a bull 3rd wave and not a bear C at all. In that case a move over 1400 would happen. We need to watch and see if the advance looks impulsive or corrective.

Uptrend,

As per your 11-7-11 post..."A big move is coming within 1 to 3 sessions. There are pennants on most of the charts. SPX 1235 must hold. US dollar on UUP is backtesting 50 sma from below. Risk on trade is somewhat on edge."

Question: is this assumption still valid as per Elliot Wave theory? That is, if we don't hold 1235 today or tomorrow, are we going down big? Thanks in advance for your response.

As per your 11-7-11 post..."A big move is coming within 1 to 3 sessions. There are pennants on most of the charts. SPX 1235 must hold. US dollar on UUP is backtesting 50 sma from below. Risk on trade is somewhat on edge."

Question: is this assumption still valid as per Elliot Wave theory? That is, if we don't hold 1235 today or tomorrow, are we going down big? Thanks in advance for your response.

Uptrend

TSP Pro

- Reaction score

- 74

The black swan came flying by -I kind of saw a problem on the charts, but there were pros and cons, so I did not heed, and now the pain. The setup was there for a big up move or a big down move.

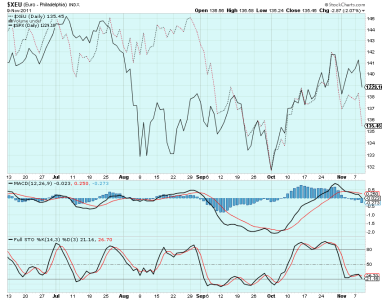

It appears to me this is all about the Euro and the US dollar inverse. See chart:

From about September 12, the Euro (dotted line) has been closely following the SPX cash(solid line). This is the roadmap. The Euro is just now getting oversold on the stochastic, but in September stayed that way for a month. The MACD has been below the zero line for the last 5 days. The first spike down in SPX cash to 1215 was a warning to get out (or on the next bounce). Because the Euro line is now below the SPX cash line suggests that SPX cash may fall further. The down moves off the 1293 high on SPX look corrective, not impulsive and this is a characteristic of a bear market, not a bull. Todays candle was a bearish engulfing on SPX. It needs confirmation.

I don't think the selling is over yet. If the 1220-1215 area breaks, then the market will test SPX 1187 next. Some of my TA is suggesting that a larger downmove is ahead. We need to watch the open, but I am tentatively posting a sell signal, as most of my system is on "sell." Bonds and F are overbought, but the trade is still intact for those that are holding. The VIX 30%+ spike today was amazing. There is real fear out there.

It appears to me this is all about the Euro and the US dollar inverse. See chart:

From about September 12, the Euro (dotted line) has been closely following the SPX cash(solid line). This is the roadmap. The Euro is just now getting oversold on the stochastic, but in September stayed that way for a month. The MACD has been below the zero line for the last 5 days. The first spike down in SPX cash to 1215 was a warning to get out (or on the next bounce). Because the Euro line is now below the SPX cash line suggests that SPX cash may fall further. The down moves off the 1293 high on SPX look corrective, not impulsive and this is a characteristic of a bear market, not a bull. Todays candle was a bearish engulfing on SPX. It needs confirmation.

I don't think the selling is over yet. If the 1220-1215 area breaks, then the market will test SPX 1187 next. Some of my TA is suggesting that a larger downmove is ahead. We need to watch the open, but I am tentatively posting a sell signal, as most of my system is on "sell." Bonds and F are overbought, but the trade is still intact for those that are holding. The VIX 30%+ spike today was amazing. There is real fear out there.

Uptrend

TSP Pro

- Reaction score

- 74

A sell signal has been given for C, S and I. F is overbought, but can move higher. IMO a stop may be SPX 1187, if this is a B wave or major B or primary ABC, or it could be worse. That is, it could be starting major wave one of primary C down. Good luck to all in the market. Capital preservation is numero uno.

Kaufmanrider

TSP Analyst

- Reaction score

- 17

A sell signal has been given for C, S and I. F is overbought, but can move higher. IMO a stop may be SPX 1187, if this is a B wave or major B or primary ABC, or it could be worse. That is, it could be starting major wave one of primary C down. Good luck to all in the market. Capital preservation is numero uno.

Uptrend, I see your system gave a sell signal yesterday morning, but you stayed in the market? Just wondering why?

Thanks

- Reaction score

- 2,458

Kauf -

Uptrend is actually in the F fund today. At least it will look that way when the AutoTracker gets updated tonight.

He forgot to input his 100% F IFT on Thursday and unfortunately let me know too late (I had already processes Thursday's data) so it will be processed on Friday. Because of the holiday, Friday also gets processed with Thursday's prices so returns-wise, we can still make it look like he made the IFT on Thursday. I hope that makes sense.

By the way, any other IFT's made today get pushed to COB Monday.

Uptrend is actually in the F fund today. At least it will look that way when the AutoTracker gets updated tonight.

He forgot to input his 100% F IFT on Thursday and unfortunately let me know too late (I had already processes Thursday's data) so it will be processed on Friday. Because of the holiday, Friday also gets processed with Thursday's prices so returns-wise, we can still make it look like he made the IFT on Thursday. I hope that makes sense.

By the way, any other IFT's made today get pushed to COB Monday.

Kaufmanrider

TSP Analyst

- Reaction score

- 17

Thanks Tom.

Uptrend

TSP Pro

- Reaction score

- 74

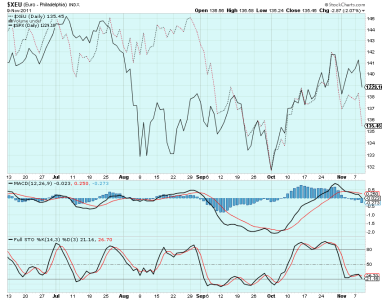

Why I think the US markets will decline in the near term (1-2 months). Subtitle: Watch the Euro

I posted a chart the other day showing that the SPX was tracking the Euro. Well here is a chart of the FX market Eur/USD pair on a monthly basis. The channel has been sloping down for some time. I have circled 3 peaks on the ROC (rate of change). You can see that the market fell for 5-7 months after the peak the past 2 times. So far it has been about 5 months on the current EUR/USD decline. So, if history repeats the Eur/USD pair should decline for about 2 more months before relief. The ROC and MACD are both below the zero line so the downtrend should start to get more intense (more selling & larger drops) Euro down means US dollar up, if the correlation continues. And US dollar up means equities down. The lower channel target is near 1.15 -1.10 depending on how may months it takes to get there. The US markets should tank at this Euro level.

I have thought about the Europeans and where they would stash their Euros during a decline. Emerging markets, real estate, gold, and US treasuries? If so, bond prices should go higher. The US banks holding Euro wealth should really get hurt and this may cascade the US equities into a more severe drop. Just thinking out loud. Alternative opinions welcome.

I posted a chart the other day showing that the SPX was tracking the Euro. Well here is a chart of the FX market Eur/USD pair on a monthly basis. The channel has been sloping down for some time. I have circled 3 peaks on the ROC (rate of change). You can see that the market fell for 5-7 months after the peak the past 2 times. So far it has been about 5 months on the current EUR/USD decline. So, if history repeats the Eur/USD pair should decline for about 2 more months before relief. The ROC and MACD are both below the zero line so the downtrend should start to get more intense (more selling & larger drops) Euro down means US dollar up, if the correlation continues. And US dollar up means equities down. The lower channel target is near 1.15 -1.10 depending on how may months it takes to get there. The US markets should tank at this Euro level.

I have thought about the Europeans and where they would stash their Euros during a decline. Emerging markets, real estate, gold, and US treasuries? If so, bond prices should go higher. The US banks holding Euro wealth should really get hurt and this may cascade the US equities into a more severe drop. Just thinking out loud. Alternative opinions welcome.

Uptrend

TSP Pro

- Reaction score

- 74

More on Europe and the Euro; and it ain't pretty

Biz talk

http://www.zerohedge.com/news/european-funding-crisis-accelerating

So Italian bonds were under 7% for what, about 3 days?

http://www.marketwatch.com/story/italy-10-year-bond-yields-rise-back-above-7-2011-11-15

"Fact #4. Last week, S&P sent a notice to its private subscribers stating that its AAA rating of France was on the chopping block; that a downgrade was in the works. France reacted with great outrage. And, surprisingly, S&P responded by sheepishly stating that the message was an “accident.”

http://www.moneyandmarkets.com/the-next-two-victims-of-the-debt-contagion-48021

Who even heard of this 3 months ago?

http://www.cnbc.com/id/45300333

Biz talk

http://www.zerohedge.com/news/european-funding-crisis-accelerating

So Italian bonds were under 7% for what, about 3 days?

http://www.marketwatch.com/story/italy-10-year-bond-yields-rise-back-above-7-2011-11-15

"Fact #4. Last week, S&P sent a notice to its private subscribers stating that its AAA rating of France was on the chopping block; that a downgrade was in the works. France reacted with great outrage. And, surprisingly, S&P responded by sheepishly stating that the message was an “accident.”

http://www.moneyandmarkets.com/the-next-two-victims-of-the-debt-contagion-48021

Who even heard of this 3 months ago?

http://www.cnbc.com/id/45300333

Birchtree

TSP Talk Royalty

- Reaction score

- 143

"In the 1990s equity markets in the US rallied as the US dollar rallied as well. The main idea is that under the fall melt-up scenario, do not let currency movements trick you into thinking that a strong dollar is bearish for equities. If anything, it would further the case for a Grand Surprise in risk assets into the end of the year."

- Reaction score

- 2,458

Agree, but the trend is the trend and that is the current trend - dollar down, stocks up / dollar up, stocks down.

At some point stocks will go up, bonds yields will go up, and the dollar will go up. But when? When that trend starts we'll go with that.

At some point stocks will go up, bonds yields will go up, and the dollar will go up. But when? When that trend starts we'll go with that.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

When we put policies in place that promote our economic strength and growth, and not until then...But when?

Uptrend

TSP Pro

- Reaction score

- 74

Well folks, apologize for fewer posts lately, as I have been busy balancing two jobs and then keeping an eye on the market. Anyway here is my take: You know we had a large pennant, and it has broken down. IMO this is not a fake-out but a real break. The chart below shows what I think is going on. Or course, I could be wrong but this is a fairly high probability based on the evidence. I have used two different methods to arrive at the SPX 1158 area as being the bottom before a turn takes place. The time projection by my methodology, is Nov 28, as the turn date.

The big picture is this: we are in a bear market, not a bull. The bear market has 3 primary waves, as all bear markets do, A,B and C. We are currently in primary wave B, the retracemnt wave against the downtrend, and in major wave B going the same direction as the downtrend. A major wave C (upward) must take place to complete the B primary wave, when the current downwave completes. This major wave C should terminate within 1% of the April, 2011 1370 high, based on historical evidence for bear market rallies.

The big picture is this: we are in a bear market, not a bull. The bear market has 3 primary waves, as all bear markets do, A,B and C. We are currently in primary wave B, the retracemnt wave against the downtrend, and in major wave B going the same direction as the downtrend. A major wave C (upward) must take place to complete the B primary wave, when the current downwave completes. This major wave C should terminate within 1% of the April, 2011 1370 high, based on historical evidence for bear market rallies.

Similar threads

- Replies

- 0

- Views

- 112

- Replies

- 0

- Views

- 233

- Replies

- 0

- Views

- 168

- Replies

- 1

- Views

- 235