Uptrend

TSP Pro

- Reaction score

- 74

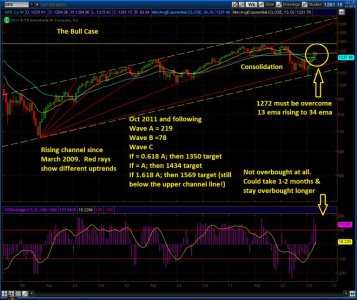

Market appears to be at a turning point this AM; meets time projections. Appears to me to be start of the major B wave down of primary wave B (of bear market ABC). I know, I missed the very profitable major A wave, but better to be safe than chase. Also, the market has now partially shown it's hand. Based on the 1257 top, I am projecting SPX 1187 - 1144 as the turn point for the start of major wave C. Some say that major wave B has already occurred and we would now be topping wave C and then starting primary wave C, but that does not line up with my analysis. Major wave C could attain SPX 1330-1370 (or even higher), before rolling over.

Bonds are waking up. I see a +1-2% trade in the next week. That is a guess, based on the structure of the set-up.

Bonds are waking up. I see a +1-2% trade in the next week. That is a guess, based on the structure of the set-up.

![thumbnail[6].jpg thumbnail[6].jpg](https://forum.tsptalk.com/data/attachments/4/4818-28d05a5f3877dc9bac58e18c5e2376df.jpg?hash=08BcrpyclP)