My weekly charts show more room to move to the upside, but that is HIGHLY dependent on the news and economic data and revisions through the end of this week. More and more analysts, CEO's, and politicians are becoming more positive in their opinions regarding the fiscal cliff. However, if you look at Friday's daily volume for the $SPX, it was the lowest in over 6 months, by over half a BILLION shares. If you want to stay all F/G, I definitely dont think you are alone in your position and/or overall outlook on the market, but I am all in the C fund right now. My weekly charts crossed the buy line last week. With that chart, plus the economic news seeming to turn a bit more positive, I feel overall pretty comfortable about my decision.

The Intraday chart today showed a sell-off in the morning and then slow and technical buying throughout the rest of the trading day. The chart tested and retested its support along the 50 day moving average, slowly gaining strength. After 245pm, the chart moved higher and tested its 20 as support until the Heavy buying volume that pushed the final close back up to 1406.29, less than 3 points below its open at 1409.15.

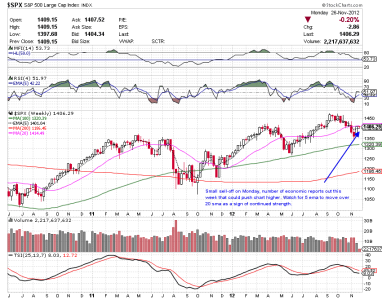

My Weekly chart below is still holding abve its buy signal line (EMA 5). Had there not been a normal sell-off in the morning, I believe the S&P would have climbed slightly higher than its previous close. Tomorrow there are a few economic numbers coming out, durable goods orders at 830, home price index at 9, and consumer confidence at 10. Most forecasts are for revisions/reports to be lower because of SS Sandy. I don't think they really know what to expect. If these numbers come in higher, I look for that to be a catalyst for the bulls. Any numbers slightly lower or in-line with expectations, I don't see having a great impact, because of Sandy. I think they will be brushed off as a sign of the storm rather than that of economic weakness. I guess only time will tell, but I don't look to try to move out of the C fund unless there is a significant move in the markets.

As always, any opinions or comments are welcome!!