-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tsunami's Account Talk

- Thread starter Tsunami

- Start date

Tsunami

TSP Pro

- Reaction score

- 62

Airlift - Thanks

FS - No I don't follow "Trader Joe" at that site but used to watch his videos and still have it bookmarked. I found him to be too inaccurate and stopped paying attention. Most Elliott wave guys seem to have a bearish bias all the time (e.g., Daneric, and the guys at elliottwave.com and other bearish gurus that I used to subscribe to (Prechter and Steven Hochberg, and Robert McHugh, and Tim Wood). I subscribed to those latter three for a long time and boy did they cost me tons of money with their constant bearish views. Having said that, I think during bear markets they're worth paying attention too, so I'll give that post by McHugh that MrJohnRoss a read today as I watch my Seahawks tear up the Bears (I hope). I know that Tim Wood says his "DNA markers" are now in place for a major crash, and McHugh has been big on that megaphone pattern, which is quite scary and I'm not ready to believe it will happen yet (e.g., a plunge clear down to well below the 2009 low of 666), but I'm not dismissing it entirely since it's conceivable this bear market could snowball into an out of control unraveling of government debt worldwide.

Law87 - Yep, and that 7-year cycle is probably the #1 reason I'm convinced this is indeed a bear market and not something that will rhyme with 2011 as the wall street pros who need to sell stocks would have us believe. I used to post about the late Terry Laundry a few years ago before his untimely passing in July 2012. Just before he passed, he began warning of an eventual major top around (gulp) mid-2015 and then a massive plunge to a low around April 2016 in what he dubbed his "M" cycle low, which was basically a 76 week cycle and a 7-year cycle combined, with the biggest drops coming at the confluence of a 76-week cycle and the 7-year cycle... he also combined that with what a friend of his (Edson Gould) called the megaphone formation. He's the one that first coined it back in the 60's and you can Google "Edson Gould megaphone formation" and find a few links about it. Basically it's the what McHugh is warning of, and here's a little more discussion of it from a former subscriber of Terry Laundry (Bob Carver):

Stock Market Update the 2nd and 3rd charts there show it as it looked a few years ago.

The Dow hit the top of the pattern perfectly this year. So here we are more than 3 years after Laundry's death, and the market is still following what he predicted it would do 3 years later. He was predicting that his cycles and the Edson Gould formation would merge to create a huge drop in late 2015 and 2016, bottoming around April 2016...so when McClellen and others (David Petch) more recently came up with that same date a few years later it's made me pay attention big time.

Eerie and scary if it comes to fruition.

FS - No I don't follow "Trader Joe" at that site but used to watch his videos and still have it bookmarked. I found him to be too inaccurate and stopped paying attention. Most Elliott wave guys seem to have a bearish bias all the time (e.g., Daneric, and the guys at elliottwave.com and other bearish gurus that I used to subscribe to (Prechter and Steven Hochberg, and Robert McHugh, and Tim Wood). I subscribed to those latter three for a long time and boy did they cost me tons of money with their constant bearish views. Having said that, I think during bear markets they're worth paying attention too, so I'll give that post by McHugh that MrJohnRoss a read today as I watch my Seahawks tear up the Bears (I hope). I know that Tim Wood says his "DNA markers" are now in place for a major crash, and McHugh has been big on that megaphone pattern, which is quite scary and I'm not ready to believe it will happen yet (e.g., a plunge clear down to well below the 2009 low of 666), but I'm not dismissing it entirely since it's conceivable this bear market could snowball into an out of control unraveling of government debt worldwide.

Law87 - Yep, and that 7-year cycle is probably the #1 reason I'm convinced this is indeed a bear market and not something that will rhyme with 2011 as the wall street pros who need to sell stocks would have us believe. I used to post about the late Terry Laundry a few years ago before his untimely passing in July 2012. Just before he passed, he began warning of an eventual major top around (gulp) mid-2015 and then a massive plunge to a low around April 2016 in what he dubbed his "M" cycle low, which was basically a 76 week cycle and a 7-year cycle combined, with the biggest drops coming at the confluence of a 76-week cycle and the 7-year cycle... he also combined that with what a friend of his (Edson Gould) called the megaphone formation. He's the one that first coined it back in the 60's and you can Google "Edson Gould megaphone formation" and find a few links about it. Basically it's the what McHugh is warning of, and here's a little more discussion of it from a former subscriber of Terry Laundry (Bob Carver):

Stock Market Update the 2nd and 3rd charts there show it as it looked a few years ago.

The Dow hit the top of the pattern perfectly this year. So here we are more than 3 years after Laundry's death, and the market is still following what he predicted it would do 3 years later. He was predicting that his cycles and the Edson Gould formation would merge to create a huge drop in late 2015 and 2016, bottoming around April 2016...so when McClellen and others (David Petch) more recently came up with that same date a few years later it's made me pay attention big time.

Eerie and scary if it comes to fruition.

FogSailing

Market Veteran

- Reaction score

- 61

Thanks for the heads up on "bearish" bias. I hadn't recognized that yet, probably because I've only been following him recently and the market has been "bearish". Hope the Hawks won today. We've had party guests who just left and I haven't caught on sports.

FS

FS

burrocrat

TSP Talk Royalty

- Reaction score

- 162

Thanks for the heads up on "bearish" bias. I hadn't recognized that yet, probably because I've only been following him recently and the market has been "bearish". Hope the Hawks won today. We've had party guests who just left and I haven't caught on sports.

FS

they did. at least you got your priorities straight and checked up here before nfl.com.

Tsunami

TSP Pro

- Reaction score

- 62

they did. at least you got your priorities straight and checked up here before nfl.com.

Yep, the 'Hawks looked a lot better playing at home, against a helpless Chicago team. It looks like Arizona is the team to beat in the NFC west though this year. I'm thinking of trying to get tickets for the final game of the season, Seattle at Arizona, and combine it with visiting family there for the New Year. That game could decide home field advantage or even whether Seattle makes the playoffs at all.

Here's a simple price T chart (where the number of days before the bottom will equal the number of days from the bottom to the next top, doesn't always work but frequently does). This one is of TZA, but it would look the same for any inverse ETF and suggests that the bottom of this current slide could come on about 10/9. That's as good of a guess as any for a bottom for now, so my plan for today is to look for a bottom to buy near 10/9.

http://i.imgur.com/SiiO2Bx.jpg

The futures are down but I'm not dismissing the possibility of another rally on Monday that goes a bit above Friday morning's high.

Time to check out the eclipse. We'll have a great view of it as the moon rises over the Sandia Mts., like this...

https://41.media.tumblr.com/tumblr_lyp8y4HF731rochvuo1_500.jpg

Tsunami

TSP Pro

- Reaction score

- 62

Looking things over this evening, the evidence is growing that a tradable bottom could be quite near....maybe as soon as tomorrow, that would not surprise me one bit...

or maybe near 10/7?

Almanac Trader

But not until after a little "Octoberphobia"?

Almanac Trader

More interesting stuff, I'm bookmarking this site for sure...

Almanac Trader

Last edited:

FogSailing

Market Veteran

- Reaction score

- 61

Glad the Hawks won. This year is starting to turn difficult. We live in Phoenix and support the Cardinals here and really like them....BUT my home team is the Hawks. We'll see how the season unfolds and which side of the family I get to PO the most at the end of the season if both teams are still standing. My Wife likes the Cards better...yikes..

I'm thinking DCB tomorrow but who knows how the headlines will drive things tomorrow, so perhaps sideways if the bears play..

Beautiful photo. Looks like you had a nice view near the Sandia Mtns.

FS

I'm thinking DCB tomorrow but who knows how the headlines will drive things tomorrow, so perhaps sideways if the bears play..

Beautiful photo. Looks like you had a nice view near the Sandia Mtns.

FS

Tsunami

TSP Pro

- Reaction score

- 62

Argh, that figures. Looks like that was a "truncated" wave 5 bottom yesterday. The bears have run out of steam. If the S&P surpasses 9/24's low of 1908.84 then that would likely mean the bottom is in and I'm stranded with no IFTs. The market loves to take off and leave people behind watching and that might happen today. Sure glad I covered all my short positions yesterday.

Argh, that figures. Looks like that was a "truncated" wave 5 bottom yesterday. The bears have run out of steam. If the S&P surpasses 9/24's low of 1908.84 then that would likely mean the bottom is in and I'm stranded with no IFTs. The market loves to take off and leave people behind watching and that might happen today. Sure glad I covered all my short positions yesterday.

Tsunami, SPX 9/24 low (1908.84) -- intraday or COB? Tia.

Tsunami

TSP Pro

- Reaction score

- 62

DreamboatAnnie

TSP Legend

- Reaction score

- 912

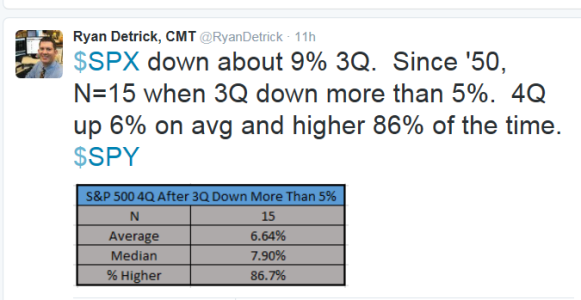

Gosh... I going in very short term.. and only 50%. Very risky but this is very short term!! Wishing you all the best!!!!! :smile:Intraday, and it was broken quickly after the open. Things are looking bullish and here's a good stat to back that up...

View attachment 35379

Tsunami

TSP Pro

- Reaction score

- 62

Things like this still bother me... I'm still wondering if this could be a fake-out rally and there's more pain ahead for another week or so...

https://href.li/?http://jeffhirsch.tumblr.com/post/129864278803/octobers-recent-21-year-trend

I don't know, not even the shadow knows. It's all up to mass psychology. For the moment I'm not too terribly upset that I have no IFT's and can't jump in today, but I'll have to decide tomorrow. Dropping back below 1900 would keep me bearish.

https://href.li/?http://jeffhirsch.tumblr.com/post/129864278803/octobers-recent-21-year-trend

I don't know, not even the shadow knows. It's all up to mass psychology. For the moment I'm not too terribly upset that I have no IFT's and can't jump in today, but I'll have to decide tomorrow. Dropping back below 1900 would keep me bearish.

felixthecat

TSP Analyst

- Reaction score

- 41

- AutoTracker

Things like this still bother me... I'm still wondering if this could be a fake-out rally and there's more pain ahead for another week or so...

https://href.li/?http://jeffhirsch.tumblr.com/post/129864278803/octobers-recent-21-year-trend

I don't know, not even the shadow knows. It's all up to mass psychology. For the moment I'm not too terribly upset that I have no IFT's and can't jump in today, but I'll have to decide tomorrow. Dropping back below 1900 would keep me bearish.

Out of moves...but if I had a move I would jump in here. I believe there is a least a 2 percent move up from here as a minimum. However...there is risk from broader market negative news...but in the USA I believe we have had the correction needed to move up from this area. Given the proper market dynamics and positive world news...2-5 percent gain from these levels is possible. Good enough to take some risk. Yes, I'm already assuming a 2 percent market rise today.

Tsunami

TSP Pro

- Reaction score

- 62

Things like this still bother me... I'm still wondering if this could be a fake-out rally and there's more pain ahead for another week or so...

https://href.li/?http://jeffhirsch.tumblr.com/post/129864278803/octobers-recent-21-year-trend

I don't know, not even the shadow knows. It's all up to mass psychology. For the moment I'm not too terribly upset that I have no IFT's and can't jump in today, but I'll have to decide tomorrow. Dropping back below 1900 would keep me bearish.

I'm still very leery of this rally, not convinced, and may hold my October IFTs close to the vest for a while.

Tsunami

TSP Pro

- Reaction score

- 62

Too much of the rally I was expecting already will be over by the close today, plus I'm just chicken, so I doubt I'll be jumping in today.

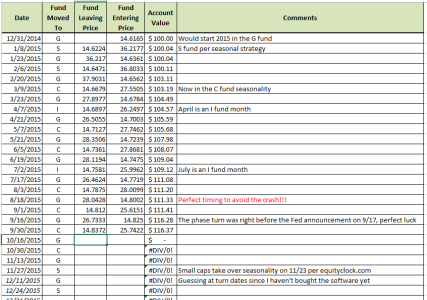

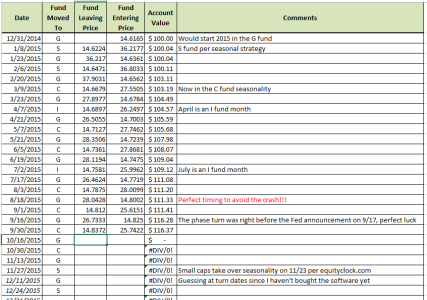

For those interested, here's a snippet from my 2015 spreadsheet tracking the lunatic trading system so far this year. This is the G fund version (on average, using the F fund does even better) and through September it's up an amazing 16.37% this year...once or twice a year (like yesterday) this system will run into a problem where you would need a 3rd IFT to move into stocks near the end of the month but wouldn't be able to. I don't plan to ever use it, but it sure is tempting.

For those interested, here's a snippet from my 2015 spreadsheet tracking the lunatic trading system so far this year. This is the G fund version (on average, using the F fund does even better) and through September it's up an amazing 16.37% this year...once or twice a year (like yesterday) this system will run into a problem where you would need a 3rd IFT to move into stocks near the end of the month but wouldn't be able to. I don't plan to ever use it, but it sure is tempting.

Tsunami,

I'm hoping that you are correct. This is very interesting. As per your projections, "the bottom of this current slide could come on about 10/9. That's as good of a guess as any for a bottom for now, so my plan for today is to look for a bottom to buy near 10/9.,,, The futures are down but I'm not dismissing the possibility of another rally on Monday that goes a bit above Friday morning's high."

Just to make sure, is it your position that there is a high probability that, if there are no surprising catalysts to end this upside run, we should see higher highs for 2 or 3 more trading days before beginning a slide to the approximate date of 10/9? Thanks in advance for your response.

I'm hoping that you are correct. This is very interesting. As per your projections, "the bottom of this current slide could come on about 10/9. That's as good of a guess as any for a bottom for now, so my plan for today is to look for a bottom to buy near 10/9.,,, The futures are down but I'm not dismissing the possibility of another rally on Monday that goes a bit above Friday morning's high."

Just to make sure, is it your position that there is a high probability that, if there are no surprising catalysts to end this upside run, we should see higher highs for 2 or 3 more trading days before beginning a slide to the approximate date of 10/9? Thanks in advance for your response.

Tsunami

TSP Pro

- Reaction score

- 62

Tsunami,

I'm hoping that you are correct. This is very interesting. As per your projections, "the bottom of this current slide could come on about 10/9. That's as good of a guess as any for a bottom for now, so my plan for today is to look for a bottom to buy near 10/9.,,, The futures are down but I'm not dismissing the possibility of another rally on Monday that goes a bit above Friday morning's high."

Just to make sure, is it your position that there is a high probability that, if there are no surprising catalysts to end this upside run, we should see higher highs for 2 or 3 more trading days before beginning a slide to the approximate date of 10/9? Thanks in advance for your response.

Well, at this point it looks like the rally might already be over, but I was expecting more upside, maybe to 1940ish at least. Normally you don't want to be short going into a jobs report, but things are sure looking weak so far today. Bottom line is, I don't know, but my hunch is there's at least one lower low below 1867 coming in the next week or two, in the mid to low 1800s....but the with all the craziness going on in Syria and elsewhere, there could even be some sort of black swan event that gets things really rolling hard downhill.

ravensfan

Market Veteran

- Reaction score

- 316

Well, at this point it looks like the rally might already be over, but I was expecting more upside, maybe to 1940ish at least. Normally you don't want to be short going into a jobs report, but things are sure looking weak so far today. Bottom line is, I don't know, but my hunch is there's at least one lower low below 1867 coming in the next week or two, in the mid to low 1800s....but the with all the craziness going on in Syria and elsewhere, there could even be some sort of black swan event that gets things really rolling hard downhill.

I'm hoping 1867 does not come until next Friday. Part of the reason I got in yesterday was to be invested on October 1st. I would then be able to pick up these gains (1940ish sounds good) exit to the G Fund (probably on the 7th or 8th) and then jump back in when we hit that lower low.

I know it's easy to get wrapped around the axle with all the turmoil in the world. I think sometimes you just have to turn that stuff off and go for it. Besides, no risk, no reward...

ravensfan

Market Veteran

- Reaction score

- 316

Too much of the rally I was expecting already will be over by the close today, plus I'm just chicken, so I doubt I'll be jumping in today.

For those interested, here's a snippet from my 2015 spreadsheet tracking the lunatic trading system so far this year. This is the G fund version (on average, using the F fund does even better) and through September it's up an amazing 16.37% this year...once or twice a year (like yesterday) this system will run into a problem where you would need a 3rd IFT to move into stocks near the end of the month but wouldn't be able to. I don't plan to ever use it, but it sure is tempting.

View attachment 35392

Thanks for the chart Tsunami. I was just trying to figure out how to track this and low and behold, it is provided. I want to add two columns to it though, one for percentage gain/loss per trade and one for a year to date running percentage total. But thanks for the hard work. You just made my day!:smile:

Tsunami

TSP Pro

- Reaction score

- 62

For chart enthusiasts out there, here's a rather gloomy looking one...

The instructions:

Zahorchak Measure II

And the weekly version of the chart:

http://stockcharts.com/c-sc/sc?s=!B...=0&i=p94153107637&a=423668328&r=1443712805473

The instructions:

Zahorchak Measure II

And the weekly version of the chart:

http://stockcharts.com/c-sc/sc?s=!B...=0&i=p94153107637&a=423668328&r=1443712805473

Similar threads

- Replies

- 3

- Views

- 151

- Replies

- 8

- Views

- 692