- Reaction score

- 2,635

What else but buy, buy, buy?!WWBTD? (What Would BirchTree Do)

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

What else but buy, buy, buy?!WWBTD? (What Would BirchTree Do)

WWBTD? (What Would BirchTree Do)

BT is more an investor than a trader. Keep it in perspective. If you want to be like BT, 80%I and 20%C and hold it. New investments into C.

I liked this comment.BT is more an investor than a trader. Keep it in perspective. If you want to be like BT, 80%I and 20%C and hold it. New investments into C.

Interesting... in diplomatic terms, I'm too much of a chicken for that recipe. Although the idea of at least putting a temporary toe in the I fund someday after one of the future international market downturns, which has not occured to me until recently, might be worth looking at. So many different pullbacks to attack!After the close of business

Read up on the I fund before you dip your toes in there. The FV (fair value) will get you... on a day you think it will be up 1%, it will only be up .5%

One thing to know about the I-fund is how it is directly inversely correlated with the dollar. If the dollar is up 1%, the I-fund will do what the EAFE did minus 1%. If the dollar is down 1%, add the EAFE plus 1%.

CNBC is not quite as giddy about Dow 14,000 this morning. Maybe that's a bullish sign. They were falling all over themselves when it was nearing it the first time a few days ago.

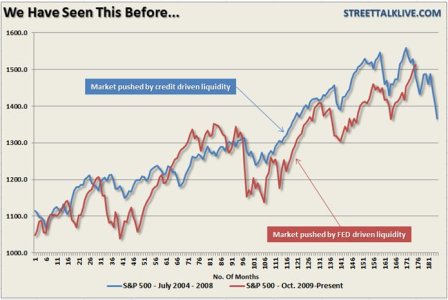

The S&P is still below that 1525 mark by about 0.5%. Will these two areas be resistance, or will momentum take the indices through?

on track for 7 positive weeks in a row, looks like that hasn't happened once in the last 5 years. when was the last time we had such a streak?