userque

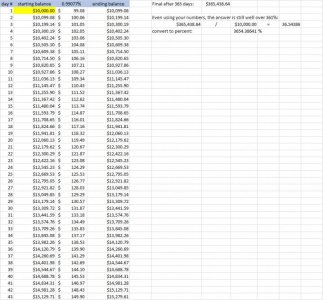

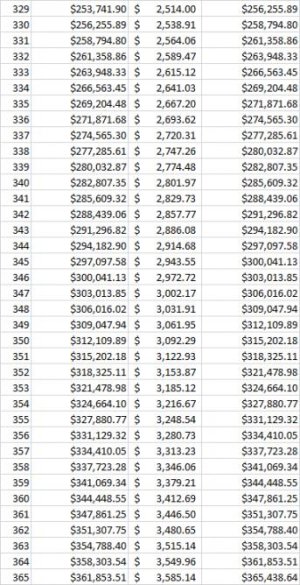

TSP Legend

- Reaction score

- 36

according to robert, 'Point of Order: Infraction of the rules, or improper decorum in speaking. Must be raised immediately after the error is made.'

in order to avoid a 'point of order' motion, may i seek clarification of the rules before i break them?

today i was holding short, but sold the close for a long position. 1 transaction fee? and if i do nothing i am long for tomorrow?

may i choose to (before the open) sell my now long position at the open strike and goto cash, or goto back short only for the cost an additional transaction fee?

Yes, there is a $5 fee when your position changes. Of course, there are three positions. You went from SHORT to LONG. Five bux was deducted from your balance at close.

"...and if i do nothing i am long for tomorrow?"

You are now LONG going INTO THE OPEN. That trade was made at the close today. Now, your only option is to make a trade between now and the open, that will execute at the open, establishing your position going INTO THE CLOSE...After the opening bell, your only option will be to make a trade (again, after the open) but before (or near) the close, that will execute at the close going INTO THE NEXT OPENING. I use CAPS to emphasize those phrases as that is the same language I use on the tally to describe the trades.

In other words:

For a trade to execute at the close, it should be posted near or before the close.

For a trade to execute at the open, it should be posted near or before the open.

Trades executed at the open define your position (from the open) going INTO THE CLOSE.

Trades executed at the close define your position (since the close) going INTO THE OPEN.

You are listed as being LONG going into the OPEN AND as being LONG going into the (following) close. However, If you go short at the open, then you will no longer be going LONG into the close. Since I don't know what anyone will do at the next day's open, I just label that position (going into the CLOSE) the same as the position going into the open. Even so, such changes are recorded in your transaction history, and that history is available to posted anytime you wish.

If you trade the open, it will be reflected in the numbers on the next tally. But the trade designations on the next tally will reflect the next day's action, not that day's action (the past).

You can always request that I post your individual trades/stats at anytime for clarity/verification/error checking, etc.

"may i choose to (before the open) sell my now long position at the open strike and goto cash, or goto back short only for the cost an additional transaction fee?"

You may. That's why I redesigned the whole spreadsheet; so you would be able to do just that--trade the open.

Are there any further points of information to The Chair?