Last week we saw what appeared to be a market showing signs of topping. Small and Mid-cap issues were hit fairly hard, although Large Cap's tended to fare much better. This week that type of action has largely reversed. One caveat to this week's bullish action is that the DOW has been unable to hold 12,000, while the S&P hasn't been unable to close above 1300. If this market wasn't in a long term sustained uptrend, I might be inclined to think we're peaking. But bullish sentiment hasn't been enough to entice a correction nor any measure of bad news, which really tempers any bearishness on my part. I've felt all along that this market will probably continue its drive higher for at least the first half of this year, but I wouldn't expect it to do it without correcting along the way. This week's action has now caused the Seven Sentinels to begin leaning bullish again, although it still technically remains on a sell. More on that in a moment.

This morning we had some market data that provided a mixed fundamental picture of our economy. December durable goods orders fell 2.5%, which follows a 0.1% decline from the previous month. Take out transportation and Decembers durable goods orders comes in at 0.5%, but still a tad below expectations.

Initial jobless claims totaled 454,000, which was much higher than the expected 410,000 claims. Continuing claims also moved higher to 3.99 million, from 3.90 million.

Real Estate continues to surprise as pending home sales jumped 2.0%, well above an anticipated 0.5% decline.

The Dollar traded down modestly, while treasuries were marginally higher.

Here's today's charts:

NAMO and NYMO remain on buys.

NAHL and NYHL also remain on buys.

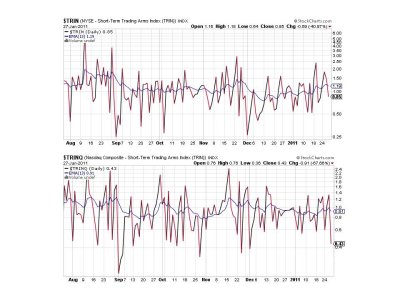

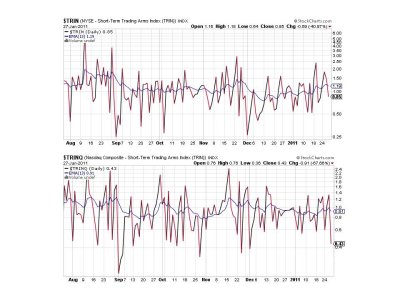

Both TRIN and TRINQ flipped to buys today as well.

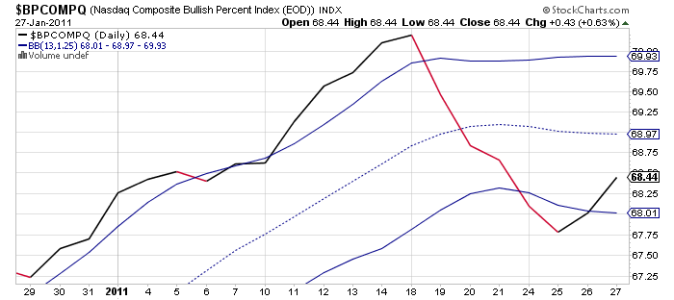

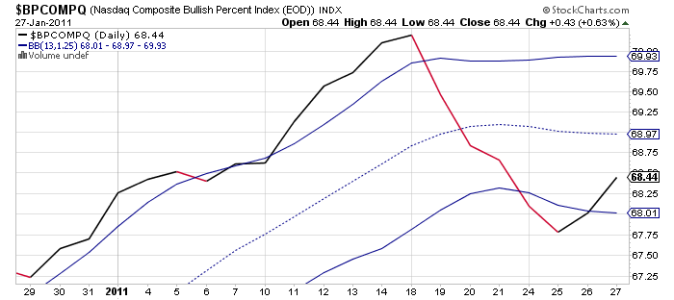

Not surprisingly given the Nasdaq's healthy gains today, BPCOMPQ crossed up through the lower bollinger band, which triggered a buy condition.

So if you're keeping count you'll know that all seven signals are flashing buys, which is one of the conditions necessary to trigger a buy signal for the system. The only thing missing is for NYMO to hit a fresh 28-day trading high. Here's where that stands:

Currently, NYMO is at 14.32. It needs to exceed about 34.0, which was established on 3Jan. That's not too terribly far away if this market continues to rally.

So technically the system remains on a sell without that 28-day trading high.

Admittedly, sell signals have not been worth a whole lot these past few months, but buy signals have. If one is more inclined towards risk you may want to take a position in stocks now given all seven went to a buy status today. A more conservative investor may want to wait for NYMO to hit that 28-day trading high.

As a reminder, Tuesday we get fresh IFTs for the month of February.

This morning we had some market data that provided a mixed fundamental picture of our economy. December durable goods orders fell 2.5%, which follows a 0.1% decline from the previous month. Take out transportation and Decembers durable goods orders comes in at 0.5%, but still a tad below expectations.

Initial jobless claims totaled 454,000, which was much higher than the expected 410,000 claims. Continuing claims also moved higher to 3.99 million, from 3.90 million.

Real Estate continues to surprise as pending home sales jumped 2.0%, well above an anticipated 0.5% decline.

The Dollar traded down modestly, while treasuries were marginally higher.

Here's today's charts:

NAMO and NYMO remain on buys.

NAHL and NYHL also remain on buys.

Both TRIN and TRINQ flipped to buys today as well.

Not surprisingly given the Nasdaq's healthy gains today, BPCOMPQ crossed up through the lower bollinger band, which triggered a buy condition.

So if you're keeping count you'll know that all seven signals are flashing buys, which is one of the conditions necessary to trigger a buy signal for the system. The only thing missing is for NYMO to hit a fresh 28-day trading high. Here's where that stands:

Currently, NYMO is at 14.32. It needs to exceed about 34.0, which was established on 3Jan. That's not too terribly far away if this market continues to rally.

So technically the system remains on a sell without that 28-day trading high.

Admittedly, sell signals have not been worth a whole lot these past few months, but buy signals have. If one is more inclined towards risk you may want to take a position in stocks now given all seven went to a buy status today. A more conservative investor may want to wait for NYMO to hit that 28-day trading high.

As a reminder, Tuesday we get fresh IFTs for the month of February.