Yesterday I said it was all about jobs. And it was. But the market often seems to move in accordance with its own twisted logic. Today was no exception.

At first glance, today's news that September nonfarm payrolls fell by -95,000 (zero had been expected) and private payrolls increased by 64,000 (74,000 had been expected) should have invited a serious decline. But it didn't. How could the market possibly rally on a continued poor jobs picture? Apparently it was through the realization that most of the drop in nonfarm payrolls was due to government layoffs and that weak economic data could support further quantitative easing.

I wonder how the market would have reacted to good news? As if further QE is a truly desired outcome.

So the dollar weaken on the news while stocks slowly rallied.

I have been calling for futher upside and we've been getting it. I really believe its primarily due to the overall bearish tone of the news coupled with the incredulity of traders and investors. Today's volume seems to provide credence to this notion as share volume on the NYSE failed to hit its 50-day moving average by a large margin.

So I wonder if this rally is the real deal based on fundamentals or simply the market fooling the majority as it so often loves to do. Whatever the answer to that question being on the right side of the trade has proven highly profitable.

Here's today's charts:

Back to buys for NAMO and NYMO and notice we aren't that far above the neutral area. If this move is for real I would expect to see momentum increase as we move forward as we are not overbought according to these measures.

NAHL and NYHL are also flashing buys.

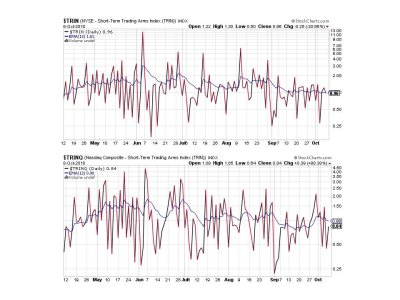

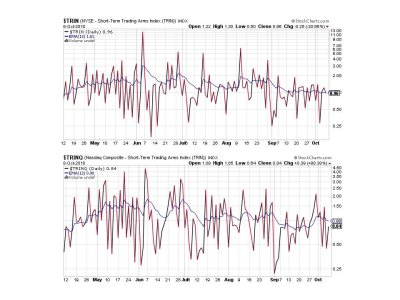

TRIN and TRINQ are in buy mode.

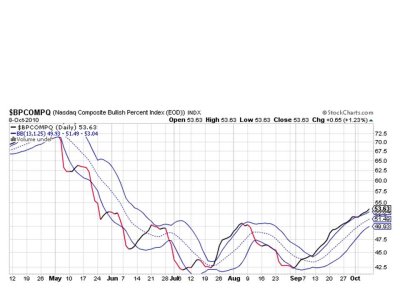

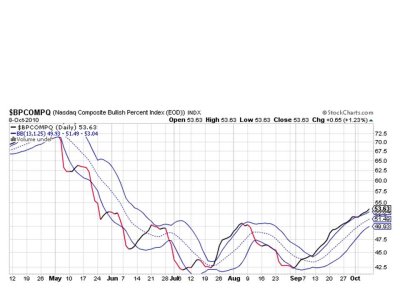

BPCOMPQ continues to reach higher and sure is looking bullish.

So all seven signals are flashing buys, which keeps the system on a buy. My short term system remains neutral after today, but overall this market is showing the intermediate term is still up for stocks so I have no reason to lighten up.

I can't help but think that as long as sentiment has a heathly number of bears and volume remains low overall, we'll move higher, short term corrections notwithstanding.

See you this weekend when I post the tracker charts.

At first glance, today's news that September nonfarm payrolls fell by -95,000 (zero had been expected) and private payrolls increased by 64,000 (74,000 had been expected) should have invited a serious decline. But it didn't. How could the market possibly rally on a continued poor jobs picture? Apparently it was through the realization that most of the drop in nonfarm payrolls was due to government layoffs and that weak economic data could support further quantitative easing.

I wonder how the market would have reacted to good news? As if further QE is a truly desired outcome.

So the dollar weaken on the news while stocks slowly rallied.

I have been calling for futher upside and we've been getting it. I really believe its primarily due to the overall bearish tone of the news coupled with the incredulity of traders and investors. Today's volume seems to provide credence to this notion as share volume on the NYSE failed to hit its 50-day moving average by a large margin.

So I wonder if this rally is the real deal based on fundamentals or simply the market fooling the majority as it so often loves to do. Whatever the answer to that question being on the right side of the trade has proven highly profitable.

Here's today's charts:

Back to buys for NAMO and NYMO and notice we aren't that far above the neutral area. If this move is for real I would expect to see momentum increase as we move forward as we are not overbought according to these measures.

NAHL and NYHL are also flashing buys.

TRIN and TRINQ are in buy mode.

BPCOMPQ continues to reach higher and sure is looking bullish.

So all seven signals are flashing buys, which keeps the system on a buy. My short term system remains neutral after today, but overall this market is showing the intermediate term is still up for stocks so I have no reason to lighten up.

I can't help but think that as long as sentiment has a heathly number of bears and volume remains low overall, we'll move higher, short term corrections notwithstanding.

See you this weekend when I post the tracker charts.