I've been saying for a few days now that although this market should have pulled back long before now we would probably close above 1130 on the S&P and turn the death cross back up before any meaningful pullback materializes. We did that today in spades. Now the question is just how far and how long can we rally? It's not like most folks are on this train if our tracker is any indication, (and I think it is).

After 4 long term buy signals in three months, we may finally have one that will follow through. But I'm not betting on it. I think this rally is mostly about the upcoming mid-term elections. And did you see the headline today that the recession is over?

If ever the masses should hate the market, it's probably now. I don't even think Pinocchio ever felt this manipulated.

But it is what it is and if you're on it you're loving life, even if you are on pins and needles.

Here's today's charts:

The momo is still here.

NAHL and NYHL continue to move higher.

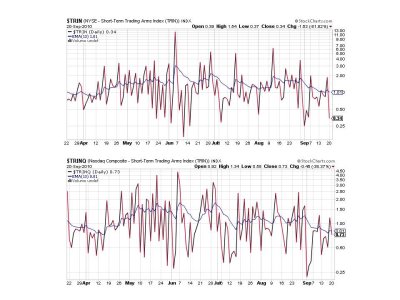

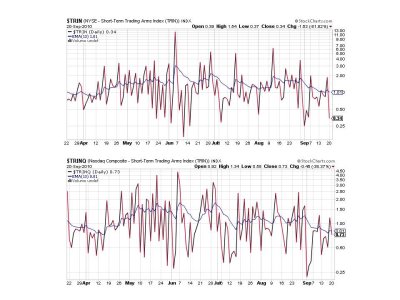

Two buys for TRIN and TRINQ.

BPCOMPQ hasn't looked back all month.

So all 7 signals are buys, which keeps the system on a buy.

Unfortunately, for those that are left sitting on the sidelines the decision to get invested is not as easy as it may seem. We've seen this market do an about face numerous times and the downside tends to come faster than the upside. So you can imagine that if we did begin to sell off how fast that might happen.

But that's what "may" happen. The fact remains that technically this market is healthy and we could move higher for some time yet. Although I doubt it will continue to be by leaps and bounds. It's just not natural for a market to move in just one direction. So good luck with that decision. Even if you're on the train you have to be nervous knowing how this market likes to fool the majority, and those bears should be beginning to capitulate by now.

After 4 long term buy signals in three months, we may finally have one that will follow through. But I'm not betting on it. I think this rally is mostly about the upcoming mid-term elections. And did you see the headline today that the recession is over?

If ever the masses should hate the market, it's probably now. I don't even think Pinocchio ever felt this manipulated.

But it is what it is and if you're on it you're loving life, even if you are on pins and needles.

Here's today's charts:

The momo is still here.

NAHL and NYHL continue to move higher.

Two buys for TRIN and TRINQ.

BPCOMPQ hasn't looked back all month.

So all 7 signals are buys, which keeps the system on a buy.

Unfortunately, for those that are left sitting on the sidelines the decision to get invested is not as easy as it may seem. We've seen this market do an about face numerous times and the downside tends to come faster than the upside. So you can imagine that if we did begin to sell off how fast that might happen.

But that's what "may" happen. The fact remains that technically this market is healthy and we could move higher for some time yet. Although I doubt it will continue to be by leaps and bounds. It's just not natural for a market to move in just one direction. So good luck with that decision. Even if you're on the train you have to be nervous knowing how this market likes to fool the majority, and those bears should be beginning to capitulate by now.