I'm having some computer trouble, so I'm going to go right to the charts this evening.

Yesterday I noted that NAMO and NYMO had ramped up to a level that suggested another turn was right around the corner. I'd say today's action qualifies that statement. Both signals took a dive today and crossed back into a sell condition.

The same is true of NAHL and NYHL. Both are back to a sell condition.

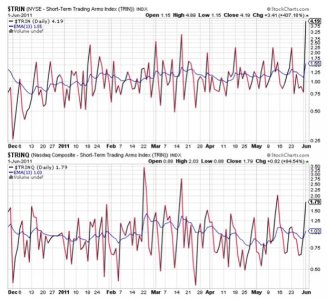

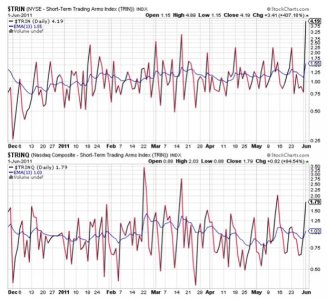

TRIN and TRINQ are also flashing sells, but suggest today's selling pressure was overdone in a very short time frame. I don't know if some measure of rally materializes tomorrow or not, but it's a possibility with these readings.

BPCOMPQ kept its buy condition, which it achieved yesterday, but it turned back down as a result of today's negative action.

So the Seven Sentinels remain in a sell condition, but we have a volatile market to deal with. I'm still expecting lower prices, but I'm not so sure they'll come quickly with POMO still being pumped. Treasuries continue to be a good bet for those who want less volatility with lower risk. That's where I'm at until I see an entry I like. Sure feels good to have some IFTs again. All two of them.

Yesterday I noted that NAMO and NYMO had ramped up to a level that suggested another turn was right around the corner. I'd say today's action qualifies that statement. Both signals took a dive today and crossed back into a sell condition.

The same is true of NAHL and NYHL. Both are back to a sell condition.

TRIN and TRINQ are also flashing sells, but suggest today's selling pressure was overdone in a very short time frame. I don't know if some measure of rally materializes tomorrow or not, but it's a possibility with these readings.

BPCOMPQ kept its buy condition, which it achieved yesterday, but it turned back down as a result of today's negative action.

So the Seven Sentinels remain in a sell condition, but we have a volatile market to deal with. I'm still expecting lower prices, but I'm not so sure they'll come quickly with POMO still being pumped. Treasuries continue to be a good bet for those who want less volatility with lower risk. That's where I'm at until I see an entry I like. Sure feels good to have some IFTs again. All two of them.