After mounting an impressive rally since the intra-day low on Tuesday, the broader market sold off in moderate fashion, but only retraced a portion of yesterday's gains.

Let's see, we have to have a reason each time the market inhales or exhales and today is no exception. We can at least partially blame Fitch for today's turnaround as their analysts stated that a debt rating downgrade may be levied against both Japan and China. We also had a decision by the European Central Bank, which opted to keep its target rate of 1.50%, but provided no amplifying information beyond that. Throw in a downward revision to the EU's GDP forecast and we apparently have sufficient reason to take the market down.

On the domestic front, weekly initial jobless claims rose by 2,000 from the prior week to 414,000, which exceeded economists estimates of 400,000 claims. And the July trade deficit came in at $44.8 billion, which easily beat estimates of $51.5 billion. The market didn't seem to be affected by that report, but if you look hard enough, you can find some media outlet who can put a great spin on it.

And finally, Fed Chair Bernanke gave a speech to the Minnesota Economic Club this afternoon, which seemed to coincide with increased selling pressure by the broader market. He didn't provide any clues to potential changes of monetary policy however, and that apparently didn't sit well with traders.

But the day isn't over as the main event today (at least to some) is the President's job speech to be delivered nationally this evening. It'll be interesting to see how futures react to this speech this evening.

Here's today's charts:

NAMO and NYMO tracked a bit lower today and flipped back to sells in the process.

TRIN and TRINQ continue to hold their own and do suggest higher prices down the road.

TRIN spiked back to an overall neutral reading, but technically flipped to a sell, while TRINQ held its buy status and worked off a bit of its oversold reading.

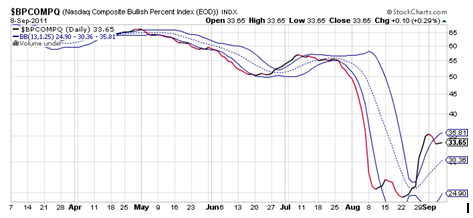

BPCOMPQ tracked a bit sideways on today's action and remain in a sell condition.

So the Seven Sentinels are giving mixed and relatively neutral readings overall, but that still keeps the system in a buy condition.

I can see this market going either way given the almost daily news catalysts that are consistently being served up. And there really doesn't seem to be a trend right now as we're currently stuck in a trading range. So for now I'm simply watching both BPCOMPQ and NAMO/NYMO for a clue to the next sustained move and given the former flipped to a sell a few days ago, I chose to be on alert for a downside surprise. I'm also influenced by the historically weak month we're in as well as the bear market condition of the overall market. For me, patience is the name of the game right now.