What started out looking like follow-through from Tuesday's decline, instead became another very short buying opportunity for the bulls to pile in as the major indexes popped right back up near their 52 week highs.

There was not much in the way of news to drive the markets, so it would seem sentiment was the primary catalyst. Dips have been few and far in between and this one was no exception. Early morning caution saw the downside quickly become limited and as confidence grew that a another turn was at hand it was off to the races.

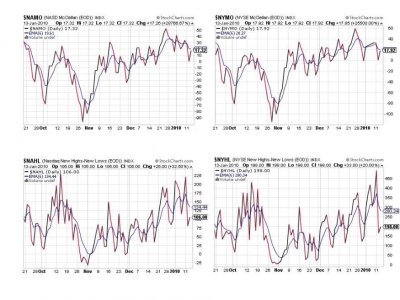

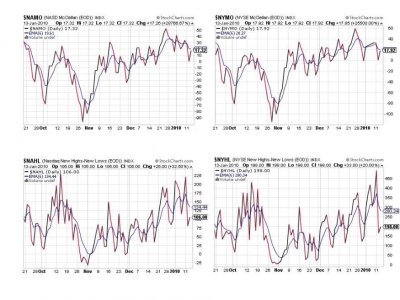

The Seven Sentinels remain on a buy after today's action, but look tired.

Tomorrow we have numerous data points being released before the open to include: Initial claims, Continuing claims, Retail sales, Retail sales ex-auto, Export prices ex-ag, and Export prices ex-oil.

Here's today's charts:

Improvement here, but still all flashing sells.

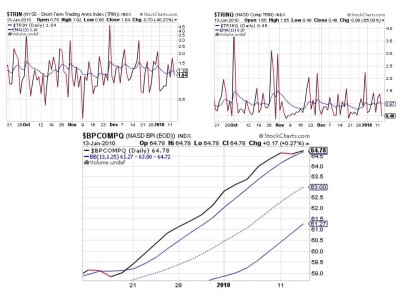

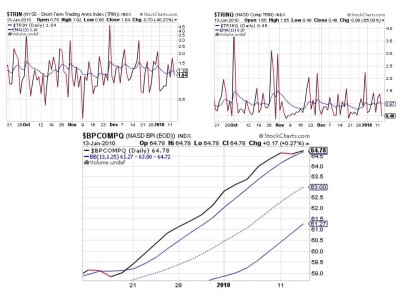

TRIN and TRINQ flipped back to a buy and BPCOMPQ remained on a buy, but it is hugging the upper bollinger band now. The charts look ready to roll over, but the underlying strength in this market may make that a difficult task for the bears.

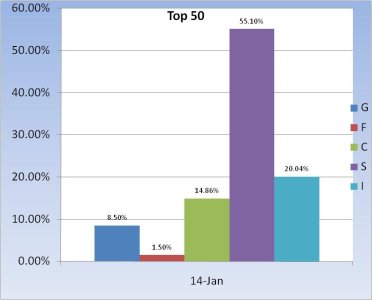

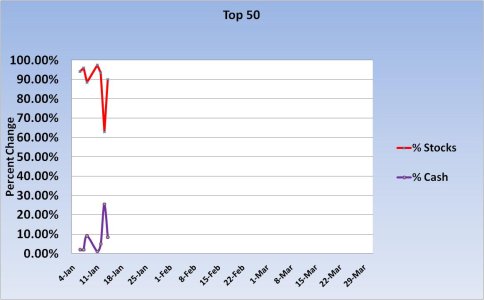

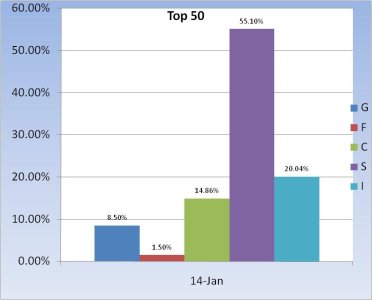

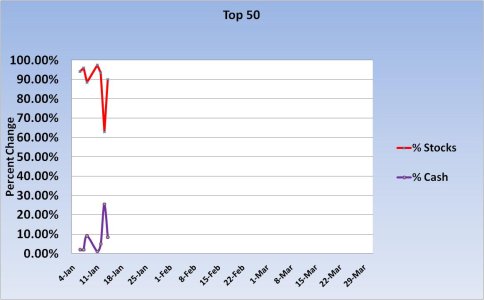

Our Top 50 tracker positions favor the S fund and holding stocks continue to be the working formula early in the new year. That's it for today, see you tomorrow.

There was not much in the way of news to drive the markets, so it would seem sentiment was the primary catalyst. Dips have been few and far in between and this one was no exception. Early morning caution saw the downside quickly become limited and as confidence grew that a another turn was at hand it was off to the races.

The Seven Sentinels remain on a buy after today's action, but look tired.

Tomorrow we have numerous data points being released before the open to include: Initial claims, Continuing claims, Retail sales, Retail sales ex-auto, Export prices ex-ag, and Export prices ex-oil.

Here's today's charts:

Improvement here, but still all flashing sells.

TRIN and TRINQ flipped back to a buy and BPCOMPQ remained on a buy, but it is hugging the upper bollinger band now. The charts look ready to roll over, but the underlying strength in this market may make that a difficult task for the bears.

Our Top 50 tracker positions favor the S fund and holding stocks continue to be the working formula early in the new year. That's it for today, see you tomorrow.