Yesterday I said I expected at least a short term top on Tuesday's trading, and we may have seen it. There are technical indicators saying it's time to jump in and get invested, but golden crosses and new highs are not guarantees of anything. They tend to be magnets for reversals under the right conditions. And that's where sentiment is going to be important moving forward.

We now have an overbought market and a VIX well below 20, which is in sell territory. Now we could move higher, but again I think it's going to depend on sentiment and how resilient the market is should any selling pressure develop.

Today's charts:

NAMO and NYMO look toppy again and poised for at least some moderate selling pressure. Both are on buys.

NAHL and NYHL continue their move higher. This is beginning to look a bit extended too. Both are also on buys.

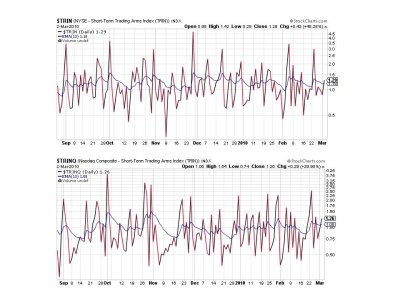

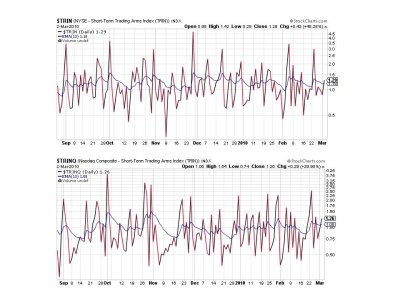

TRIN and TRINQ are both flashing sells, but are close their EMAs.

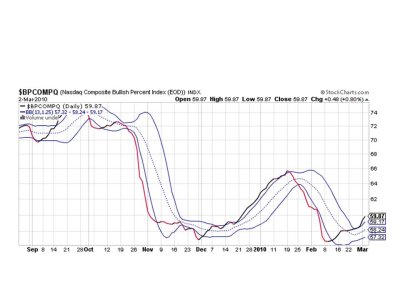

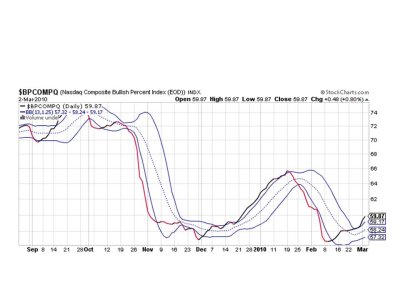

BPCOMPQ is still trending higher and remains on a buy.

I don't know that the market is ready for any significant selling pressure at this point. I'm more inclined to think choppy trading with a downward bias, but perhaps not enough to trigger a SS sell signal. I am looking for a possible entry point back into this market, and being overbought with the VIX below 20 in addition to NAMO and NYMO getting extended seem to suggest a better opportunity is ahead. The question is, and this assumes we get some selling soon, can the SS remain on a buy during a bout of selling? Obviously that's important because I don't want to buy a dip if there's a chance of the system rolling over. It will take a fair amount of selling to get to that point though. For the moment, I don't think that's going to happen, but I can only read the charts one or two days ahead.

For now risk to the downside is elevated and I need to see how well the market holds its gains. The SS remain on buy with 5 of 7 signals in buy territory.

I'm going to post Top 15 and Top 50 charts separately this evening as I cannot post more than 5 charts per blog. Both groups are showing significant activity and may offer more clues where we may be headed short term.

We now have an overbought market and a VIX well below 20, which is in sell territory. Now we could move higher, but again I think it's going to depend on sentiment and how resilient the market is should any selling pressure develop.

Today's charts:

NAMO and NYMO look toppy again and poised for at least some moderate selling pressure. Both are on buys.

NAHL and NYHL continue their move higher. This is beginning to look a bit extended too. Both are also on buys.

TRIN and TRINQ are both flashing sells, but are close their EMAs.

BPCOMPQ is still trending higher and remains on a buy.

I don't know that the market is ready for any significant selling pressure at this point. I'm more inclined to think choppy trading with a downward bias, but perhaps not enough to trigger a SS sell signal. I am looking for a possible entry point back into this market, and being overbought with the VIX below 20 in addition to NAMO and NYMO getting extended seem to suggest a better opportunity is ahead. The question is, and this assumes we get some selling soon, can the SS remain on a buy during a bout of selling? Obviously that's important because I don't want to buy a dip if there's a chance of the system rolling over. It will take a fair amount of selling to get to that point though. For the moment, I don't think that's going to happen, but I can only read the charts one or two days ahead.

For now risk to the downside is elevated and I need to see how well the market holds its gains. The SS remain on buy with 5 of 7 signals in buy territory.

I'm going to post Top 15 and Top 50 charts separately this evening as I cannot post more than 5 charts per blog. Both groups are showing significant activity and may offer more clues where we may be headed short term.