Perhaps it was inspired by a meeting currently in progress at Jackson Hole, WY, or more to the point, by a perceived Fed rescue, but whatever the reason today's action caught the bears off-guard as a seemingly innocuous open turned into a full blown bullish assault that saw the major averages post hefty gains across the board. At the close, the DOW had rallied 2.97%, the Nasdaq 4.29%, and the S&P 500 3.43%.

During the course of the rally stocks did see a brief, relatively shallow sell-off that came in response to reports of a moderate earthquake striking the Washington, D.C. area, but even that bit of unexpected news did little to squash the bullish party once it was learned that no major damage or casualties were reported.

And while the bull was doing a dance, gold fell 1.4% to a closing price of $1863.50 per ounce, while treasuries were relatively flat.

So what do we make of today's action? We know how volatile this market can be and we seem to have a catalyst in the form of a potential Fed rescue to explain the seemingly unfounded buying spree. Buying the rumor? And what happens once the Fed Chairman makes his anticipated media appearance at the conclusion of this year's Federal Reserve symposium?

While gold may have fallen and treasures finished flat, neither indicator seemed to suggest the reality of our current economic situation has changed. Is that a clue to the not-so-distant future of stock prices?

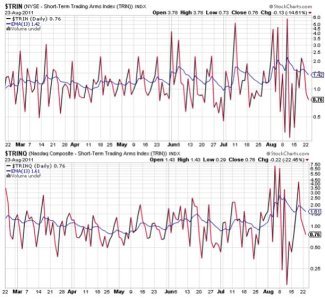

Here's today's charts:

Both NAMO and NYMO added to their modest gains yesterdays and are now both sitting near the net-neutral line. Both are also now flashing buys.

NAHL and NYHL are also now back to buy conditions.

Yesterday I had said that "these two signals suggest that a bit more upside may come in the short term, but I'm not expecting anything significant."

I was only half right in that we got the upside, but rather than token upside action we got a significant rally. Both remain in buy conditions as a result and believe it or not, neither is suggesting more than modestly overbought conditions, which means more upside may be on the way.

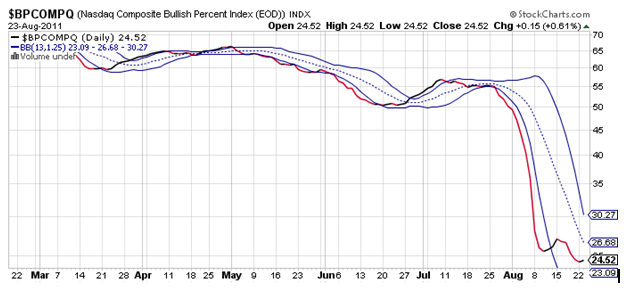

Yes, it's been on a buy all along, but BPCOMPQ has shown little to inspire its buy condition as it has grudgingly fallen for a number of days. Until today that is, but only in modest measure as it turned up just a bit on today's action.

So all Seven Sentinels are back in an unconfirmed buy condition, while the system officially remains on an intermediate term sell. To confirm a buy condition NYMO needs to rise above its Aug 15th high of about 38 on the chart, which is not all that far off if this rally has any legs.

And would I follow such a signal should it be produced before the Fed announcement on Friday?

Not a chance.