The Seven Sentinels are still solidly in buy territory, but Friday's action took some momentum away. Some selling pressure is due after this last move higher and this week could provide that. But I don't expect it to reverse this up leg.

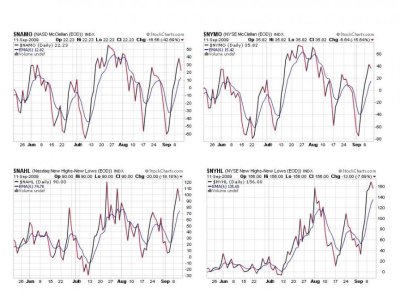

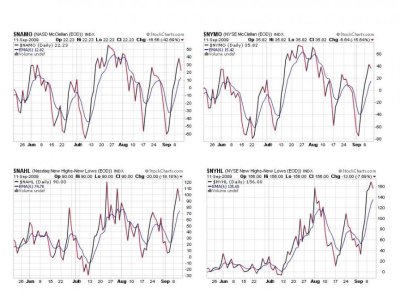

Here are the first four SS signals:

We can see some of the momentum has faded on each of these charts, but all are still on a solid buy.

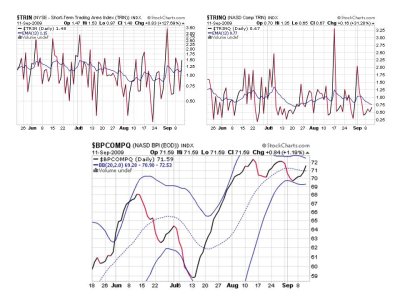

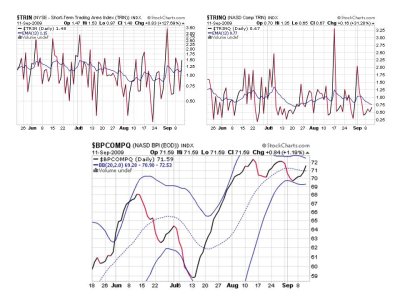

Only one chart here is showing a sell ($TRIN). What I am watching here though, is $BPCOMPQ. It is sitting at a lower high from the last high. I would not be surprised to see some selling at this point.

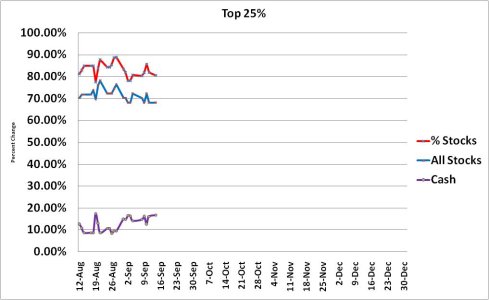

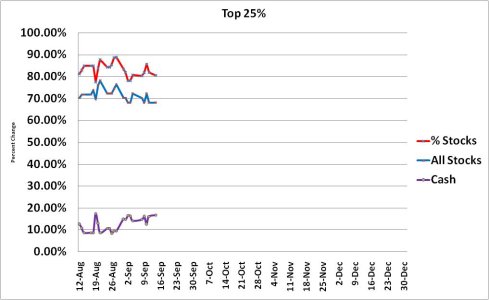

So the Seven Sentinels remain on a buy. It should come as no surprise then that our top 25% TSP accounts on the tracker remain bullish as well.

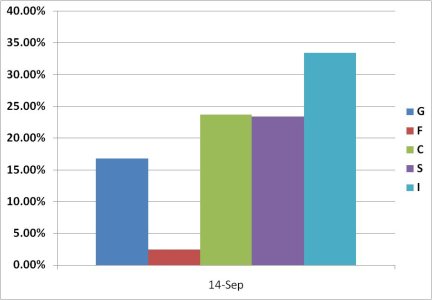

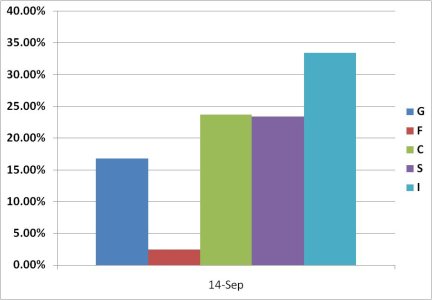

The allocations remain within a tight range. Cash inched up a little and stock exposure had a corresponding decline.

This chart reflects the first one. Solidly bullish.

So no changes for me. I'll continue to hold my 100% stock position.

Here are the first four SS signals:

We can see some of the momentum has faded on each of these charts, but all are still on a solid buy.

Only one chart here is showing a sell ($TRIN). What I am watching here though, is $BPCOMPQ. It is sitting at a lower high from the last high. I would not be surprised to see some selling at this point.

So the Seven Sentinels remain on a buy. It should come as no surprise then that our top 25% TSP accounts on the tracker remain bullish as well.

The allocations remain within a tight range. Cash inched up a little and stock exposure had a corresponding decline.

This chart reflects the first one. Solidly bullish.

So no changes for me. I'll continue to hold my 100% stock position.