RealMoneyIssues

TSP Legend

- Reaction score

- 101

Re: Don't fall in love with the downside and keep emotions out of it.

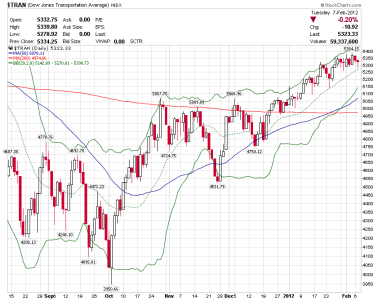

Nope, this rally is unrealistic considering the fundamentals and has been since the August 2011 drop... The US corporate or government is not in a condition for the markets to be at 3 year highs, it just isn't realistic.\

If it wasn't for the Fed pumping nearly free money, thereby debasing our already fiat USD, the markets wouldn't be were they are at... can you say "bubbles eventually pop"?

And, yes, being on the sidelines is kinda frustrating

Or are you upset that you are on the sidelines and not riding the choo choo train?

Just saying...

Nope, this rally is unrealistic considering the fundamentals and has been since the August 2011 drop... The US corporate or government is not in a condition for the markets to be at 3 year highs, it just isn't realistic.\

If it wasn't for the Fed pumping nearly free money, thereby debasing our already fiat USD, the markets wouldn't be were they are at... can you say "bubbles eventually pop"?

And, yes, being on the sidelines is kinda frustrating