After beginning the trading session modestly lower, stocks managed to get back near the neutral line by 10:00 EST. But that was as high as they would go as the broader market made a steady decline that was punctuated with the heaviest selling pressure in the final hour trade. And after 7 days of selling we're now back to lows not seen since March.

This was in spite of a higher debt ceiling being signed into law today. Apparently, the market now wants to shift its focus to a possible debt rating downgrade.

But economic data has done little to instill any confidence in this bull market of late either. June's personal spending dropped by 0.2%, which fell short of estimates looking for a 0.1% increase. But we did see personal incomes increase in June by 0.1%. But that's not nearly enough good news to off-set the seemingly endless supply of negative ones.

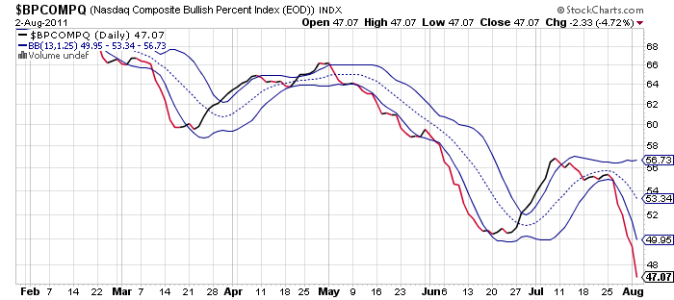

What's disconcerting about today's action is that the S&P 500 had its worst one-day performance in almost a year and it was on strong volume to boot. BPCOMPQ had been suggesting continued negative action in spite of modest indications that at least a short term bottom may be getting close. It's possible we needed a wash-out day to demoralize the bulls and today may have been that day.

Here's today's charts:

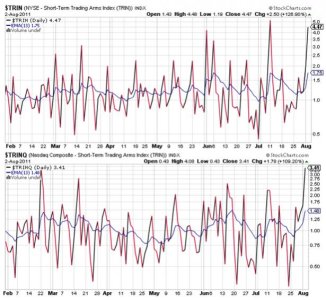

Momentum turned back to the downside for both NAMO And NYMO, which continue to wallow in very negative territory.

NAHL and NYHL also fell, with NYHL hitting multi-month lows.

TRIN and TRINQ both spiked to extreme readings today, which strongly suggest an oversold market that is more than ready for a bounce.

The main indicator of the seven, BPCOMPQ, is falling off a cliff with an almost straight down trajectory after today.

So all signals are in sell conditions, but the system has been on a sell since 27 July. For once, an official signal has not been whipsawed early on. But I don't think the bears can be too confident about shorting a market that's fallen as much as this one has in such a short period of time. And I also think the bulls need consider the possibility that a top may now be in until proven otherwise.

For the next day or so I am looking for a bounce based on TRIN and TRINQs extreme readings. If we get one and it's anemic, this market may be in trouble. If we don't get one at all, then look out below.