We had choppy trade today in a relatively tight range, but all three TSP stock funds managed to post modest to moderate gains. Even the FOMC minutes were met with a relative mute response.

Tomorrow morning we have four econmic reports being released; Initial Claims, Continuing Claims, PPI, and Core PPI. The market is due for some consolidation in the very least and these reports may provide that excuse.

Here's today's charts:

NAMO and NYMO managed to eke out more upside, but they really look extended at this point and suggest continued choppy action at the least, but more than likely some downside action is what we'll see very soon.

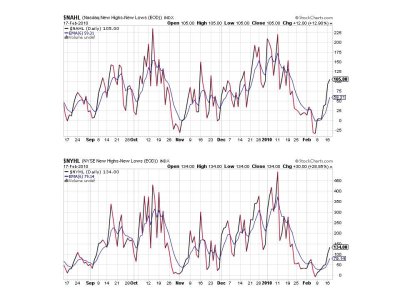

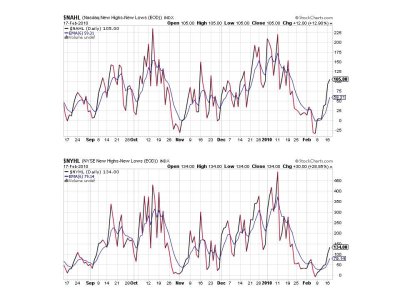

NAHL and NYHL continue to inch higher here.

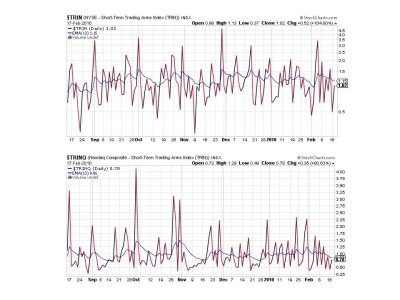

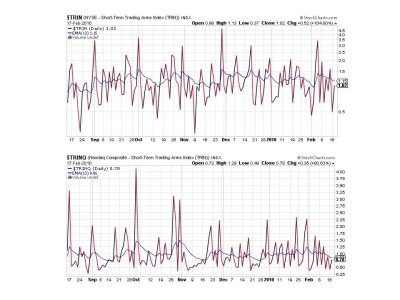

TRIN and TRINQ are close to their 6 day EMA and just like NAMO and NYMO, suggest some selling pressure soon.

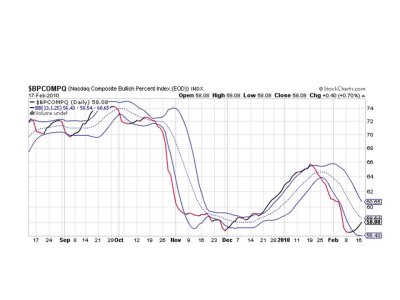

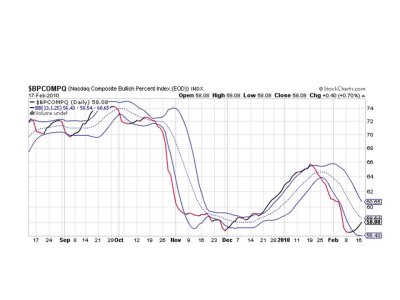

More upside for BPCOMPQ today, which suggests the trend is up for now.

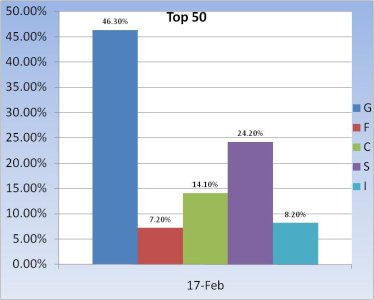

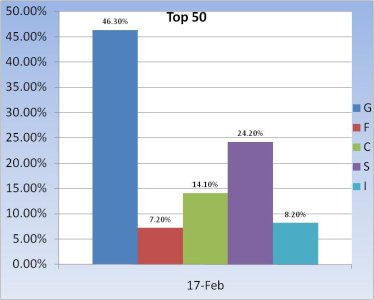

Our Top 50 are evenly split between stocks and cash. It's not likely the sideline folks are going to be willing to buy into this market after recent gains, but any significant selling pressure may make dip buyers out of them. Other folks in this group have already used their IFTs so new allocations may be limited at this point.

In spite of my decision to go to cash yesterday I am not bearish, but merely ensuring I take advantage of a good trade without getting greedy. The SS suggest that in spite of any short term selling pressure, the system itself might remain on a buy for a little while yet. If I had another IFT I'd probably buy the next significant dip; if internals don't deteriorate that is.

So the system remains on a buy with all 7 signals in buy territory, but looking toppy for NAMO and NYMO. TRIN and TRINQ also appear to suggest some downside action very soon. But if it materializes it may not be enough to flip the system to a sell, so if you're holding a stock position keep this in mind. BPCOMPQ makes me think any selling pressure will be short lived and relatively shallow.

Those are my thoughts for this evening. Happy trading.

Tomorrow morning we have four econmic reports being released; Initial Claims, Continuing Claims, PPI, and Core PPI. The market is due for some consolidation in the very least and these reports may provide that excuse.

Here's today's charts:

NAMO and NYMO managed to eke out more upside, but they really look extended at this point and suggest continued choppy action at the least, but more than likely some downside action is what we'll see very soon.

NAHL and NYHL continue to inch higher here.

TRIN and TRINQ are close to their 6 day EMA and just like NAMO and NYMO, suggest some selling pressure soon.

More upside for BPCOMPQ today, which suggests the trend is up for now.

Our Top 50 are evenly split between stocks and cash. It's not likely the sideline folks are going to be willing to buy into this market after recent gains, but any significant selling pressure may make dip buyers out of them. Other folks in this group have already used their IFTs so new allocations may be limited at this point.

In spite of my decision to go to cash yesterday I am not bearish, but merely ensuring I take advantage of a good trade without getting greedy. The SS suggest that in spite of any short term selling pressure, the system itself might remain on a buy for a little while yet. If I had another IFT I'd probably buy the next significant dip; if internals don't deteriorate that is.

So the system remains on a buy with all 7 signals in buy territory, but looking toppy for NAMO and NYMO. TRIN and TRINQ also appear to suggest some downside action very soon. But if it materializes it may not be enough to flip the system to a sell, so if you're holding a stock position keep this in mind. BPCOMPQ makes me think any selling pressure will be short lived and relatively shallow.

Those are my thoughts for this evening. Happy trading.