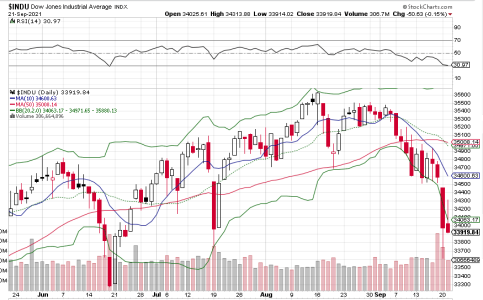

Got in yesterday at 30c and 20s for today’s bounce. I really thought I was getting in too early just like all the other times where it fell once I got in more. I really thought it would drop more and was regretting my decision to enter all day (I don’t look at the markets between noon and 4 since there’s nothing I can do about it). I was really surprised at the bounce today. It still may be short lived though. Lots of bad news, low readings on cnn fear index, poor breadth, low number of stocks below 200 day, It’s August! But today market participants said something at least. Good luck all!

-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

retread's Account talk

- Thread starter retread

- Start date