It was a mixed market today, with all three TSP stock funds moving lower. The C fund was only just barely under the flatline at -0.03%, the S fund dropped -0.46%, and the I fund fell -0.58%, mostly due to a hefty 0.8% rise in the dollar. Interestingly though, the DOW was up 0.42%, so the market was mixed.

In today's economic releases the February CPI was flat while Core CPI ebbed higher by 0.1%. No surprises with either of those numbers.

Initial jobless claims were slightly higher than expected at 457,000, while continuing claims rose to 4.58 million, which exceeded expectations.

The March Philadelphia Fed Index was a bit higher than expected at 18.9, while the Leading Indicators saw a 0.1% increase. All in all none of today's data offered any surprises and the market seemed to drift as a result.

Yesterday the Seven Sentinels seemed to be indicating more gains were in store in the coming days, but today's listless trading has stalled them once again. One thing that does bother me is the VIX, which dropped 1.71% to settle at 16.62, a new 52-week high. While the system remains on a buy, I'd be remiss if I didn't admit that this upleg may be close to running its course. Here's today's charts:

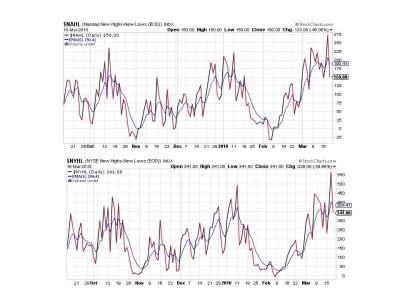

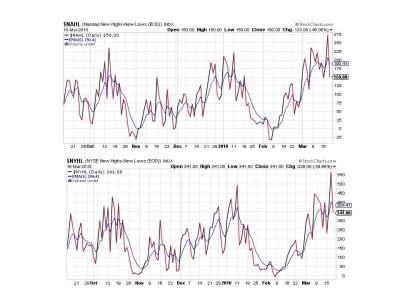

Both NAMO and NYMO are flashing sells, but I can't call them bearish as they aren't all that far above the zero line.

NAHL and NYHL turned around today and flipped back sells. I'm not particulary concerned about this given today's trading action.

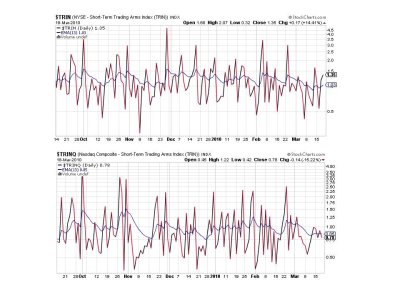

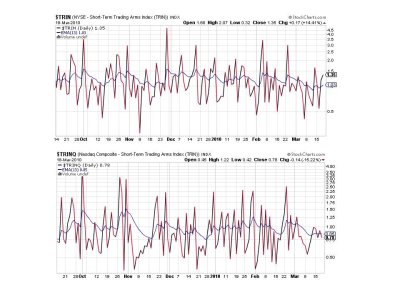

TRIN remains on a sell, while TRINQ flipped to a buy (barely). These are not particularly bearish either.

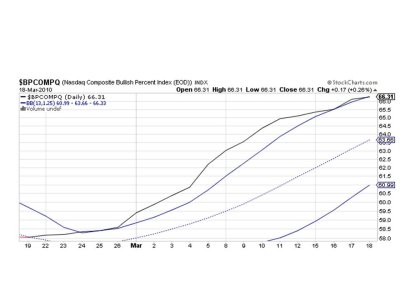

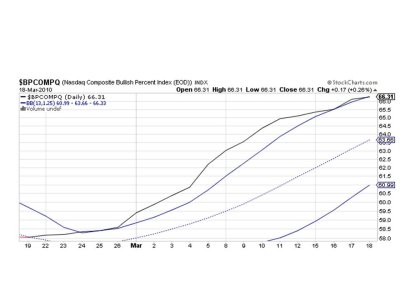

BPCOMPQ moved a bit sideways today and is very close to decisively penetrating the upper bollinger band, but the signal itself has not turned down.

The SS seems to be offering a very different look today as opposed to yesterday. We have 5 of 7 signals on a sell and the two that remain on a buy could roll over with enough selling pressure. But I can't say I'm confident in front running a sell signal here. We could have more upside given how resilient this market has been. There has been very little serious selling pressure for some time now. So I guess I'm on the fence here, but the fact is the system remains on a buy regardless. Tomorrow is OPEX, which won't be particularly telling of market direction going into next week either.

I've only just jumped back into stocks, but I can't say I'm comfortable about it. But then I'm not often comfortable when I'm taking on maximum risk. See you tomorrow.

In today's economic releases the February CPI was flat while Core CPI ebbed higher by 0.1%. No surprises with either of those numbers.

Initial jobless claims were slightly higher than expected at 457,000, while continuing claims rose to 4.58 million, which exceeded expectations.

The March Philadelphia Fed Index was a bit higher than expected at 18.9, while the Leading Indicators saw a 0.1% increase. All in all none of today's data offered any surprises and the market seemed to drift as a result.

Yesterday the Seven Sentinels seemed to be indicating more gains were in store in the coming days, but today's listless trading has stalled them once again. One thing that does bother me is the VIX, which dropped 1.71% to settle at 16.62, a new 52-week high. While the system remains on a buy, I'd be remiss if I didn't admit that this upleg may be close to running its course. Here's today's charts:

Both NAMO and NYMO are flashing sells, but I can't call them bearish as they aren't all that far above the zero line.

NAHL and NYHL turned around today and flipped back sells. I'm not particulary concerned about this given today's trading action.

TRIN remains on a sell, while TRINQ flipped to a buy (barely). These are not particularly bearish either.

BPCOMPQ moved a bit sideways today and is very close to decisively penetrating the upper bollinger band, but the signal itself has not turned down.

The SS seems to be offering a very different look today as opposed to yesterday. We have 5 of 7 signals on a sell and the two that remain on a buy could roll over with enough selling pressure. But I can't say I'm confident in front running a sell signal here. We could have more upside given how resilient this market has been. There has been very little serious selling pressure for some time now. So I guess I'm on the fence here, but the fact is the system remains on a buy regardless. Tomorrow is OPEX, which won't be particularly telling of market direction going into next week either.

I've only just jumped back into stocks, but I can't say I'm comfortable about it. But then I'm not often comfortable when I'm taking on maximum risk. See you tomorrow.