-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

rangerray's Account Talk

- Thread starter rangerray

- Start date

rangerray

TSP Pro

- Reaction score

- 209

rangerray

TSP Pro

- Reaction score

- 209

Looks like it hit the 38% retracement and bounced back down.

I'm hoping it's headed back to that 38% level. That was part of my decision making process. More good news on the Russian front might be the catalyst. I've suspected all along Putin is toying with us.

DreamboatAnnie

TSP Legend

- Reaction score

- 838

its looking real good right now. S fund up 3.08%. C fund up 1.56%. Had to look at S fund twice. Wow...so maybe not such a bad exit.

rangerray

TSP Pro

- Reaction score

- 209

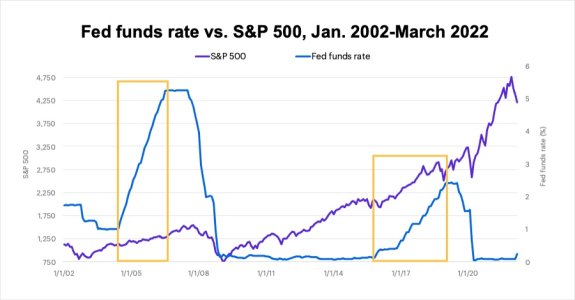

This is a good read that might help to take some of the anxiety out of what you’re doing with your IFT’s.

https://realinvestmentadvice.com/ma...A Email Marketing Software&utm_term=READ MORE

Scott Harrison

Senatobia, MS

https://realinvestmentadvice.com/ma...A Email Marketing Software&utm_term=READ MORE

Scott Harrison

Senatobia, MS

rangerray

TSP Pro

- Reaction score

- 209

I moved into stocks partially yesterday, but this rally might have legs, so I'm going to 50% S & 50% C. This is my last move for the month, so with this IFT I went with a 100% allocation because it looks ripe to me at the moment and I can reduce accordingly if this rally turns south. Of course, if this turns out to be a 1-day spike, then it'll bite me, but I'm gambling there will be some follow through tomorrow.

I do think the market is primed for a rally, all things considered, but I am skeptical that a rally lasts more than a day in this current environment. Two or three days of GREEN would be a welcomed relief!

I do think the market is primed for a rally, all things considered, but I am skeptical that a rally lasts more than a day in this current environment. Two or three days of GREEN would be a welcomed relief!

Similar threads

- Replies

- 60

- Views

- 950

- Replies

- 3

- Views

- 194