Another signal, another interpretation.

The Seven Sentinels flashed another sell signal today, this one more convincing than the last.

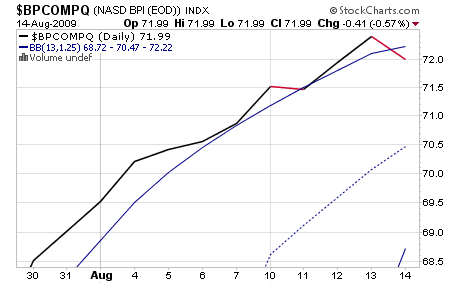

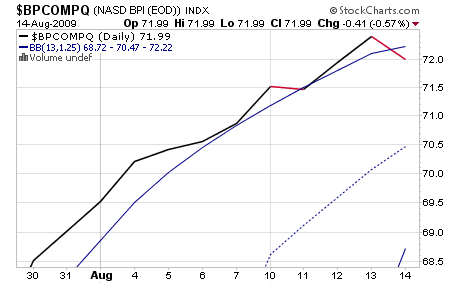

I'm only going to show one chart. It's the one that's the hardest to see without a close-up view.

This time it clearly penetrated the upper bollinger band to the downside.

Two sells in one week.

It may be time to get defensive. Or it could be another false signal. The market has been very difficult to gauge. My friend Poolman is looking for an exit. Good strategy going to the S fund from the I fund. Any bounce will probably be most evident in the S fund.

We are just over two weeks from the end of the month and two new IFTs. OPEX is next Friday, and the run-up to that date will almost certainly be volatile as da boyz take positions.

I think there's time to bail before any sustained selling kicks in. The underlying strength in the market will probably show up again soon. But can it continue its unrelenting rise without any serious selling taking place first?

I'm not saying this up leg is over. I don't really know the answer to that question. I can see both sides of the bull/bear debate. And each trading day changes the picture so my comments at the moment are just that... comments at the moment.

One never wants to marry their position. Not without a nuptial agreement anyway.

The Seven Sentinels flashed another sell signal today, this one more convincing than the last.

I'm only going to show one chart. It's the one that's the hardest to see without a close-up view.

This time it clearly penetrated the upper bollinger band to the downside.

Two sells in one week.

It may be time to get defensive. Or it could be another false signal. The market has been very difficult to gauge. My friend Poolman is looking for an exit. Good strategy going to the S fund from the I fund. Any bounce will probably be most evident in the S fund.

We are just over two weeks from the end of the month and two new IFTs. OPEX is next Friday, and the run-up to that date will almost certainly be volatile as da boyz take positions.

I think there's time to bail before any sustained selling kicks in. The underlying strength in the market will probably show up again soon. But can it continue its unrelenting rise without any serious selling taking place first?

I'm not saying this up leg is over. I don't really know the answer to that question. I can see both sides of the bull/bear debate. And each trading day changes the picture so my comments at the moment are just that... comments at the moment.

One never wants to marry their position. Not without a nuptial agreement anyway.