Pre-Bell  Brief

Brief

Time: 13-Nov-2025 08:37 (ET)

Key Takeaway

Key Takeaway

Market eyes CPI restart after shutdown as futures drift and missing data keep the Fed's path uncertain. [1]

What Moved Overnight

What Moved Overnight

• Asia mixed, tech soft as shutdown end and Fed cut odds keep risk appetite in check. [2]

• Europe modestly lower, banks ease after relief rally while growth worries cap moves. [2]

• U.S. futures near flat after Dow record, with higher VIX keeping tone cautious into CPI. [3]

• FX / Rates: US dollar index a touch lower, 10Y yield near 4.10% and oil stabilizing after this week's slide. [3]

How the Prior Session Closed

How the Prior Session Closed

• Tone: Dow hit a fresh high while SPX eked out a gain and growth pockets stayed choppy. [4]

• Breadth: Gains leaned to defensives and financials as mega-cap tech stayed under pressure. [4]

• AMD +9.00% on AI demand optimism after strong guidance. [4]

• PSKY -6.99% as traders reversed recent gains in the group. [4]

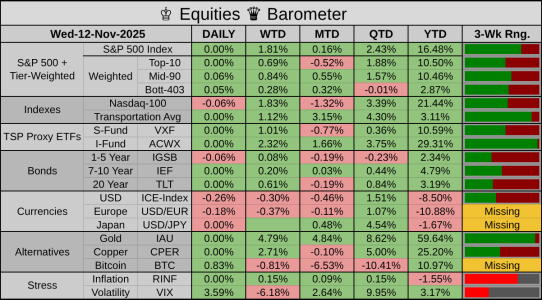

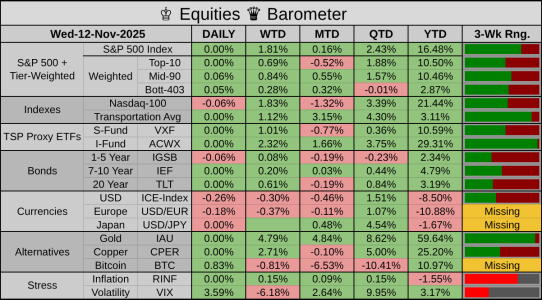

♔ Equities ♛ Barometer

• SPX barely higher as mid-pack names outperformed the Top-10. [4]

• NDX dipped as investors took profits in AI and added to value. [4]

• VIX edged up but stayed in the high teens after calmer sessions. [4]

• Overall tone: slow grind up, not a melt-up, as shutdown relief meets CPI and Fed uncertainty. [5]

Today’s 1st Hour of Trading

Today’s 1st Hour of Trading

• Questionable 08:30 - CPI and jobless claims hit together, first full data since shutdown and key for cut odds. [5]

• Watch 10Y yield and curve reaction as traders test whether inflation trend survived the data blackout. [5]

• Early flow may favor quality large caps while shutdown-sensitive names trade on headlines. [5]

• S&P 500 Gap Analysis - Last 63 Sessions: No new data available for this category.

Video Link: Why October Jobs CPI Reports Are Unlikely to be released

Upcoming Headlines

Upcoming Headlines

• Questionable 11/13 THU 08:30 - CPI and weekly claims, first test of how the shutdown distorted the data run. [5]

• 11/13 THU 13:00 - 30Y Treasury auction, long-end demand read after weeks without hard data. [5]

• 11/15 SAT - Weekend Fed remarks and shutdown post-mortems could reshape December cut odds. [5]

Off in the Distance

Off in the Distance

• 12/09-10 - FOMC meeting as policymakers work from patchy official data and private CPI proxies. [5]

• Mid-December - Next major inflation updates, watched for how shutdown quirks wash through. [5]

• Ongoing - Budget talks and any new funding cliffs that could revive shutdown risk into 2026. [5]

Wrap

Wrap

• Futures cautious as shutdown relief fades and CPI uncertainty keeps bulls and bears on edge. [5]

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 13-Nov-2025: Reuters US futures muted as markets await data after federal reopen

[2] 13-Nov-2025: Saxo / NDTV Asia and Europe market quick take

[3] 13-Nov-2025: Barron's S&P 500 futures fall in premarket trading

[4] 12-Nov-2025: Investopedia / Morningstar Dow closes above 48000 as Nasdaq slips

[5] 12-13-Nov-2025: MarketWatch / Reuters / BLS U.S. economic calendar and CPI release schedule

Time: 13-Nov-2025 08:37 (ET)

Market eyes CPI restart after shutdown as futures drift and missing data keep the Fed's path uncertain. [1]

• Asia mixed, tech soft as shutdown end and Fed cut odds keep risk appetite in check. [2]

• Europe modestly lower, banks ease after relief rally while growth worries cap moves. [2]

• U.S. futures near flat after Dow record, with higher VIX keeping tone cautious into CPI. [3]

• FX / Rates: US dollar index a touch lower, 10Y yield near 4.10% and oil stabilizing after this week's slide. [3]

• Tone: Dow hit a fresh high while SPX eked out a gain and growth pockets stayed choppy. [4]

• Breadth: Gains leaned to defensives and financials as mega-cap tech stayed under pressure. [4]

• AMD +9.00% on AI demand optimism after strong guidance. [4]

• PSKY -6.99% as traders reversed recent gains in the group. [4]

♔ Equities ♛ Barometer

• SPX barely higher as mid-pack names outperformed the Top-10. [4]

• NDX dipped as investors took profits in AI and added to value. [4]

• VIX edged up but stayed in the high teens after calmer sessions. [4]

• Overall tone: slow grind up, not a melt-up, as shutdown relief meets CPI and Fed uncertainty. [5]

• Questionable 08:30 - CPI and jobless claims hit together, first full data since shutdown and key for cut odds. [5]

• Watch 10Y yield and curve reaction as traders test whether inflation trend survived the data blackout. [5]

• Early flow may favor quality large caps while shutdown-sensitive names trade on headlines. [5]

• S&P 500 Gap Analysis - Last 63 Sessions: No new data available for this category.

Video Link: Why October Jobs CPI Reports Are Unlikely to be released

• Questionable 11/13 THU 08:30 - CPI and weekly claims, first test of how the shutdown distorted the data run. [5]

• 11/13 THU 13:00 - 30Y Treasury auction, long-end demand read after weeks without hard data. [5]

• 11/15 SAT - Weekend Fed remarks and shutdown post-mortems could reshape December cut odds. [5]

• 12/09-10 - FOMC meeting as policymakers work from patchy official data and private CPI proxies. [5]

• Mid-December - Next major inflation updates, watched for how shutdown quirks wash through. [5]

• Ongoing - Budget talks and any new funding cliffs that could revive shutdown risk into 2026. [5]

• Futures cautious as shutdown relief fades and CPI uncertainty keeps bulls and bears on edge. [5]

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 13-Nov-2025: Reuters US futures muted as markets await data after federal reopen

[2] 13-Nov-2025: Saxo / NDTV Asia and Europe market quick take

[3] 13-Nov-2025: Barron's S&P 500 futures fall in premarket trading

[4] 12-Nov-2025: Investopedia / Morningstar Dow closes above 48000 as Nasdaq slips

[5] 12-13-Nov-2025: MarketWatch / Reuters / BLS U.S. economic calendar and CPI release schedule