The 63-Session Standard Deviation Low has breached Std-Dev -3 the lower Orange Band for the past 4-Consecutive sessions.

Pre-Bell Brief

Brief

Time: 20-Nov-2025 08:08 (ET)

Key Takeaway

Key Takeaway

• Nvidia's earnings jolt futures higher, turning tone cautiously risk-on as markets await shutdown-skewed jobs data.[1]

What Moved Overnight

What Moved Overnight

• Asia - Regional indexes bounced, with Asia-Pac up just over +1% as chips and miners clawed back recent losses.[3]

• Europe - STOXX 600 up about +1% led by tech and banks as Nvidia's results ease AI bubble fears.[4]

• U.S. Futures - Tech leads with NDX, SPX, and DJI futures up +0.5% to +1.5% into the open.[1]

• FX / Rates - DXY a bit firmer, 10Y yield steady, and Brent edging higher after a sharp midweek drop.[5][6][7]

How the Prior Session Closed

How the Prior Session Closed

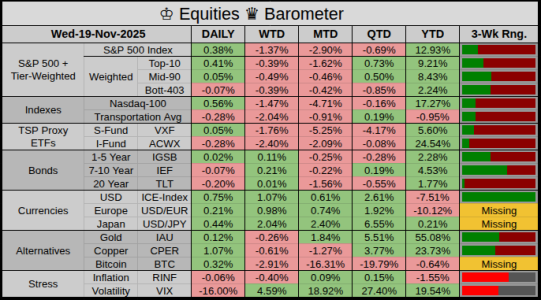

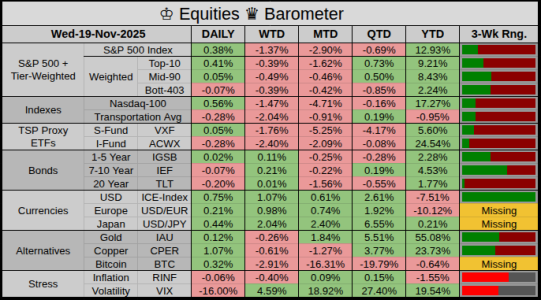

♔ Equities ♛ Barometer

• Indexes - SPX and NDX closed modestly higher, with DJI also green as dip-buyers stepped in before jobs data.[2]

• Tone - Risk-on but not euphoric, with gains concentrated in big tech while cyclicals and small caps lag.

• Breadth - Top-10 SPX names beat a flat Mid-90 and slightly red Bottom-403, so the rally leaned on the usual megacap leaders.

• Vol / Dollar - VIX tumbled about -16.00% while DXY stayed firm, more short-covering than a clean risk-on turn.[5]

• Top Gainer - XYZ +7.56%.

• Bottom Loser - ES -12.45%.

Today's 1st Hour of Trading

Today's 1st Hour of Trading

• 08:30 - Delayed September Employment Situation lands with jobless claims and the Philly Fed index in the same hour.[8]

• 10:00 - Existing Home Sales and Leading Indicators update housing and growth after weeks of missing federal data.[8]

• Theme - Nvidia and AI spending set the tone; early tape will show whether buyers chase or fade the tech-led squeeze.[1][2]

Upcoming Headlines

Upcoming Headlines

• 21-Nov FRI 10:00 - Univ. of Michigan Sentiment (final) gauges how shutdown and volatility are hitting consumers.[9]

• 21-Nov FRI - Flash PMIs in the U.S. and Europe offer fresh reads on manufacturing and services momentum into year-end.[10]

• 25-Nov TUE 08:30 - September PPI finally posts, giving a late but important inflation input ahead of the December Fed meeting.[8]

Off in the Distance

Off in the Distance

• 24-Nov MON - MSCI November index changes take effect at the close, with passive flows set to shuffle global equity weights.[11]

• 09-10 Dec - FOMC meeting and press conference, with scarce data pushing debate over a third straight rate cut.[12]

• 16-Dec TUE 08:30 - November Employment Situation, including October payrolls, becomes the shutdown era's key labor check.[8]

Wrap

Wrap

• Futures point to a tech-led pop at the open while shutdown-distorted data keep traders cautious into the December Fed decision.[1][8][12]

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 20-Nov-2025: Economic Times US stock market futures today: Nvidia earnings revive AI trade

[2] 19-Nov-2025: Reuters Wall St ends higher in anticipation of jobs data, Nvidia tops estimates

[3] 20-Nov-2025: Investing.com MSCI AC Asia Pacific - Historical Data

[4] 20-Nov-2025: Investing.com / Reuters European shares advance as Nvidia earnings light up global markets

[5] 20-Nov-2025: Investing.com US Dollar Index - Historical Data

[6] 20-Nov-2025: Investing.com US 10 Year Treasury Yield

[7] 20-Nov-2025: Investing.com Brent Oil Futures - Historical Prices

[8] 19-Nov-2025: Reuters US canceling October's employment report after shutdown prevented data collection

[9] 07-Nov-2025: The Guardian US consumer sentiment drops to near record low as shutdown persists

[10] 21-Nov-2025: CME Group / Econoday US: PMI Composite Flash

[11] 05-Nov-2025: MSCI MSCI Global Standard Indexes November 2025 Index Review

[12] 2025: Federal Reserve The Fed - Meeting calendars and information

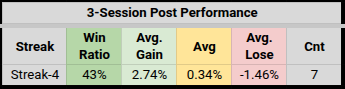

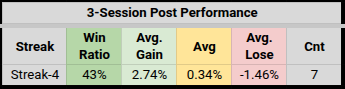

- Excluding Nov-2025 this has happened 7 times in 20 years (depending on where the streak ends)

- If the streak ends at 4, then the 3-Session Post Performance Win ratio was 43% (Next Monday)

- But...... The average is .34% (that's good)

- What makes it interesting, this is our 2nd 4-Streak this year.

4 of 7 times was 1-Session prior to the bottom - 04-Apr-2025 (1-Session prior to the bottom, from total -21.35% drop)

- 02-Aug-2024 (1-Session Prior to the bottom, from total -9.71% drop)

- 08-Sep-2020 (4th Session into a 16-Session -10.55% drop)

- 21-Aug-2015 (1-Session Prior to the bottom, from total -12.54% drop)

- 24-Jan-2014 (7th Session into a 15-Session -6.10% drop)

- 09-Apr-2012 (1-Session prior to the bottom, from total -4.57% drop)

- 17-May-2006 (8th Session into a 27-Session -8.10% drop)

Pre-Bell

Time: 20-Nov-2025 08:08 (ET)

• Nvidia's earnings jolt futures higher, turning tone cautiously risk-on as markets await shutdown-skewed jobs data.[1]

• Asia - Regional indexes bounced, with Asia-Pac up just over +1% as chips and miners clawed back recent losses.[3]

• Europe - STOXX 600 up about +1% led by tech and banks as Nvidia's results ease AI bubble fears.[4]

• U.S. Futures - Tech leads with NDX, SPX, and DJI futures up +0.5% to +1.5% into the open.[1]

• FX / Rates - DXY a bit firmer, 10Y yield steady, and Brent edging higher after a sharp midweek drop.[5][6][7]

♔ Equities ♛ Barometer

• Indexes - SPX and NDX closed modestly higher, with DJI also green as dip-buyers stepped in before jobs data.[2]

• Tone - Risk-on but not euphoric, with gains concentrated in big tech while cyclicals and small caps lag.

• Breadth - Top-10 SPX names beat a flat Mid-90 and slightly red Bottom-403, so the rally leaned on the usual megacap leaders.

• Vol / Dollar - VIX tumbled about -16.00% while DXY stayed firm, more short-covering than a clean risk-on turn.[5]

• Top Gainer - XYZ +7.56%.

• Bottom Loser - ES -12.45%.

• 08:30 - Delayed September Employment Situation lands with jobless claims and the Philly Fed index in the same hour.[8]

• 10:00 - Existing Home Sales and Leading Indicators update housing and growth after weeks of missing federal data.[8]

• Theme - Nvidia and AI spending set the tone; early tape will show whether buyers chase or fade the tech-led squeeze.[1][2]

• 21-Nov FRI 10:00 - Univ. of Michigan Sentiment (final) gauges how shutdown and volatility are hitting consumers.[9]

• 21-Nov FRI - Flash PMIs in the U.S. and Europe offer fresh reads on manufacturing and services momentum into year-end.[10]

• 25-Nov TUE 08:30 - September PPI finally posts, giving a late but important inflation input ahead of the December Fed meeting.[8]

• 24-Nov MON - MSCI November index changes take effect at the close, with passive flows set to shuffle global equity weights.[11]

• 09-10 Dec - FOMC meeting and press conference, with scarce data pushing debate over a third straight rate cut.[12]

• 16-Dec TUE 08:30 - November Employment Situation, including October payrolls, becomes the shutdown era's key labor check.[8]

• Futures point to a tech-led pop at the open while shutdown-distorted data keep traders cautious into the December Fed decision.[1][8][12]

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 20-Nov-2025: Economic Times US stock market futures today: Nvidia earnings revive AI trade

[2] 19-Nov-2025: Reuters Wall St ends higher in anticipation of jobs data, Nvidia tops estimates

[3] 20-Nov-2025: Investing.com MSCI AC Asia Pacific - Historical Data

[4] 20-Nov-2025: Investing.com / Reuters European shares advance as Nvidia earnings light up global markets

[5] 20-Nov-2025: Investing.com US Dollar Index - Historical Data

[6] 20-Nov-2025: Investing.com US 10 Year Treasury Yield

[7] 20-Nov-2025: Investing.com Brent Oil Futures - Historical Prices

[8] 19-Nov-2025: Reuters US canceling October's employment report after shutdown prevented data collection

[9] 07-Nov-2025: The Guardian US consumer sentiment drops to near record low as shutdown persists

[10] 21-Nov-2025: CME Group / Econoday US: PMI Composite Flash

[11] 05-Nov-2025: MSCI MSCI Global Standard Indexes November 2025 Index Review

[12] 2025: Federal Reserve The Fed - Meeting calendars and information