Pre-Bell  Brief

Brief

Time: 19-Nov-2025 08:26 (ET)

Key Takeaway

Key Takeaway

• Futures are modestly higher after a choppy selloff, with Nvidia and Fed minutes set to steer the next move.[1][2][8]

What Moved Overnight

What Moved Overnight

• Asia - indexes slipped again as traders stayed cautious ahead of Nvidia earnings and US data.[3]

• Europe - EuroStoxx trades near recent lows, with cyclicals soft and defensives mixed into the US open.[4]

• US futures - SPX, NDX, DJI futures up roughly +0.30% to +0.50%, signaling a tentative bounce.[1][2]

• FX-Rates-Oil - DXY is firm, 10Y near 4.10%, oil around 60, inflation near 3% keeps real yields positive.[5][6][10]

How the Prior Session Closed

How the Prior Session Closed

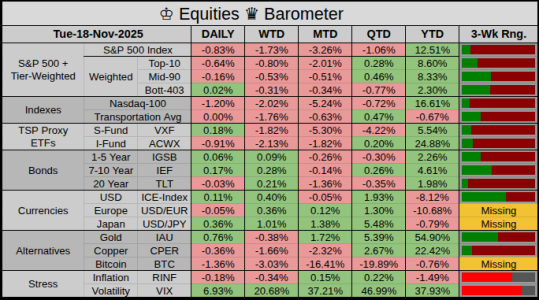

• SPX fell -0.83%, NDX -1.20%, while small caps in the proxy S-Fund finished slightly green and overseas lagged.[11]

• Tone: Risk off, selling focused in megacap tech while transports and small caps showed relative resilience, no capitulation yet.

• Breadth: Top 10 trailed the Mid-90 and Bottom-403, showing quiet rotation away from the most crowded leaders.

• Vol: VIX jumped about +6.93% on the day and over +20.00% for the week, confirming a volatility spike rather than a drift.

• Top Gainer: MDT gained +4.69% as health care finally caught a defensive bid.

• Bottom Loser: HD dropped -6.02% on softer housing linked demand and cautious guidance.

Today’s 1st Hour of Trading

Today’s 1st Hour of Trading

• 07:30 - Trade balance, housing starts and a Chicago Fed conditions update open the data day.[7]

• Nvidia reports after the close, AI complex and NDX futures stay very sensitive to its guidance.[1]

• Fed minutes for the Oct 28-29 meeting hit at 14:00, market will read tone on cuts and the data blackout.[8][12]

Upcoming Headlines

Upcoming Headlines

• 11/19 WED 14:00 - FOMC minutes for the Oct 28-29 meeting, focus on guidance into December.[8]

• 11/19 WED after close - Nvidia Q3 earnings, key read on AI spending and megacap tech sentiment.[1]

• 11/20 THU 08:30 - Weekly claims and usual Thursday releases keep a normal labor pulse on the tape.[7]

Off in the Distance

Off in the Distance

• 11/26 WED 14:00 - Fed Beige Book, regional anecdotes ahead of the December decision.[8]

• 12/09-12/10 - FOMC meeting in December, policy path and dot plot back in focus.[8]

• 12/10 WED 08:30 - US CPI for November, still scheduled even as prior reports were hit by the shutdown.[9][12]

Wrap

Wrap

• Futures hint at a modest bounce, but volatility, Nvidia and policy uncertainty keep risk management front and center.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 19-Nov-2025: Reuters - US stock futures steady in lead-up to Nvidia test

[2] 19-Nov-2025: Markets Insider - Premarket futures dashboard, major US indexes

[3] 19-Nov-2025: AP via WTOP - Asian shares retreat in cautious trading ahead of Nvidia

[4] 19-Nov-2025: Reuters - European shares hover near one-month low awaiting Nvidia

[5] 19-Nov-2025: MarketWatch - WTI crude front month quote and intraday move

[6] 19-Nov-2025: YCharts - 10 Year Treasury Rate around 4.12 percent

[7] 19-Nov-2025: New York Fed - Economic Indicators Calendar, trade and housing releases

[8] 2025: Federal Reserve - FOMC 2025 calendar, minutes, Beige Book and December meeting

[9] 19-Nov-2025: FRED - CPI release calendar showing 10-Dec-2025 slot

[10] 19-Nov-2025: Slickcharts - United States inflation rate near 3 percent

[11] 18-Nov-2025: TSPDataCenter - Latest TSP daily share prices and fund returns

[12] 12-Nov-2025: Politico - Shutdown likely to prevent release of key jobs and inflation data

Time: 19-Nov-2025 08:26 (ET)

• Futures are modestly higher after a choppy selloff, with Nvidia and Fed minutes set to steer the next move.[1][2][8]

• Asia - indexes slipped again as traders stayed cautious ahead of Nvidia earnings and US data.[3]

• Europe - EuroStoxx trades near recent lows, with cyclicals soft and defensives mixed into the US open.[4]

• US futures - SPX, NDX, DJI futures up roughly +0.30% to +0.50%, signaling a tentative bounce.[1][2]

• FX-Rates-Oil - DXY is firm, 10Y near 4.10%, oil around 60, inflation near 3% keeps real yields positive.[5][6][10]

• SPX fell -0.83%, NDX -1.20%, while small caps in the proxy S-Fund finished slightly green and overseas lagged.[11]

• Tone: Risk off, selling focused in megacap tech while transports and small caps showed relative resilience, no capitulation yet.

• Breadth: Top 10 trailed the Mid-90 and Bottom-403, showing quiet rotation away from the most crowded leaders.

• Vol: VIX jumped about +6.93% on the day and over +20.00% for the week, confirming a volatility spike rather than a drift.

• Top Gainer: MDT gained +4.69% as health care finally caught a defensive bid.

• Bottom Loser: HD dropped -6.02% on softer housing linked demand and cautious guidance.

• 07:30 - Trade balance, housing starts and a Chicago Fed conditions update open the data day.[7]

• Nvidia reports after the close, AI complex and NDX futures stay very sensitive to its guidance.[1]

• Fed minutes for the Oct 28-29 meeting hit at 14:00, market will read tone on cuts and the data blackout.[8][12]

• 11/19 WED 14:00 - FOMC minutes for the Oct 28-29 meeting, focus on guidance into December.[8]

• 11/19 WED after close - Nvidia Q3 earnings, key read on AI spending and megacap tech sentiment.[1]

• 11/20 THU 08:30 - Weekly claims and usual Thursday releases keep a normal labor pulse on the tape.[7]

• 11/26 WED 14:00 - Fed Beige Book, regional anecdotes ahead of the December decision.[8]

• 12/09-12/10 - FOMC meeting in December, policy path and dot plot back in focus.[8]

• 12/10 WED 08:30 - US CPI for November, still scheduled even as prior reports were hit by the shutdown.[9][12]

• Futures hint at a modest bounce, but volatility, Nvidia and policy uncertainty keep risk management front and center.

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 19-Nov-2025: Reuters - US stock futures steady in lead-up to Nvidia test

[2] 19-Nov-2025: Markets Insider - Premarket futures dashboard, major US indexes

[3] 19-Nov-2025: AP via WTOP - Asian shares retreat in cautious trading ahead of Nvidia

[4] 19-Nov-2025: Reuters - European shares hover near one-month low awaiting Nvidia

[5] 19-Nov-2025: MarketWatch - WTI crude front month quote and intraday move

[6] 19-Nov-2025: YCharts - 10 Year Treasury Rate around 4.12 percent

[7] 19-Nov-2025: New York Fed - Economic Indicators Calendar, trade and housing releases

[8] 2025: Federal Reserve - FOMC 2025 calendar, minutes, Beige Book and December meeting

[9] 19-Nov-2025: FRED - CPI release calendar showing 10-Dec-2025 slot

[10] 19-Nov-2025: Slickcharts - United States inflation rate near 3 percent

[11] 18-Nov-2025: TSPDataCenter - Latest TSP daily share prices and fund returns

[12] 12-Nov-2025: Politico - Shutdown likely to prevent release of key jobs and inflation data