Pre-Bell  Brief

Brief

Time: 06-Nov-2025 07:15 (ET)

Key Takeaway

Key Takeaway

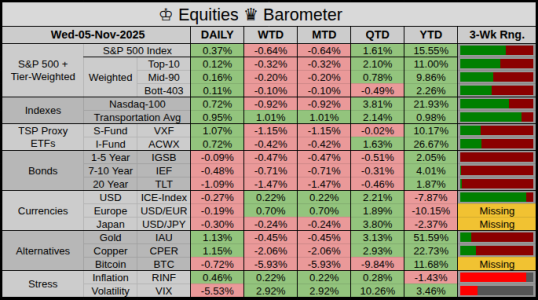

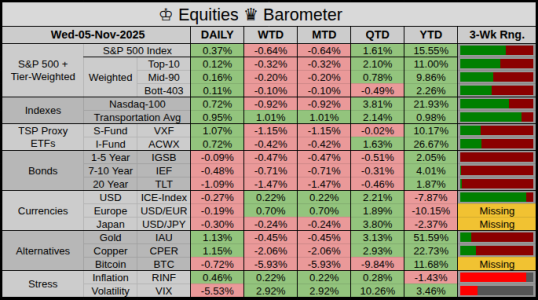

• U.S. stocks bounced on Wednesday, with broad but modest gains led by cyclicals and transports.[1][2]

• Asia followed with a cautious rebound while Europe opened softer as earnings and data stayed supportive.[3]

• U.S. futures are near flat as AI jitters linger ahead of productivity and jobless-claims data at the open.[4][5]

What Moved Overnight

What Moved Overnight

• Asia: broad gains led by China and Hong Kong, while Japan lagged after Wall Street’s rebound.[3]

• Europe: major indexes opened lower as investors locked in some gains despite solid earnings news.[3]

• U.S. futures: S&P 500 and Nasdaq 100 contracts are little changed, pointing to a quiet open.[4]

• FX / rates: the dollar is softer and yields steadier after Wednesday’s jump, easing pressure on risk assets.[1][4]

How the Prior Session Closed

How the Prior Session Closed

• Large caps rebounded, with the S&P 500 and Nasdaq 100 higher while transports led the move off recent lows.[1][2]

• Breadth improved as mid and lower S&P tiers gained more than the mega-cap Top-10, a healthier look under the surface.[1]

• Small caps and international proxies firmed, while longer Treasuries sold off and the dollar slipped from recent highs.[1][2]

• Gold and copper bounced while bitcoin stayed heavy, showing a tilt toward real assets over speculative trades.[1]

• Volatility eased as the equity fear gauge dropped, even as inflation expectations stayed firm in the background.[1][2]

• Top Gainer: STX surged 10.14% after a strong tech update inside information technology.

• Bottom Loser: ZBH slumped 15.15% on weak health-care news and guidance risk.

Today’s 1st Hour of Trading

Today’s 1st Hour of Trading

• 08:30 – Productivity and Costs for Q3, a key read on output and unit labor costs.[5][6]

• 08:30 – Weekly jobless claims, with markets watching for any fresh labor-market slowdown signal.[5]

• First hour focus: AI-heavy tech, small caps, and transports as traders test yesterday’s rotation.

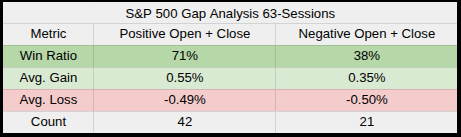

S&P 500 – Gap Analysis (Last 63 Sessions)

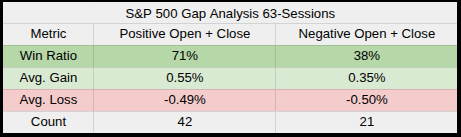

Upside gaps dominated: 42 positive vs 21 negative over the sample.

Upside gaps dominated: 42 positive vs 21 negative over the sample.

Positive gaps closed higher 71% of the time, showing a strong bias to follow-through.

Negative gaps reversed higher only 38% of the time, making fades less dependable.

Negative gaps reversed higher only 38% of the time, making fades less dependable.

For downside gaps, average win was +0.35% but average loss was -0.50%, a weak skew.

Overall, the pattern favors buying early strength more than fading weakness at the open.

Overall, the pattern favors buying early strength more than fading weakness at the open.

Tone: continuation bias holds unless downside gaps grow more frequent and persistent.

Upcoming Headlines

Upcoming Headlines

• 06-Nov-2025 08:30 – Productivity and Costs, Q3 preliminary release.[5][6]

• 06-Nov-2025 08:30 – Weekly jobless claims, fresh read on labor momentum.[5]

• 07-Nov-2025 08:30 – Employment Situation, October payrolls and jobless rate.[6]

Off in the Distance

Off in the Distance

• 13-Nov-2025 08:30 – CPI and Real Earnings for October, key inflation checkpoint.[6][8]

• 09-10-Dec-2025 – FOMC meeting, December rate decision and press conference watched closely.[7]

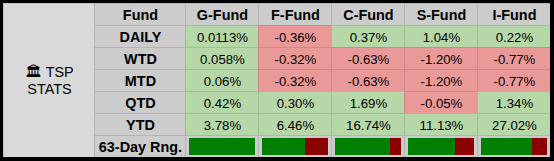

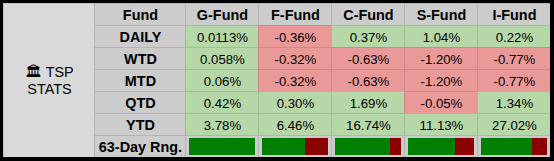

G-Fund Estimated Forward Returns

G-Fund Estimated Forward Returns

• Daily Projection: +0.0113% per day.

• Over the next 5-Days: +0.057%

• December: +0.35%

• Next 63 days: +0.71%

• One Year Out: About +2.89% based on the current G-Fund path.

With Inflation at 3.01%, real-world G-Fund returns are closer to -0.12% per year.

With Inflation at 3.01%, real-world G-Fund returns are closer to -0.12% per year.

Wrap

Wrap

• Futures are signaling a flat to slightly cautious open as traders balance rotation hopes with dense data and Fed risk ahead.[4][5]

• With U.S. inflation near 3.01%, incoming data and the December Fed meeting stay central to the medium-term path.[7][8]

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 06-Nov-2025: XTB Morning wrap (06.11.2025)

[2] 05-Nov-2025: Reuters Stocks climb after upbeat earnings, economic data

[3] 06-Nov-2025: Associated Press Asian shares advance after solid earnings and economic reports

[4] 06-Nov-2025: Morningstar North American Morning Briefing: Stock Futures Waver as AI Jitters Remain

[5] 06-Nov-2025: FRED Economic Release Calendar

[6] 10-Oct-2025: U.S. Bureau of Labor Statistics Schedule of Selected Releases for November 2025

[7] 06-Nov-2025: Federal Reserve FOMC Meeting Calendar, December 2025

[8] 30-Sep-2025: Slickcharts United States Inflation Rate (trailing 12-month)

Time: 06-Nov-2025 07:15 (ET)

• U.S. stocks bounced on Wednesday, with broad but modest gains led by cyclicals and transports.[1][2]

• Asia followed with a cautious rebound while Europe opened softer as earnings and data stayed supportive.[3]

• U.S. futures are near flat as AI jitters linger ahead of productivity and jobless-claims data at the open.[4][5]

• Asia: broad gains led by China and Hong Kong, while Japan lagged after Wall Street’s rebound.[3]

• Europe: major indexes opened lower as investors locked in some gains despite solid earnings news.[3]

• U.S. futures: S&P 500 and Nasdaq 100 contracts are little changed, pointing to a quiet open.[4]

• FX / rates: the dollar is softer and yields steadier after Wednesday’s jump, easing pressure on risk assets.[1][4]

• Large caps rebounded, with the S&P 500 and Nasdaq 100 higher while transports led the move off recent lows.[1][2]

• Breadth improved as mid and lower S&P tiers gained more than the mega-cap Top-10, a healthier look under the surface.[1]

• Small caps and international proxies firmed, while longer Treasuries sold off and the dollar slipped from recent highs.[1][2]

• Gold and copper bounced while bitcoin stayed heavy, showing a tilt toward real assets over speculative trades.[1]

• Volatility eased as the equity fear gauge dropped, even as inflation expectations stayed firm in the background.[1][2]

• Top Gainer: STX surged 10.14% after a strong tech update inside information technology.

• Bottom Loser: ZBH slumped 15.15% on weak health-care news and guidance risk.

• 08:30 – Productivity and Costs for Q3, a key read on output and unit labor costs.[5][6]

• 08:30 – Weekly jobless claims, with markets watching for any fresh labor-market slowdown signal.[5]

• First hour focus: AI-heavy tech, small caps, and transports as traders test yesterday’s rotation.

S&P 500 – Gap Analysis (Last 63 Sessions)

Positive gaps closed higher 71% of the time, showing a strong bias to follow-through.

For downside gaps, average win was +0.35% but average loss was -0.50%, a weak skew.

Tone: continuation bias holds unless downside gaps grow more frequent and persistent.

• 06-Nov-2025 08:30 – Productivity and Costs, Q3 preliminary release.[5][6]

• 06-Nov-2025 08:30 – Weekly jobless claims, fresh read on labor momentum.[5]

• 07-Nov-2025 08:30 – Employment Situation, October payrolls and jobless rate.[6]

• 13-Nov-2025 08:30 – CPI and Real Earnings for October, key inflation checkpoint.[6][8]

• 09-10-Dec-2025 – FOMC meeting, December rate decision and press conference watched closely.[7]

• Daily Projection: +0.0113% per day.

• Over the next 5-Days: +0.057%

• December: +0.35%

• Next 63 days: +0.71%

• One Year Out: About +2.89% based on the current G-Fund path.

• Futures are signaling a flat to slightly cautious open as traders balance rotation hopes with dense data and Fed risk ahead.[4][5]

• With U.S. inflation near 3.01%, incoming data and the December Fed meeting stay central to the medium-term path.[7][8]

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 06-Nov-2025: XTB Morning wrap (06.11.2025)

[2] 05-Nov-2025: Reuters Stocks climb after upbeat earnings, economic data

[3] 06-Nov-2025: Associated Press Asian shares advance after solid earnings and economic reports

[4] 06-Nov-2025: Morningstar North American Morning Briefing: Stock Futures Waver as AI Jitters Remain

[5] 06-Nov-2025: FRED Economic Release Calendar

[6] 10-Oct-2025: U.S. Bureau of Labor Statistics Schedule of Selected Releases for November 2025

[7] 06-Nov-2025: Federal Reserve FOMC Meeting Calendar, December 2025

[8] 30-Sep-2025: Slickcharts United States Inflation Rate (trailing 12-month)

Last edited: