You've been seeing how the market has been chopping around, often closing with mixed results before popping to the upside the past few weeks. Well, that's still the trend. After yesterday's pop, which was preceded by choppy, mixed action, the market has settled back into a largely sideways pattern. One thing to recognize however, is how much stronger the Wilshire 4500 (S fund) has been relative to the S&P 500 (C fund). As of yesterday's close the Wilshire 4500 is up 9.71% not counting today's modest gains, while the S&P 500 is up 5.45%. That's a pretty good spread. The I fund has posted gains of 7.34%.

Of note today, Fed Chairman Bernanke was providing testimony to the House of Representatives Budget Committee. He didn't reveal anything new and continued to portray the market as sluggish and still susceptible to shock, but overall felt the economic picture at home and in the EU was improving.

Early on today, the latest initial jobless claims total was released and it showed claims had fallen by 12,000 to 367,000. This was less than economists had forecast, which is a positive. Also released, fourth quarter productivity was up 0.7%, which was in line with estimates. In that report however, it was noted that labor was up 1.2% and that was almost double estimates.

Tomorrow we'll get the nonfarm payrolls data, which always has the potential to be a market mover. Given yesterday's ADP Employment Change fell short of estimates, the nonfarm payrolls data may do likewise.

Here's today's charts:

NAMO remains on a buy, while NYMO flipped to a sell.

NAHL and NYHL are on a buy and sell respectively.

TRIN and TRINQ remain on buys.

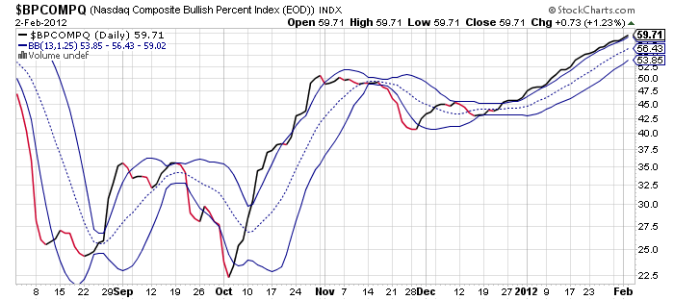

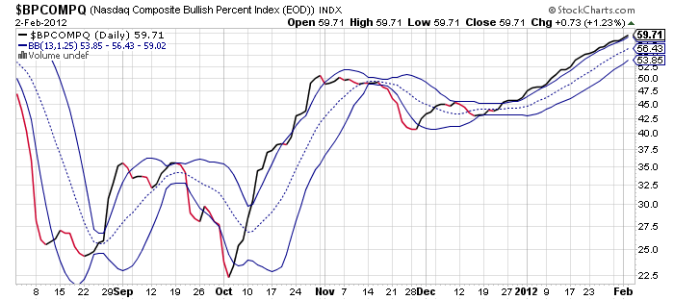

BPCOMPQ continues to track along that upper bollinger band as it has for weeks now. It remains on a buy.

So the Seven Sentinels are mixed, but the system remains in a buy status.

I am liking the relatively low volatility this market is showing. It's exactly the kind of environment the Seven Sentinels do best in. Unfortunately, I have been on the sidelines in my TSP account for some time now and that account isn't enjoying these gains, but my ROTHs have been fully exposed to the market throughout.

I don't know how long we can hope to see a low volatility environment. The longer, the better, but there is still a lot of uncertainty out there and that's what keeps me somewhat tentative. Obviously, I am hardly alone as many traders and investors are sitting on the sidelines too. But that's why I do not employ the same strategy in each of my accounts, because you can never be absolutely sure how the market will trade.

Of note today, Fed Chairman Bernanke was providing testimony to the House of Representatives Budget Committee. He didn't reveal anything new and continued to portray the market as sluggish and still susceptible to shock, but overall felt the economic picture at home and in the EU was improving.

Early on today, the latest initial jobless claims total was released and it showed claims had fallen by 12,000 to 367,000. This was less than economists had forecast, which is a positive. Also released, fourth quarter productivity was up 0.7%, which was in line with estimates. In that report however, it was noted that labor was up 1.2% and that was almost double estimates.

Tomorrow we'll get the nonfarm payrolls data, which always has the potential to be a market mover. Given yesterday's ADP Employment Change fell short of estimates, the nonfarm payrolls data may do likewise.

Here's today's charts:

NAMO remains on a buy, while NYMO flipped to a sell.

NAHL and NYHL are on a buy and sell respectively.

TRIN and TRINQ remain on buys.

BPCOMPQ continues to track along that upper bollinger band as it has for weeks now. It remains on a buy.

So the Seven Sentinels are mixed, but the system remains in a buy status.

I am liking the relatively low volatility this market is showing. It's exactly the kind of environment the Seven Sentinels do best in. Unfortunately, I have been on the sidelines in my TSP account for some time now and that account isn't enjoying these gains, but my ROTHs have been fully exposed to the market throughout.

I don't know how long we can hope to see a low volatility environment. The longer, the better, but there is still a lot of uncertainty out there and that's what keeps me somewhat tentative. Obviously, I am hardly alone as many traders and investors are sitting on the sidelines too. But that's why I do not employ the same strategy in each of my accounts, because you can never be absolutely sure how the market will trade.