We "only" lost 36,000 jobs! Break out the champagne!

Nonfarm payrolls fell 36,000, which was better than the 68,000 that was forecast. The unemployment rate remained at 9.7%, which beat the 9.8% forecast. The underlying data suggested there was some job creation too.

But that increase is due to part-term workers being hired more than anything else and is certainly not indicative of a jobs picture getting better. I wouldn't call this data point more than neutral at best.

My message of late has been that the Seven Sentinels do not look like they are going to roll over. I certainly got that right today. In spades. But I've been expecting some short term weakness in any event and on that count I've been wrong. At least so far. Looks like we're going to get some extended technical readings and when that happens things could get silly.

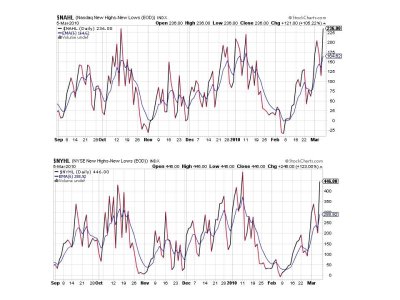

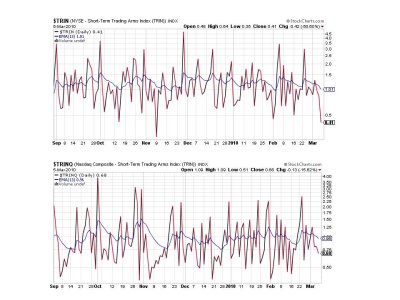

Here's the charts:

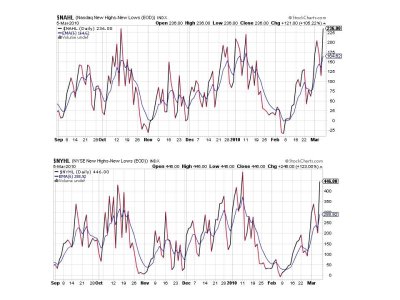

We're hitting some rarefied air now. This is the highest these two signals have been since early April of 2009.

Back in the saddle here. Flipped to buys.

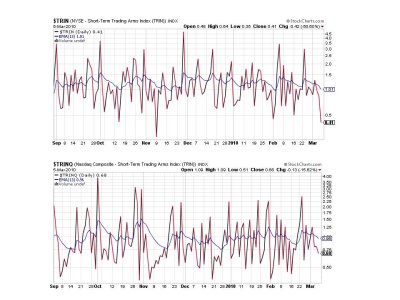

Yes, these are both buys, but TRIN in particular is showing overbought conditions, but it can go lower, and Monday's coming.

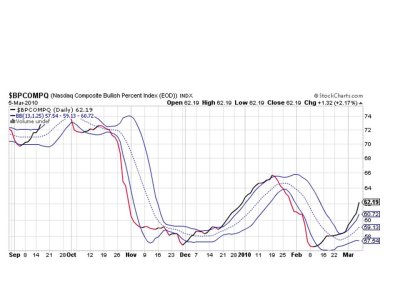

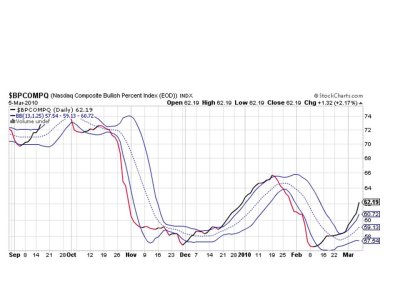

Higher still. Very bullish.

The system is showing 7 of 7 buy signals. There's nothing wrong with this picture. It's bullish, but we're still due for some profit taking. But given how today's action went I wouldn't short the market on Monday. I think this market is now gunning to establish new highs since the March low.

If you've been holding since the last Seven Sentinels buy signal, you're doing very well. This has been a very strong signal. But if you're waiting for an entry point like me you're caught in no man's land at the moment given the overbought conditions. But we could get more overbought before we see any give back too. For now, I continue to wait this out. I'll post the Top 15 and Top 50 charts later this weekend. See you then.

Nonfarm payrolls fell 36,000, which was better than the 68,000 that was forecast. The unemployment rate remained at 9.7%, which beat the 9.8% forecast. The underlying data suggested there was some job creation too.

But that increase is due to part-term workers being hired more than anything else and is certainly not indicative of a jobs picture getting better. I wouldn't call this data point more than neutral at best.

My message of late has been that the Seven Sentinels do not look like they are going to roll over. I certainly got that right today. In spades. But I've been expecting some short term weakness in any event and on that count I've been wrong. At least so far. Looks like we're going to get some extended technical readings and when that happens things could get silly.

Here's the charts:

We're hitting some rarefied air now. This is the highest these two signals have been since early April of 2009.

Back in the saddle here. Flipped to buys.

Yes, these are both buys, but TRIN in particular is showing overbought conditions, but it can go lower, and Monday's coming.

Higher still. Very bullish.

The system is showing 7 of 7 buy signals. There's nothing wrong with this picture. It's bullish, but we're still due for some profit taking. But given how today's action went I wouldn't short the market on Monday. I think this market is now gunning to establish new highs since the March low.

If you've been holding since the last Seven Sentinels buy signal, you're doing very well. This has been a very strong signal. But if you're waiting for an entry point like me you're caught in no man's land at the moment given the overbought conditions. But we could get more overbought before we see any give back too. For now, I continue to wait this out. I'll post the Top 15 and Top 50 charts later this weekend. See you then.