imike023

Investor

- Reaction score

- 1

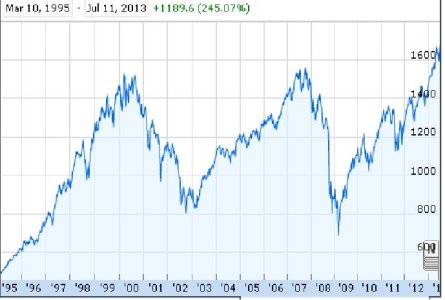

The L funds are a great recommendation for people like them who can't be active in their tsp account. They can gamble more on stocks or gamble less and keeping more money in the G fund. Either way leaving you're money in the G fund will not give them any returns and we all know that.Woohoo! I am fairly up tonight, also somewhat worried.

I do not remember if it was in this thread or another, the subject of young co-workers asking about TSP came up. I mentioned that I had been asked and I had explained how to log in and how to move money around between funds and that some of the money probably should be moved out of G and in to one of the L funds while learning more and making other decisions.

Today about quitting time while we were all submitting our T&As, the subject of money came up. This young co-worker stated that they had finally moved some money around. This person has been a fed for about four years. Another co-worker who has under two years mentioned they had just left it in G and never logged in to tsp.gov. I explained again how the IFT worked, the noon/closing rule worked and the two per month IFT limit with unlimited IFTs to G. I hope well. A question was asked about payday allocations v IFTs and I said the IFT does not effect the contribution allocation.

The co-worker who did the first IFT mentioned he moved 30% to I fund and then a foreperson walked in and said he needed to ask me some questions. The two young co-workers wisely logged out of their computers and "beat feet" as we used to say.

The question, of course could easily have been handled by e-mail and waited until say Tuesday, Then the phone rang and two e-mails from another foreperson popped up. It was BTW after quitting time by now. Fortunately all the calls/e-mails were questions easily answered. The in person foreperson was still there waiting patiently. I did get out of there less than 30 minutes after the end of the day.

I was whining above. No OT authorized for that 30 minutes BTW. Oh well. The incentive to leave on a Thursday? We are AWS 4-10 people.

Monday we celebrate Leif Ericson day.

I am happy this person finally made an IFT. I am concerned about where the rest of this person's TSP was transferred to and what will happen to the funds. I think the co-worker said he left 10% in G before end of the day work intruded. The other young co-worker seemed interested in looking in to it. I hope the other young co-worker does at least find out how to log in.

I find that most new feds may make an allocation at some dollar amount or percentage to their TSP but tend to leave it in G fund. The two above mentioned are or were trainees and concentrate on learning the j.o.b. above many other things. They also seem to be somewhat dedicated to doing things right, something I do not always see in new employees. Whatever, I hope at least that they start being aware of their TSPs.

In case anyone is worried, I tell them I cannot and will not give them advice about what fund to move to. I do tell them about my dismal returns over the years and attribute it to my lack of knowledge and attention to the account.

I also mention this forum and a couple others that they should read, and point out the returns some get.

They do not have time for all that reading/research right now so suggestions are welcome about what they might do to beat G fund. Keep in mind they do not really have time to look at TSP during the week and do not have funds for a paid service.

Hope I am not wrong about mentioning L funds as an alternative to leaving it all in G.

Younger enthused workers are the future of the crafts in the fedworld. I only wish I saw such a bright future in the GS ranks around here.

Regards

PO

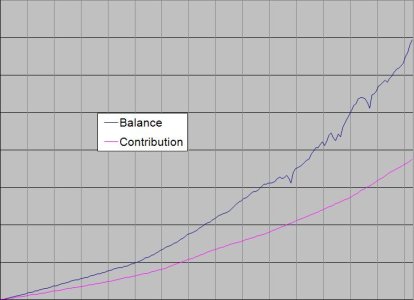

I started working for the government in 2007. I was invested in the G fund for about 4 years until I talked to one of my co-workers about my tsp fund. He started laughing saying you're going to eat peanut butter and jelly sandwiches for the rest of you're life if you don't invest you're money correctly. So I started looking at the different options and made this my hobby. Still very green on stocks, investment, ect but I am learning and I am making more money now than I would have ever made leaving it in the G fund. I sure don't want to live in the poor house when I retire