PessOptimist

Market Veteran

- Reaction score

- 67

Thought I should come by and see if I was still here.

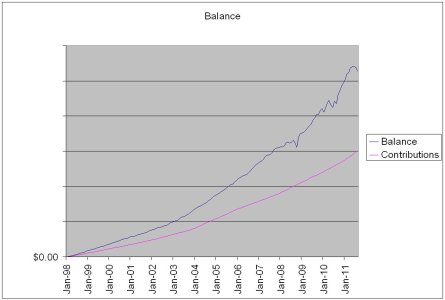

Law87, pretty much me but I don't own nearly 10k shares of any fund. I have only been at this 14 years and haven't always made the best decisions.

Birch, I didn't move to G and am still buying equities every two weeks.

Saving my pennies for someday as B. Joel wrote. No part time job or new car yet though.

Shoulda, coulda, woulda scenario: the day before I went on vacation back on Jul 15th, I almost moved it all to G since I wouldn't be able to "watch it". Common sense (??) smacked me and said "you did that a couple years ago and missed out on a big up time and besides, you never move anything and then you will have to worry about when to get back in". That move could have prevented a lot of loss. On the other hand, I'm not using this TSP thing for another six years or so. The ideal fantasy is to have gone to G then and moved back in to equities near the bottom and increased profits during the next run up. When is that run up going to happen anyway? I would really like to finish 2011 with more earnings than 2008.

Someone mentioned yesterday that the MB was being unserious this weekend. It was except for the normally serious people who help us with our investments. Thank you serious people. Thank you to those that run this MB for allowing it to become a social gathering place for friends also.

It's been pretty quiet here today. It is a day for quiet reflection. It brings back a lot of feelings. (for me) Don't let them get you down.

Regards to all

PO

Law87, pretty much me but I don't own nearly 10k shares of any fund. I have only been at this 14 years and haven't always made the best decisions.

Birch, I didn't move to G and am still buying equities every two weeks.

Saving my pennies for someday as B. Joel wrote. No part time job or new car yet though.

Shoulda, coulda, woulda scenario: the day before I went on vacation back on Jul 15th, I almost moved it all to G since I wouldn't be able to "watch it". Common sense (??) smacked me and said "you did that a couple years ago and missed out on a big up time and besides, you never move anything and then you will have to worry about when to get back in". That move could have prevented a lot of loss. On the other hand, I'm not using this TSP thing for another six years or so. The ideal fantasy is to have gone to G then and moved back in to equities near the bottom and increased profits during the next run up. When is that run up going to happen anyway? I would really like to finish 2011 with more earnings than 2008.

Someone mentioned yesterday that the MB was being unserious this weekend. It was except for the normally serious people who help us with our investments. Thank you serious people. Thank you to those that run this MB for allowing it to become a social gathering place for friends also.

It's been pretty quiet here today. It is a day for quiet reflection. It brings back a lot of feelings. (for me) Don't let them get you down.

Regards to all

PO