Lots of sideway action defined the markets today, although a late buying spree did manage to help the major averages post modest gains overall. Volume was notably anemic again, but low volume hasn't seemed to matter over the past few months.

Perhaps the biggest news of the day was January's nonfarm payrolls number, which was up by 36,000, but that wasn't even close to the expected 148,000 additions economists were looking for. Private payrolls didn't fare any better as it posted an increase of 50,000, well off the 163,000 additions that were expected.

The unemployment rate raised eyebrows again as it dropped hard in January to 9.0%. An increase of 0.1% was expected. The decline wasn't viewed particularly favorably by the talking heads.

The dollar was up 0.3% on the day, but down modestly for the week, while treasuries were trounced again.

Here's the latest charts:

NAMO and NYMO are flashing buys, but are neutral overall.

NAHL and NYHL are also on buys.

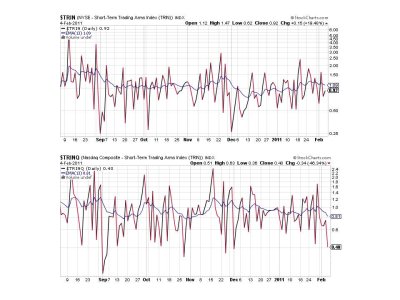

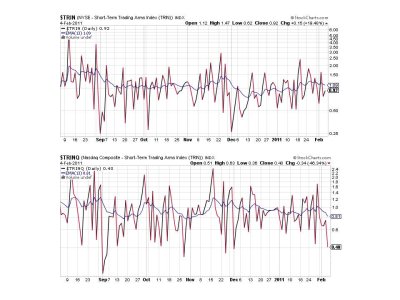

Two buys for TRIN and TRINQ, but TRINQ appears to be overbought, which suggests we could see some short term weakness in the Nasdaq early on next week.

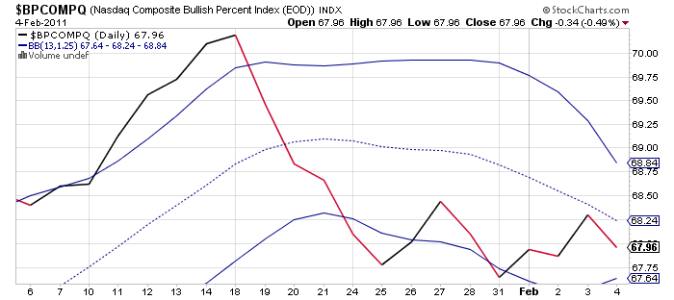

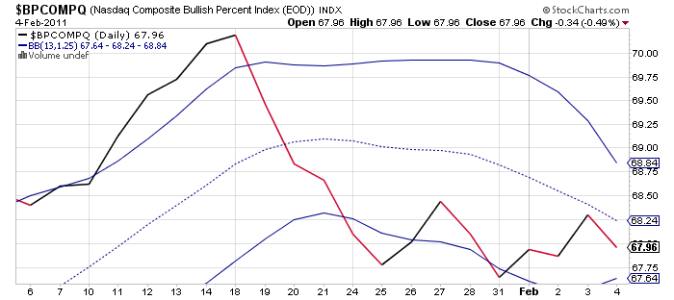

BPCOMPQ remains on a buy, but has a neutral bias with the sideways action over the past few trading days.

So all seven signals are flashing buys, but the system remains on a sell as NYMO has still not hit a fresh 28 day trading high.

If it wasn't for QE2 I'd be inclined to be more bearish as these signals, while on buys, don't look particularly bullish. But liquidity has been trumping any selling efforts for some time and there doesn't seem to be any end in sight. The Sentinels did flash an unconfirmed buy earlier in the week, and as I mentioned at the time if one is more inclined toward risk you may want to buy this market without confirmation from NYMO.

I'll be posting the updated tracker charts later this weekend. See you then.

Perhaps the biggest news of the day was January's nonfarm payrolls number, which was up by 36,000, but that wasn't even close to the expected 148,000 additions economists were looking for. Private payrolls didn't fare any better as it posted an increase of 50,000, well off the 163,000 additions that were expected.

The unemployment rate raised eyebrows again as it dropped hard in January to 9.0%. An increase of 0.1% was expected. The decline wasn't viewed particularly favorably by the talking heads.

The dollar was up 0.3% on the day, but down modestly for the week, while treasuries were trounced again.

Here's the latest charts:

NAMO and NYMO are flashing buys, but are neutral overall.

NAHL and NYHL are also on buys.

Two buys for TRIN and TRINQ, but TRINQ appears to be overbought, which suggests we could see some short term weakness in the Nasdaq early on next week.

BPCOMPQ remains on a buy, but has a neutral bias with the sideways action over the past few trading days.

So all seven signals are flashing buys, but the system remains on a sell as NYMO has still not hit a fresh 28 day trading high.

If it wasn't for QE2 I'd be inclined to be more bearish as these signals, while on buys, don't look particularly bullish. But liquidity has been trumping any selling efforts for some time and there doesn't seem to be any end in sight. The Sentinels did flash an unconfirmed buy earlier in the week, and as I mentioned at the time if one is more inclined toward risk you may want to buy this market without confirmation from NYMO.

I'll be posting the updated tracker charts later this weekend. See you then.